SEJONG -- South Korea’s export performance has remained sluggish since November, the last month that it posted a positive on-year growth figure.

In November, exports recorded 4.1 percent growth compared with a year earlier. But exports fell 1.3 percent in December and 5.8 percent in January, according to the Korea Customs Service.

Further, the nation saw exports plunge 11.7 percent on-year for the first 20 days of February, posting $23.33 billion for a difference of $3.09 billion (3.45 trillion won) compared with the corresponding period in 2018. Semiconductors and petrochemical products led the negative growth in shipments overseas, respectively showing declines of 27.1 percent and 24.5 percent.

Customs data also showed a 7.9 percent decline in exports for the first 51 days of 2019, from Jan. 1 to Feb. 20, compared with the corresponding period in 2018.

This slump in the nation’s main growth engine, exports, which generally amount to between 45 and 55 percent of the gross domestic product, can be expected to somewhat depress GDP growth this year, say economists based at institutes at home and abroad.

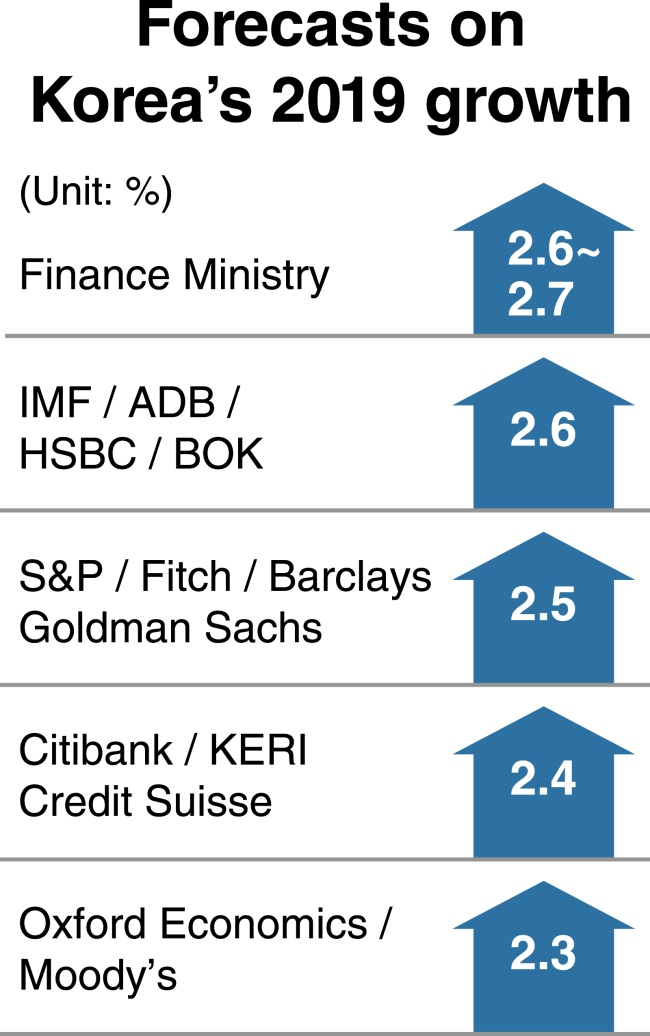

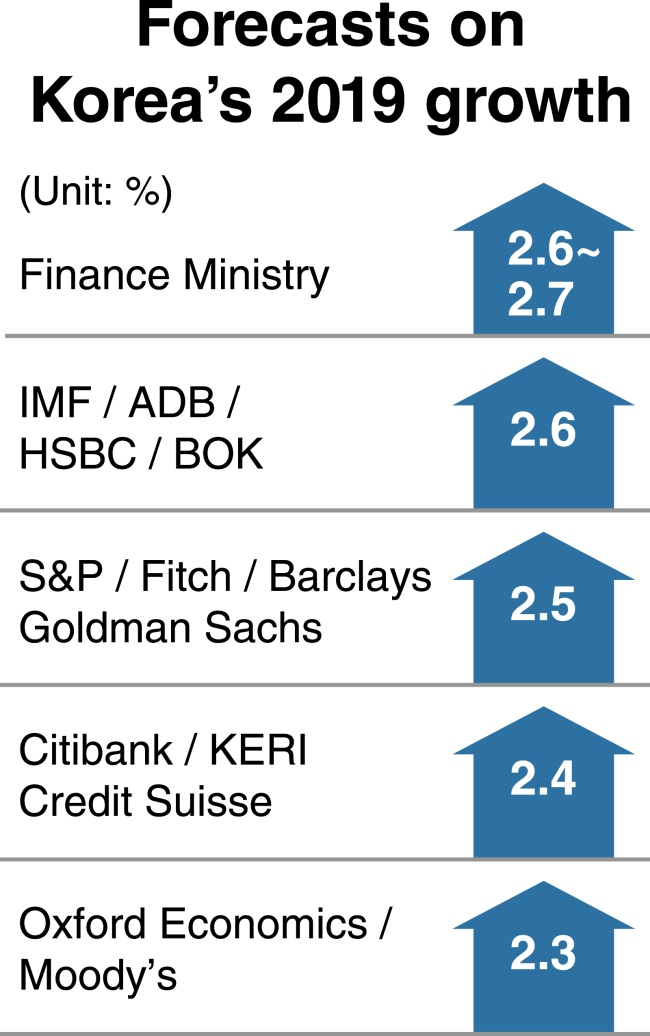

While the Korean economy expanded 2.7 percent in 2018 compared with the previous year, global organizations and investment banks forecast that the country’s 2019 GDP growth would fall short of that mark.

|

(Graphic by Heo Tae-seong/The Korea Herald) |

The Asian Development Bank in its December report revised its outlook on Korea’s 2019 economic growth downward by 0.2 percentage point to 2.6 percent. Projections from the International Monetary Fund and the Korea Development Institute also stood at 2.6 percent.

The Korea Center for International Finance, which looked at 2019 GDP growth estimates from nine investment banks, calculated an average of 2.5 percent, representing a decline of 0.1 percentage point from earlier collective estimates.

Of the nine, JPMorgan Chase & Co. offered the most optimistic forecast, 2.7 percent. It was followed by HSBC and Bank of America Merrill Lynch with estimates of 2.6 percent, Goldman Sachs and three others with 2.5 percent, and Citibank and Credit Suisse with 2.4 percent, the center said.

Further, Moody’s Investors Service and Oxford Economics each projected that the Korean economy would expand only 2.3 percent. Oxford Economics cited a slowdown in global demand, including demand from China, as a factor that might limit Korea’s exports. Meanwhile, Standard & Poor’s and Fitch Ratings predicted 2.5 percent growth.

Local private research institutes are also pessimistic. NH Investment & Securities, Hana Financial Investment and the Korea Economic Research Institute have all predicted just 2.4 GDP growth for the nation.

NH Investment analyst Ahn Ki-tae said, “Export growth this year is expected to post zero percent.” He predicted that semiconductor exports would drop sharply during the first quarter.

A Hana Investment analyst said, “There is a high possibility that the Korean economy will be determined by the extent of sagging shipments abroad. And it seems to be in for a gradual decline (in the coming months).”

|

Consumers look at products on display at Korea Brand & Entertainment Expo 2018 in Moscow in May. The Ministry of Trade, Industry and Energy, in coordination with the Korea Trade-Investment Promotion Agency, hosted the fair to promote exports. (KOTRA) |

Amid the rampant pessimism, more and more market insiders raise the possibility that the GDP growth rate could fall below 2.5 percent for the first time in seven years. (Export growth posted 2.3 percent in 2012 during the tenure of former President Lee Myung-bak.) Predictions for this year from the Ministry of Economy and Finance and the Bank of Korea came to 2.6-2.7 percent and 2.6 percent, respectively.

Korea’s GDP growth posted 2.9 percent in 2013, 3.3 percent in 2014, 2.8 percent in 2015, 2.9 percent in 2016 and 3.1 percent in 2017.

The Sejong City-based Korea Institute for Industrial Economics & Trade recently released a report predicting that the nation’s GDP growth would dip below 2 percent per annum in the decade starting about seven years from now.

The state-run KIET said GDP growth posted 3.03 percent per annum during the 2006-2015 period, but forecast that the figure would fall to 2.71 percent during the 2016-2025 period.

It also suggested the corresponding figure for 2026-2035 could plummet to only 1.93 percent.

“The Korean economy has faced a low-growth era in the wake of negative factors such as cutthroat competition in export markets, a drop in population for production and a drop in working hours,” according to the KIET analysis.

Calling on Korea to map out effective measures to prepare for the fourth industrial revolution, the institute said the fourth industrial revolution should be regarded as a concept essential to survival, unlike past decades when a return to stable growth was possible.

By Kim Yon-se (

kys@heraldcorp.com)