SWORDS, Ireland — With a complex system of metal pipes filling up the space, trucks carrying large tanks of marked substances and chimneys belching out puffs of white, the facility seems like a typical fine chemicals plant from the outside.

However, it is not brewing chemicals for heavy industry, but the baseline ingredients for life-saving medications developed by some of the world’s leading pharmaceutical companies including Bristol-Myers Squibb, AstraZeneca and Pfizer.

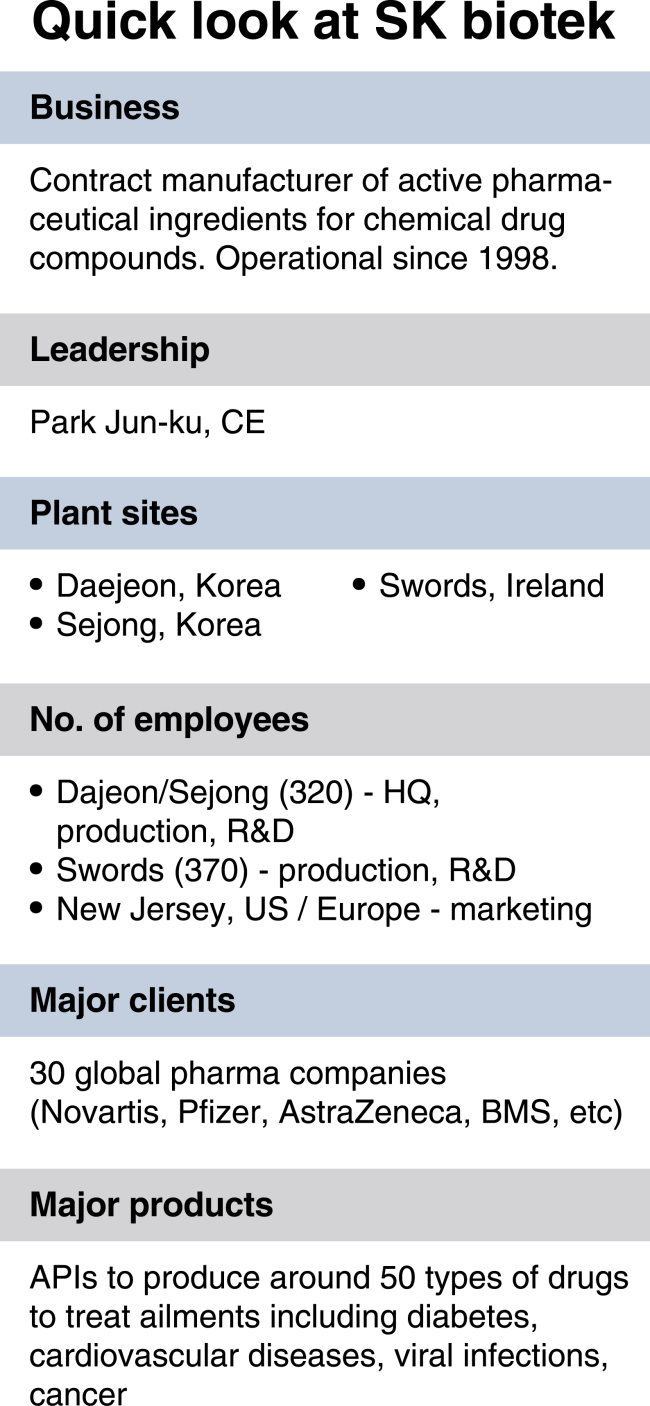

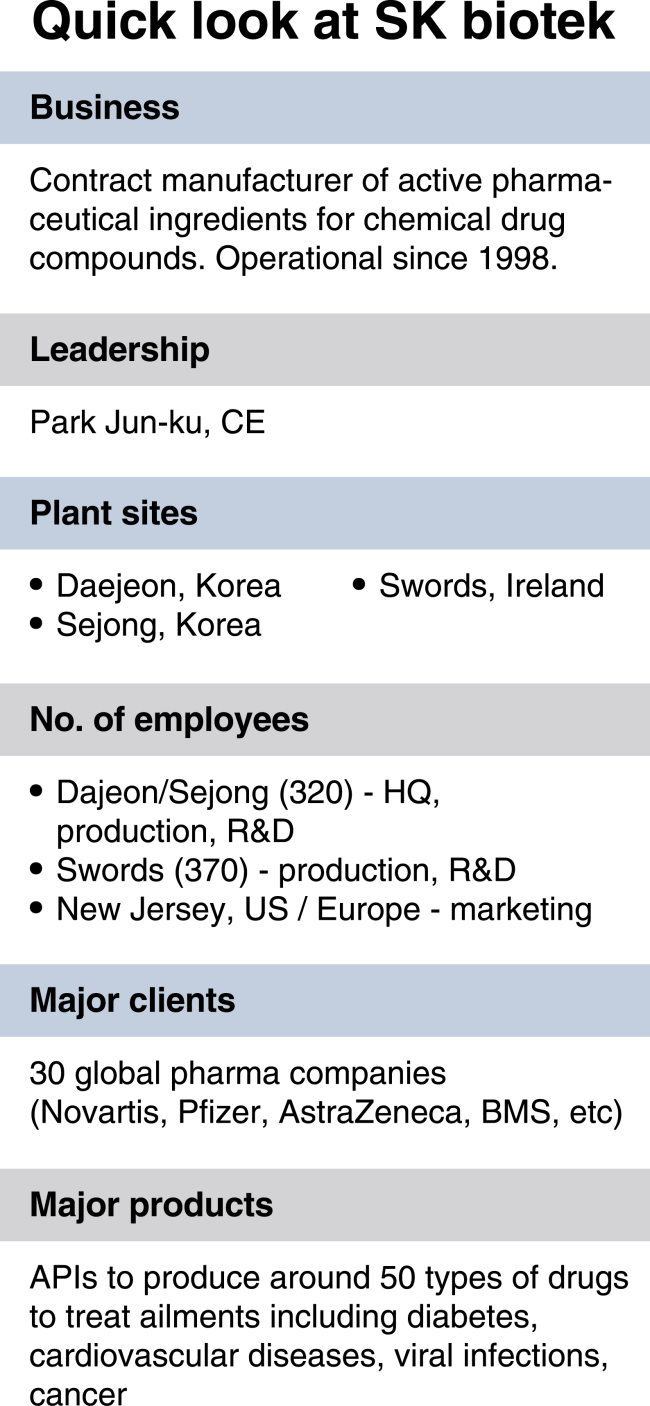

Meet SK biotek Ireland, a pharmaceutical contract manufacturing organization owned by South Korea’s SK biotek. Based in Swords, located around 13 kilometers north of Dublin, Ireland, the CMO produces to specification small molecule active pharmaceutical ingredients for chemical combination drugs on a contract basis.

|

SK biotek Ireland employees add baseline chemicals to batch reactors inside a production plant at the company’s headquarters in Swords, Ireland (SK biotek) |

The Swords facility -- comprising of six multi-purpose plants -- currently boasts a net production capacity of 81,000 liters and manufactures API for a number of high-value chemical combination drugs for clients including Bristol-Myers Squibb and AstraZeneca.

Right now, most of the API produced at the plant are baseline ingredients for ailments like cardiovascular diseases and diabetes. Also being formulated in smaller batches are high-potency API used to make antiviral therapies, according to the company.

How does the process work? As an API CMO, SK biotek follows a “drug combination recipe” to synthesize multiple chemicals — usually 4-5 types — at the right temperatures to formulate a particular chemical drug compound in the form of a powder.

The finished APIs are then sent over to clients, to undergo the latter portion of the drug manufacturing process that comes afterward, including type-selection and formulation, packaging and final delivery.

The Swords production site was originally established as an in-house pharma API manufacturing facility by Bristol-Myers Squibb, But it was acquired in June 2018 by SK biotek — a wholly-owned subsidiary of Korea’s third-largest conglomerate SK Group.

The acquisition had marked the first-ever cross-border deal between a Korean corporation and a global big pharma company. With the deal, SK also became the Korean company to obtain a pharma manufacturing base in the European region.

One year has passed since SK acquired the Swords plant from BMS. With transition procedures now complete, the Korean semiconductors-to-chemicals conglomerate says it is ready to use the Swords facility as a springboard for SK’s global growth into a global leader in the pharma API business.

Aiming high

With a new operations base in Ireland, SK biotek is hoping to bring its API CMO business to a new level. The company hopes to raise its revenue to 1.5 trillion won and market cap to 4 trillion won by 2020, to become one of the world’s top 10 pharma CMOs.

To get there, SK biotek is currently in the process of building additional production facilities to its sites in Korea and Ireland to raise its total annual capacity to 1 million liters by 2020. In addition to the Swords plant, SK biotek operates API manufacturing and R&D facilities in Daejeon and Sejong of Korea.

|

SK biotek CEO Park Jun-ku speaks during a press conference at SK biotek Ireland in Swords, Ireland on Tuesday. (SK biotek) |

According to SK biotek CEO Park Jun-ku, each site will serve a different role. The Swords facility will specialize in high-value API production, and act as a strategic base through which it can land more manufacturing outsourcing contracts with European clients.

Meanwhile, the Daejeon facility will specialize in small-scale production and R&D while the Sejong site will focus more on large-scale API production, the CEO said.

In addition to internal capacity expansion, the SK biotek CEO believes the next big leap for the company will come through strategic mergers and acquisitions.

“Right now, SK biotek’s revenue sits just below around 300 billion won. But as our Dajeon and Sejong sites in Korea become 3-4 times larger, we expect our revenue to enter into the trillions range. And this will all likely happen through M&As,” Park said in a press conference in Swords on Tuesday.

Potential acquisition targets include companies that can help strengthen SK’s flagship API manufacturing business, as well as those specializing in the “drug production” side of the business that come after the API production.

“We want to eventually expand our business to include finished drug production, becoming a “full service” pharma production company,” Kim said.

In eyeing the drug production business, SK is interested in the high-value side. For instance, SK is less interested in relatively low-cost procedures like standard pill manufacturing, but inclined to embrace firms with strengths in technologies like pre-filled syringe packaging, he explained.

Looking ahead, the SK biotek CEO is confident that the API CMO business will continue to grow, fueling new business and profits.

“The growth rate for the (API CMO) business is higher than that of pharmaceutical companies focusing on development. While drug development might yield more profits, it has a high likelihood of failure. However, contract-dependent CMOs (guarantee more stable) outcomes,” he said.

Market research firm Mordor Intelligence predicts the global pharmaceutical contract manufacturing market will expand at a compound annual growth rate of 8.08 percent, from 92.31 billion in 2017 to $146.41 billion by 2023.

The analytics firm accredited the growth to rising demand for generic medicines and biologics, rising costs, and complex manufacturing requirements that have pushed pharma companies to outsource their manufacturing needs to CMOs for both clinical and commercial stage manufacturing.