The increase in tax revenue that South Korea is expected to see in the coming years should not give it a false sense of security in light of the fiscal cliff that might be ahead, experts say.

The government now envisions that an additional 60 trillion won ($53.6 billion) in taxes will be collected over the next five years, compared with amounts projected in a midterm fiscal management plan drawn up last year. Finance Minister Kim Dong-yeon recently said the excess revenue would amount to 19 trillion won this year alone, bringing total tax revenue for 2018 to 287.1 trillion won. The revenue increase has emboldened President Moon Jae-in’s administration to seek to expand fiscal spending to fund lavish employment and welfare programs in line with its income-led growth policy.

|

(Yonhap) |

Since its inception in May 2017, the Moon government has poured 54 trillion won into various job programs -- only to see the country’s employment conditions worsen.

In their meeting Sunday, senior officials from the administration and the ruling party decided to additionally allocate more than 22 trillion won to carry forward employment programs next year.

On the following day, Moon called on his economic team to push ahead with an expansionary fiscal policy to help improve labor market conditions, referring to “bright prospects for tax revenue this year and next.”

In a forum on fiscal management last week, Finance Minister Kim suggested government outlays would increase more than 7.7 percent next year following a 7.1 percent rise this year.

The rate of increase is expected to be close to 10 percent, as the ruling Democratic Party of Korea has called for a double-digit hike. This means fiscal spending could exceed 470 trillion won for the first time next year.

The 2019 budget is set to be submitted to the National Assembly in early September, after being approved by the Cabinet next week.

The Moon administration has been the target of growing criticism for relying on fiscal expenditures as a panacea for unemployment and other problems.

“It is structurally unsustainable to create jobs with taxpayers’ money and collect levies from such jobs,” said Cho Dong-geun, an economics professor at Myongji University.

While criticizing what they view as the Moon administration’s misguided policies, experts still agree on the need to strengthen fiscal roles to tackle a range of problems that hamper sustainable growth and social harmony. Among them are income inequality, poverty among elderly people, household debt, youth unemployment, the low birthrate and the aging population.

Experts say that the expansion of fiscal spending should be accompanied by measures to prevent long-term fiscal soundness from being compromised.

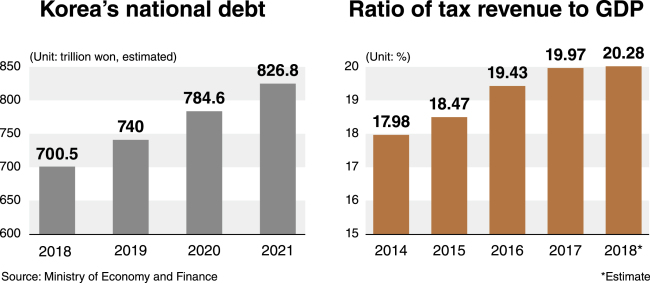

The country’s national debt is set to reach 700.5 trillion won this year, or 38.6 percent of the gross domestic product. Korea’s debt-to-GDP ratio remains relatively low compared with those of other major developed economies. What is concerning is the fast pace at which the debt is rising.

According to the Ministry of Economy and Finance, Korea’s national debt is forecast to reach 740 trillion won next year, 784.6 trillion won in 2020, and 826.8 trillion won in 2021.

The ministry expects the debt-to-GDP ratio to rise to 62 percent by 2060. But a report released last year by the National Assembly Budget Office warned that it could soar to 194 percent by then.

At last week’s forum, Kim Jung-hun, a researcher at the Korea Institute of Public Finance, noted that Korea, whose population is aging at the fastest pace in the world, is set to shoulder the heaviest fiscal burden among member states of the Organization for Economic Cooperation and Development. He warned that the country’s fiscal plans would be unsustainable if the proportion of people aged over 65 exceeded 30 percent.

The researcher said it was necessary to consider increasing taxes and readjusting the structure of fiscal spending.

Finance Minister Kim also raised the need to discuss whether and how to increase taxes in preparation for a fiscal cliff, which he said the country might face in about 10 years.

He suggested that excess tax revenue would help cover expanded government spending in the coming years, but that measures to raise tax burdens would need to be taken beyond then.

Economists worry that as domestic companies become less profitable -- due to anti-business policies at home and rising trade barriers abroad -- the benefits to the country from this excess revenue might begin to diminish sooner than the government expects.

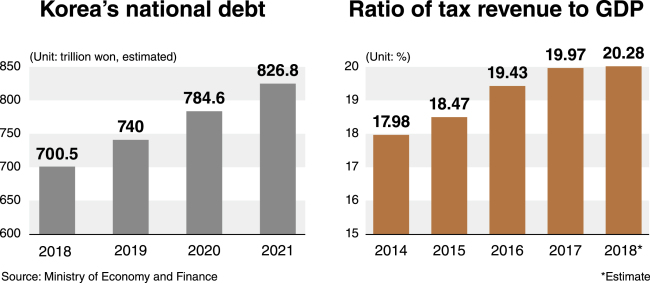

Korea’s ratio of tax revenue to GDP is estimated to reach 20.28 percent this year, up from 19.97 percent last year.

Finance Ministry officials note that this ratio is relatively low compared with other major advanced economies, and say they are hoping for discussion about increasing the tax burden if social consensus is reached on the expansion of fiscal expenditures.

But KIPF researcher Kim indicated that taxes might be raised by a maximum of 3 percent from the current level, given the sharp increase in contributions to a set of public insurance programs.

This makes it all the more necessary to readjust government spending to help maintain long-term fiscal soundness.

Experts say it is necessary to increase fiscal spending to help forge new industries, which would bolster the economy and expand the tax base. Educational and training systems need to be overhauled to make workers better prepared for the new wave of industrial renovations, they add.

By Kim Kyung-ho

(

khkim@heraldcorp.com)