[

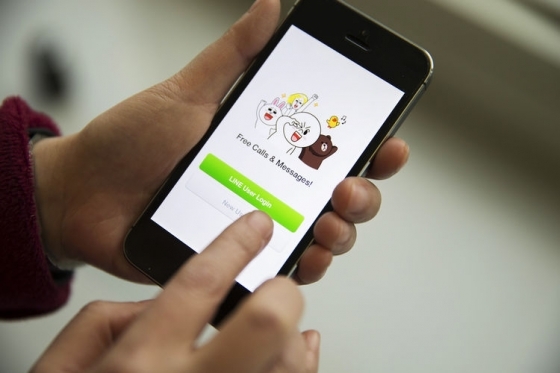

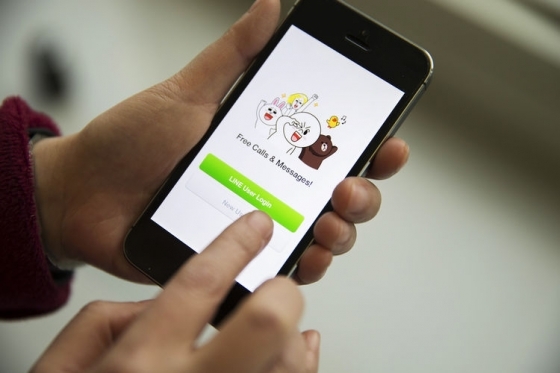

THE INVESTOR] LINE Corp. has set the price for its initial public offering at the top of its marketing range, raising up to 132.8 billion yen ($1.3 billion), the company said in a regulatory filing Monday in Tokyo.

The popular mobile messaging service, owned by Korean Internet giant

Naver, will sell 35 million shares at 3,300 yen per share. Another 5.25 million shares will be sold through a greenshoe option, allowing it to increase the amount of stock sold.

The company had initially set the price range at 2,700-3,200 yen last week.

At the IPO price, the company is valued at about $6.9 billion, making it the biggest stock market tech debut this year.

LINE will begin trading in New York on July 14 and in Tokyo the next day.

By Lee Ji-yoon (

jylee@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)