The market on Thursday reacted quickly to Hyundai Motor Group’s governance reform scheme announced Wednesday, with the share prices of its affiliates subject to spinoffs and mergers going in opposite directions.

Investors pulled more than 2 trillion won ($1.88 billion) off the market value of Hyundai Mobis on Thursday morning trade, less than a day after the group released a structural overhaul plan to spin off the parts maker’s more lucrative businesses and merge them with Hyundai Glovis. The share price of the logistics affiliate of the nation’s largest carmaker shot up 4.9 percent while that of Hyundai Mobis closed down 2.87 percent.

The scheme, according to the group, is aimed at improving the transparency of its governance structure and bolstering shareholder value. The deal still needs approval from shareholders.

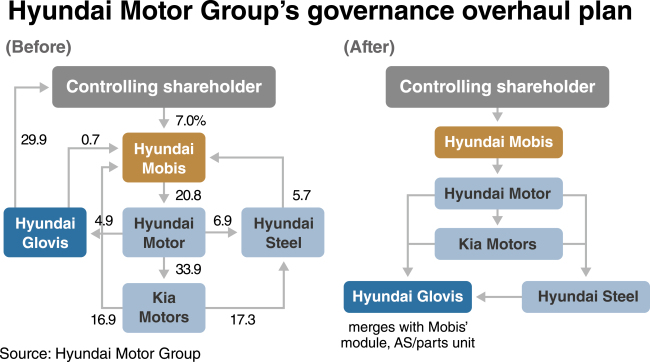

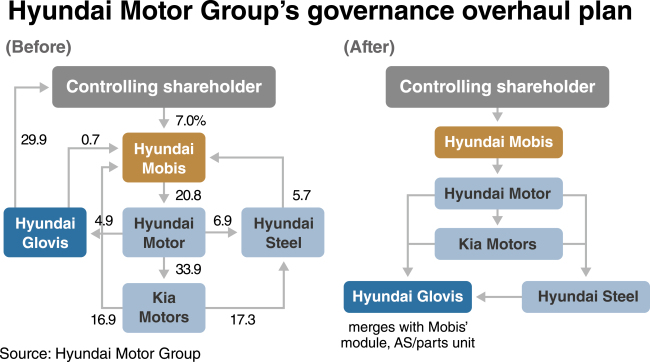

Under the plan, four out of nine cross-shareholding links will be removed, addressing public concerns over fair market competition that center on years of inter-affiliate trading.

Kim Sang-jo, chairman of the nation’s antitrust watchdog and the former shareholder rights activist, has been publicly pointing at Hyundai to cut off such links and conduct governance restructuring since last year.

Kim said he viewed the plan “positively.” Analysts also welcomed the auto giant’s move, saying it would lift uncertainty on the company’s profitability and raised expectations of more shareholder-friendly policies.

|

Chung Mong-koo, chairman of Hyundai Motor Group |

But some say the move would benefit the controlling family.

Announcing the plan, group said that the change has nothing to do with transferring control from Chairman Chung Mong-koo to his son Vice Chairman Chung Eui-sun, as the father would remain as the principal shareholder.

“The plan could be a response to the regulator’s reform drive, and the issue is how it will be achieved,” said Park Ju-gun, CEO of CEOScore, a local corporate tracker.

“(The spin off merger plan could make) the share value of Hyundai Glovis grow further to have Kia and Hyundai Steel buy them at its peak price. (Selling Hyundai Glovis’ share at peak price) could provide enough funds for Vice Chairman Chung Eui-sun to pay transaction tax and other costs to strengthen his power,” he said, adding that the heir was the single-largest shareholder of Hyundai Glovis with 23.3 percent. His father holds another 6.7 percent.

The group is expected to have Kia Motors and its steel arm Hyundai Steel buy shares of Hyundai Glovis through a series of block deals, possibly in July, if the deal is approved at shareholders’ meeting on May 29.

Board members of Kia Motors, Hyundai Glovis and Hyundai Steel, meanwhile, will review whether to sell each affiliate’s shares of Hyundai Mobis to the controlling family of the nation’s second-largest conglomerate.

Kia Motors currently owns 16.9 percent of shares of Hyundai Mobis, Hyundai Glovis 0.7 percent and Hyundai Steel 5.7 percent.

|

Chung Eui-sun, vice chairman of Hyundai Motor Group |

In order to do so, the controlling family needs money to acquire the shares of Hyundai Mobis, the group’s de facto holding company, by selling their Hyundai Glovis stocks, among others.

Securing additional shares of Hyundai Mobis might require about 4.5 trillion won for both the chairman and his son, and another trillion won for transactions tax when offloading their shares in Hyundai Glovis.

To persuade the shareholders, the group would need to say why the spinoff plan is beneficial, and convince them that it is not solely being pursued in the interest of the Chung family, experts noted.

“The structural spinoff is being proposed to increase (the group)’s business efficiency, but the market needs clear reason why it plans to hand over after-service and module units to Hyundai Glovis, and how the controlling family would buy shares, as well as the reasoning behind the distribution ratio” said Yoon Tae-ho, analyst at Korea Investment and Securities.

The distribution ratio for the spin-off merger between Hyundai Mobis and Hyundai Glovis was measured at 0.61:1. This means that every share of Hyundai Mobis stockholders would receive 0.61 new shares of Hyundai Glovis after the overhaul.

By Cho Chung-un (

christory@heraldcorp.com)

![[Out of the Shadows] Seoul room clubs offer drugs to compete for clientele](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/05/20241105050566_0.jpg)