|

SK hynix CEO Kwak Noh-jung delivers a speech during a press conference for CES 2024 at Mandalay Bay in Las Vegas on Jan. 8. (SK hynix) |

SK hynix will upgrade its legacy chip fab in China to produce high-value-added products to enhance profitability and meet the demand for recovery, the company said on Thursday.

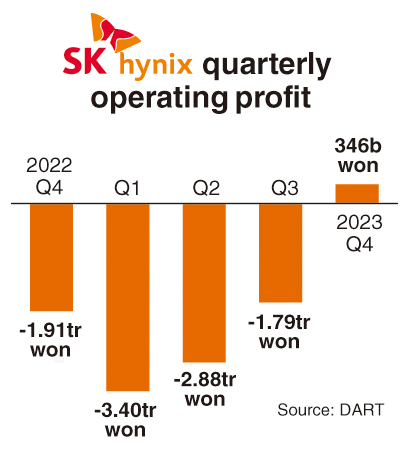

In its regulatory filing on the same day, the world's second-largest chipmaker reported an earnings surprise for the October-December period in 2023, marking a turnaround after struggling from losses for four straight quarters earlier.

"Unlike in the past, we will focus our investment decisions to deliver value rather than to increase capacity. We will try to make the most efficient use of our cleanroom space," Kim Woo-hyun, Vice President and Chief Financial Officer at SK hynix said in the earnings call.

"Under this principle, the Wuxi fab will eventually enable mass production of products such as DDR5 and LPDDR5 by migrating to 1a nanometer to extend the utilization period as much as possible," the official explained, referring to the company's DRAM production line in Wuxi, Jiangsu Province in China. The Wuxi plant currently produces legacy chips that are one or two generations behind the 1alpha nano DRAMs.

The company said it also plans to utilize the remaining space in the M15 fab in Cheongju, North Chungcheong Province, and M16 fab in Icheon, Gyeonggi Province, for the next few years.

For the fourth quarter of 2023, SK hynix said it achieved an operating profit of 346 billion won ($259.1 million), and sales of 11.31 trillion won. The company posted a net loss of 1.38 trillion won and the profit margin stood at 3 percent.

"We achieved a remarkable turnaround, marking the first operating profit in the fourth quarter following a protracted downturn, thanks to our technological leadership in the AI memory space,” said Kim Woo-hyun, Vice President and Chief Financial Officer at SK hynix.

"We are now ready to grow into a total AI memory provider by leading changes and presenting customized solutions as we enter an era for a new leap forward."

With the recovery in the final quarter, the company was able to narrow the operating loss for the year 2023 to 7.73 trillion, and a net loss of 9.14 trillion won, the company said. The revenues were 32.7 trillion won.

For the recovery in quarterly earnings, the company credited the improvement in the overall memory market conditions, backed by the increase in demand for artificial intelligence servers and mobile applications. The rise in the average selling price also affected the profit.

According to DRAMeXchange, a market tracker, the price of DRAM has been on an upward trend in the past months, jumping 26.9 percent in December when compared to October in the same year.

The company also aggressively cut production to improve prices and reduce inventories.

|

SK hynix quarterly profit (Graphics by The Korea Herald) |

SK hynix said that sales of its main products, DDR5 and HBM3, increased by more than four and five times, respectively, compared with a year earlier. In the NAND space, where recovery is relatively slow, the company prioritized streamlining investments and costs.

The chipmaker forecast the demand growth rate would be around mid-10 percent for both DRAM and NAND flash chips, thanks to the rise of the AI server and its more diversified application in the market.

Kim Kyu-hyun in charge of DRAM marketing at SK hynix said the rise of AI will be the key drive to the company's boost in HBM sales.

"In 2024, the HBM market is still going to be driven by demand growth from large customers. At the same time, we expect to see diversification in the sources of demand as the big tech companies compete for AI leadership, and also cloud service providers develop their own projects," Kim said.

Unlike conventional memory chips, HBM has a nature that is similar to order-based business with capacity being determined in consultation and contract with customers at least one year in advance. So, the company can remain cautious in investment and respond to supply in line with expected demand levels, Kim explained, dismissing concerns of oversupply.

The chipmaker said it will proceed with the mass production of HBM3E, a main AI memory product, and ongoing development of HBM4 smoothly. At the same time, it will be supplying high-performance, high-capacity products such as DDR5 and LPDDR5T to server and mobile markets in a timely manner, the company added.

In the rising market for AI servers and ondevice AI adoption, SK hynix said it will prepare high-capacity server module MCRDIMM and mobile module LPCAMM2 as well.

The chipmaker will be increasing its capital expenditure to 7 trillion won this year, slightly up from the 6 trillion won last year.

Announcing the improved earnings report on Thursday, the chipmaker said it will provide an incentive of 2 million and 15 stocks of the company to its employees to boost morale. The stock price is around 140,000 won, so one employee would be receiving stocks worth some 2.1 million won.

The company will also be giving out productivity incentives to the employees that are worth 50 percent of the base pay.

The global memory market has experienced a severe downturn after a surge in demand in the period when the COVID-19 pandemic hit. In the following time, the global economy struggled from inflation and a plunge in overall demand, leading to losses for major chipmakers including SK hynix.

![[KH explains] Will CATL’s Korean push reshape battery alliance with Hyundai, Kia?](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/10/09/20241009050092_0.jpg)