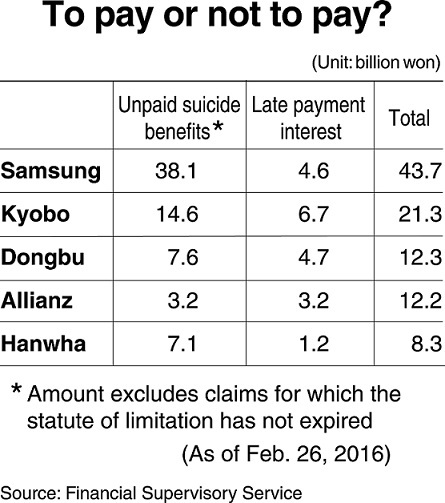

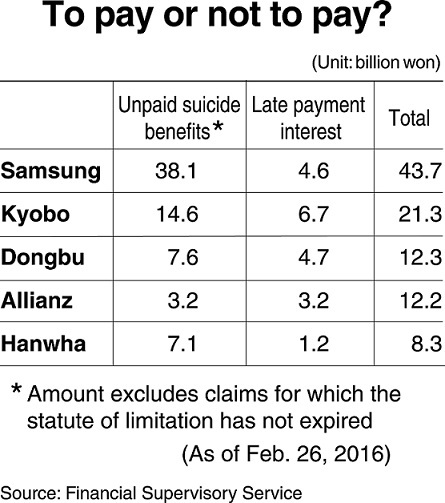

Korea’s life insurers are torn over how to deal with a mistake in their insurance contracts regarding suicide coverage, which would amount to 246.5 billion won ($213.8 million) in additional payouts to policyholders.

While five small and medium-sized players have surrendered under increasing pressure from financial authorities and the public to pay according to the contracts, eight are refusing to do so, arguing the statutes of limitation have already expired in most cases.

|

In this photo taken on May 23, 2016, an FSS official explains the financial regulator's position about the payment of insurance money to the bereaved family of a policyholder who kills himself. (Yonhap) |

The latter group includes Korea’s top three life insurers -- Samsung, Hanwha and Kyobo.

“Our shared stance is that we will wait for the Supreme Court’s decision on the issue of statutes of limitation,” said Lee Kwon-hee, a spokesperson for Kyobo Life.

Kyobo, the smallest of the trio, sold 338 policies that contained the error, stipulating the firm will pay accidental death benefits to policyholders who commit suicide. Kyobo, however, treated suicides as non-accidental deaths, paying smaller benefits.

The difference between what should have been paid by the contract and was actually paid totals 19.4 billion won, with interest on late payments estimated at 7.1 billion won.

Kyobo’s unpaid 26.5 billion won bill is the third-largest of all Korean life insurers facing the same issue.

ING Life’s figure is the highest at 81.5 billion won, followed by Samsung Life at 60.7 billion won.

The total for the whole of the life insurance industry is, according to the Financial Supervisory Service, 246.5 billion won, including the interest amounts, on 2,314 suicide cases.

It all first started with Donga Life Insurance, now KDB Life, making a mistake in writing the death coverage of its own product in 2001. What could have been a problem confined to one company became an industry-wide issue over time, as other insurers started copying the flawed policy contract of Donga without a proper review.

It was only in 2010 when they realized the error and fixed it.

By that time, over 2.8 million policies had been sold.

As the companies refused to pay accidental death benefits they promised, it became a legal issue, with the first lawsuit filed in 2012.

Then this May has brought a dramatic turn of events as the Supreme Court ruled that the insurers should give the additional payouts they owed to the families of suicide victims.

“The ruling has cleared confusions surrounding the payment of accidental death benefits in suicide cases, stemming from inconsistent decisions at lower courts,” the top court’s spokesperson explained.

In a separate case, the top court is now reviewing whether the two-year statute of limitation on death claims should be applied. In lower courts, judge ruled in favor of the insurers, saying they may refuse to pay claims filed after the deadline.

Of the 2,314 suicides covered by the old policies, 81 percent, or 200.3 billion won, hadn’t been filed before the deadline.

The judgements of the public and the regulator seem to be out already.

The Financial Supervisory Service last month ordered the firms to make full payments, even on claims filed after the limitations period had expired.

“Insurers should pay without delay. They shouldn’t wait for the Supreme Court’s decision on the statute of limitation,” Kwon Soon-chan, deputy governor of insurance at the FSS, said at a press conference held after the court decision came out.

So far, five insurers have decided to pay the unpaid benefits on all claims. They are ING, Metlife, Shinhan, DGB and Hana.

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)