The Bank of Korea held the benchmark rates steady for the sixth straight month Thursday, citing the deepening eurozone debt crisis abroad and slowing exports at home.

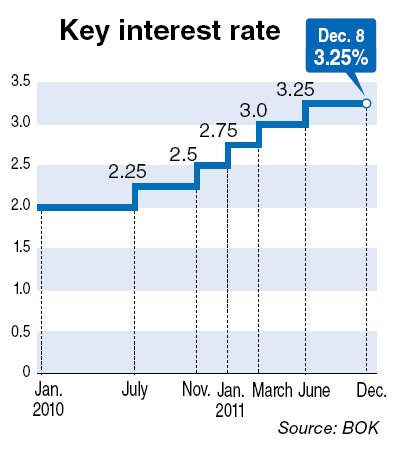

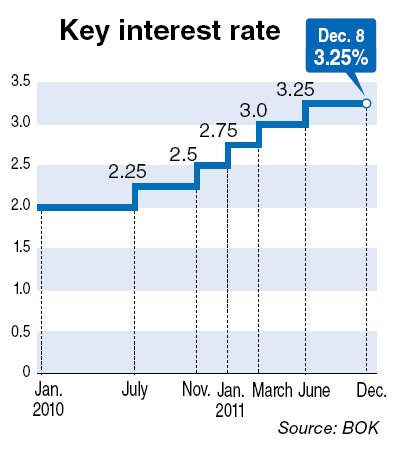

The monetary policy committee led by Gov. Kim Choong-soo unanimously agreed to freeze the rate at 3.25 percent, a move aimed at helping Asia’s fourth-largest economy fight the external risks that threaten its export-oriented growth.

“Downside risks to growth are high, due mostly to the sovereign debt crisis in Europe and to the possibility of slumps in major national economies and the unrest in international financial markets continuing,” the central bank said in its statement.

The BOK’s policy focus has shifted to growth since it raised the key rate by 125 basis points in five steps since July last year to rein in inflation.

Consumer prices, even after its index was rebased, rose 4.2 percent in November from the same period a year earlier, surpassing the central bank’s 2-4 percent target band and accelerating from October’s 3.6 percent.

The BOK said inflation would ebb in the coming months with the help of a fall in food and commodity prices, but the pace would still be fast due to public utility charge hikes and ongoing high inflation expectations.

Despite the high inflation, the central bank is focused more on growth worries. The country’s third-quarter gross domestic product grew by a revised, seasonally adjusted 0.8 percent from the previous quarter, slowing for the second straight quarter.

The country’s exports in November reached $47 billion, little changed from the previous month, but the outlook remains murky as the fiscal turmoil in Europe and the slowing U.S. economy might weaken demand for Korean goods and services.

Given that in addition to the eurozone problem, domestic demand continues to be tepid, household debt rose and facilities investment shrank in the third quarter, analysts expect the BOK to begin considering a rate cut in the near future, following in the footsteps of other central banks, including Australia and Brazil.

Goldman Sachs said on Wednesday that Korea’s benchmark rate might be cut by 50 basis points in the first half of next year.

However, Gov. Kim said on Thursday Korea is in a different situation with other countries which opted for a rate cut, reiterating that there is no major change in the central bank’s policy stance of rate normalization.

“Recently, some countries (in Europe) lowered the rate, but Korea has a different situation, and it’s also inappropriate to talk about the possibility of a mild recession for Korea,” he said.

The central bank will release its 2012 outlook on Friday, probably lowering its forecasts in consideration of the heightened external risks.

By Yang Sung-jin (

insight@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)