World’s sixth reactor exporter seeks to expand foray into global markets after UAE deal

Since a watershed deal with the United Arab Emirates in 2009, Korea has been ratcheting up its ambitions to promote its know-how in nuclear plant construction overseas.

The $20 billion contract has since bolstered Korea’s confidence in its newly defined foray into the high-entry-barrier market, making it the sixth member of the league of reactor exporters following the U.S., France, Russia, Canada and Japan.

Equipped with an over 30-year safety record and technological prowess, Seoul officials are believed to be in talks with their counterparts in countries including Turkey, Finland, Vietnam and Saudi Arabia, which are slowly resuming plans for their own atomic reactors.

Despite the Japanese calamity, the global nuclear industry will gradually rebound, some experts say, on the back of concerns about global warming and skyrocketing electricity demand.

“(Japan’s disaster) has slowed down a certain number of projects but we expect it to pick up very soon,” Luc Oursel, president and chief executive of Areva, a French energy giant, told journalists on the sidelines of the Nuclear Industry Summit in Seoul on Friday.

Fukushima’s legacy

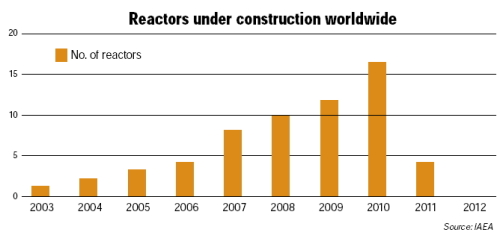

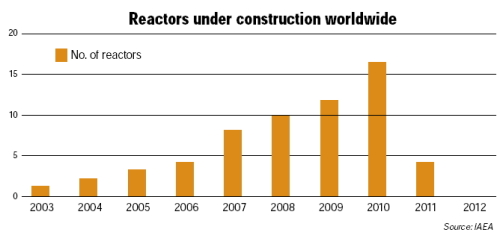

Last year’s Fukushima fiasco injected serious doubt into the once fast-growing global nuclear plant sector.

At least 80,000 residents were evacuated and many of them will never return. Radioactive contamination in food prompted import bans on Japanese produce. Protests relayed around the world.

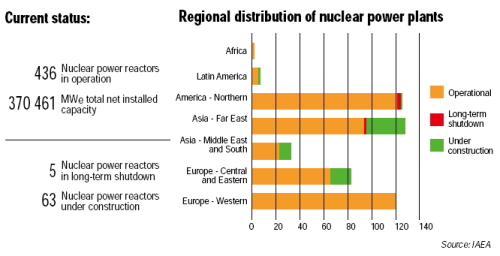

Under mounting pressure, Germany shut down eight of its 17 reactors for good and vowed to close the remainder by 2022. Switzerland and Spain barred the construction of new reactors. Many others including Italy, Taiwan, Mexico and Belgium plan to phase out or scale down their atomic facilities.

Further, while existing reactors remain a money-spinning business, building new ones is no longer a feasible option without state subsidies. The tax burden is rising in line with lengthening construction periods. The risks of proliferation or terrorism, as well as a spillover of radioactive materials, have also put the industry under heavy international regulations and civic scrutiny.

“Fukushima has accelerated a trend towards more ‘energy democratization,’” said Christoph Frei, secretary-general of the World Energy Council.

“At the heart of this is the question of trust. The public demands transparency and participation in decisions about the future of their country’s energy mix.”

In the wake of the industry’s worst crisis since Chernobyl, Korea has outlined far-reaching stress tests for existing stations, while notching up earthquake resistance standards for forthcoming ones.

It also wrote 50 short- and long-term contingency plans based on worst-case scenarios covering an extreme natural disaster, power failure and severe accident, to which the International Atomic Energy Agency recently gave a positive review.

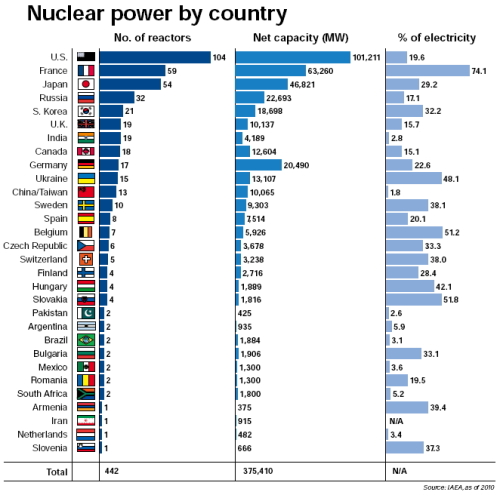

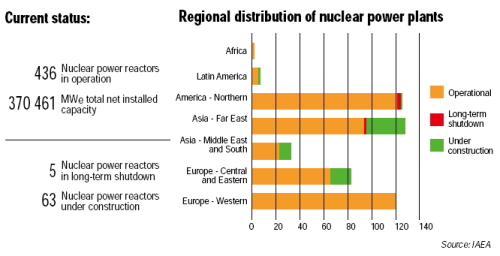

Unwavering in its plan, however, Korea is pushing to expand nuclear energy to 59 percent of its electricity production by 2030 from around 30 percent now. It is set to add 19 to its current 23 reactors, its second-largest power source after coal.

Landmark deal

Since its first commercial operation in 1978 with help from U.S.-based Westinghouse Electric Co. LLC, Korea has grown into the world’s fifth-largest atomic power generator without any major accident. Its 23 reactors churned out more than 20,600 megawatts of electricity as of March 24, IAEA figures show.

Although a relative newcomer to the global atomic power scene, Korea has gained recognition for its safety, cost-efficiency, technological expertise and rapid construction times.

Its reactors’ capacity factor averaged at 90.7 percent last year, far above the world average of 79 percent, according to Korea Hydro & Nuclear Power Co., the state-run nuclear plant operator.

Capacity factor is a gauge of the performance of a power generator as a ratio of its actual output over time to its full potential. A higher reading implies greater execution.

To better compete with leaders in international markets, the KHNP and KEPCO Engineering and Construction Co. teamed up to craft Korea’s own standard light-water reactor models. They introduced the Optimized Pressurized Reactor 1000 in 1995 and its upgraded version, Advanced Pressurized Reactor 1400, in 2002.

In 2009, the UAE chose to adopt four units of the APR 1400 for its first nuclear plant scheduled for 2020. Seoul officials expect to rake in an additional $20 billion from a separate order for operation and maintenance for 60 years.

Korea is now gearing up to net another mega deal with the UAE as the Middle East’s emerging power mulls building an extra four reactors.

“Thanks to an active national program of nuclear power plant construction, Korea has developed distinct competitive advantages in terms of low cost, high credibility and high performance,” said Michel Berthelemy and Francois Leveque of Mines ParisTech, a France-based engineering school, in a 2010 report.

Prospective partners

¡¡ Turkey and Finland are also in the government’s sights. If a deal is reached in either country, experts say, it will create further momentum for Korea, which is seeking to dismantle Areva’s dominance in the European market.

Talks with the Eurasia nation restarted after nearly two years of dormancy when Premier Recep Tayyip Erdoğan officially requested Korea’s participation in November. Turkey aims to build four atomic reactors in regions along the Black Sea, valued at $5 billion apiece.

Finland was the first country to officially announce a plan for a new reactor since Fukushima. Given delays in the French powerhouse’s ongoing program in the Nordic country, Korea can expect a better chance this year, experts say.

“Success in mature markets like Finland will be significant for the Korean nuclear industry,” said Chang Soon-heung, a professor at Korea Advanced Institute of Science and Technology in Daejeon.

“I believe Korea can penetrate the European market as shown during the UAE auction. It has necessary technology, infrastructure, safety measures and price competitiveness.”

The Korean consortium beat an Areva-led team in the race for the industry’s most coveted deal.

Vietnam is also interested in applying Korean technology to its two new reactors as it faces chronic power shortages, according to Meritz Securities.

“Simultaneous construction of a bunch of reactors is inevitable for Vietnam to ensure stable electricity supplies and spur economic growth,” said Kim Seung-churl, the brokerage’s analyst.

Other candidates may include Malaysia, South Africa and India, he notes. Despite stalled progress, Korea clinched memoranda of understanding with Saudi Arabia and Argentina in 2011 and 2010 for their respective projects for atomic plants.

Still, a rise in new orders does not necessarily boost Korea’s prospects for further exports. The country also faces a deepening anti-nuclear sentiment and political challenges in an election year.

The current slump, however, could eventually provide a steppingstone for Korea to take off as a major player on the world stage, Kim adds.

“Taking lessons from Japan, we should keep safety as a priority at this point. But, at the same time, those reinforced safety standards will step up our competitiveness in the global market,” said Chang, who also chairs the Korean Nuclear Society.

By Shin Hyon-hee (

heeshin@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)