Low price of soju costing Korea enormously

Binge-drinking in Korea was once viewed as a relatively harmless deviation among the nation’s workaholics, but its burden on public money and social capital is starting to prompt action.

The cost of premature death caused by alcohol exceeded 3 trillion won ($2.6 billion) in 2007 and is likely to have risen since.

The government has been tightening the regulatory system. Drinking in public parks will be banned from next year. In Seoul, there are proposals prohibiting drinking in school areas, youth centers and hospitals.

But none of the proposals touch on a significant aspect of the problem: Alcohol is cheap.

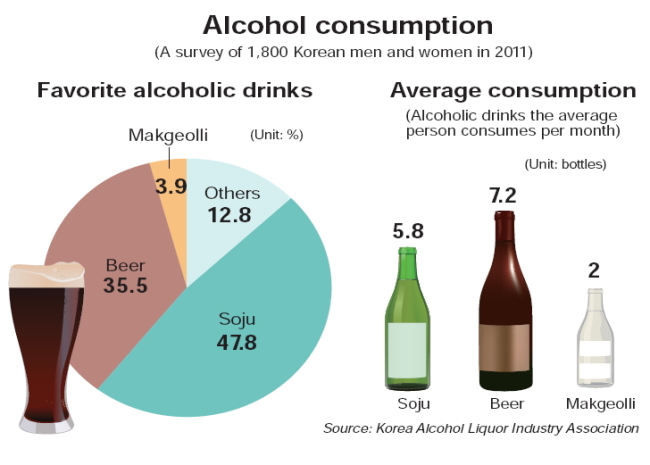

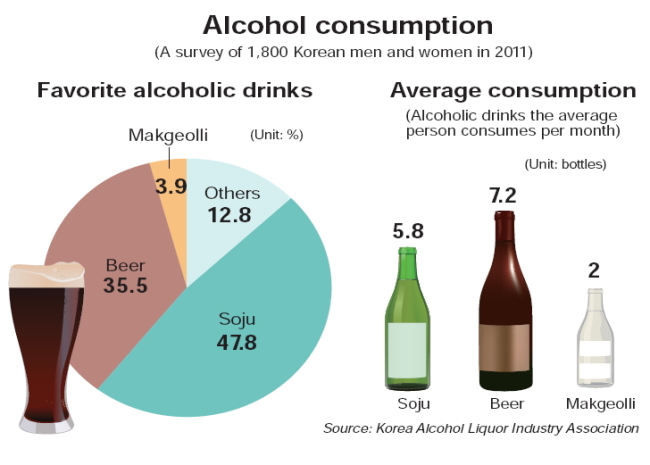

Soju is by far the most popular alcoholic beverage in Korea with a 51 percent share of the market. Its low price, roughly 1,200 won for a 350 ml bottle, coupled with a high alcohol content of roughly 20 percent have made it the favorite drink across all incomes.

The cost of producing a bottle of soju is less than 400 won, and the price has increased at a slower rate than inflation since 2008, when President Lee Myung-bak froze the prices of 52 items including soju as part of a policy to limit the effects of inflation and economic difficulties on the working class.

Indeed, soju has an image of being a companion and a comfort for the working class. The irony, according to former Hongik University professor Jang Geun-ho ― now a director in the Ministry of Strategy and Finance ― is that the low price of soju may not necessarily benefit the poor but do just the opposite.

In 2006, there were discussions in the government of raising the tax on alcoholic beverages relative to their level of alcohol by volume. Park Byong-won, then vice minister in the Ministry of Strategy and Finance, said, “It is a global trend to raise the duty on alcoholic beverages with high content.”

The argument adopted by the government was also well supported by scholars in the field. According to Park Sang-won, a researcher at the Korea Institute of Public Finance, since it is the amount of alcohol and not the quantity of liquid that causes social problems, the government should tax various alcoholic beverages differently.

For example, beer and soju are taxed equally in Korea. Korea is one of only three OECD countries to tax alcohol in this way. All the other OECD countries instead have a specific commercial duty on alcohol, generally levying more tax on higher-strength drinks.

But this policy met fierce opposition from Korean lawmakers, who cited the effect of price rises on the poor.

Nonetheless, extensive studies show increasing the duty on high-percentage alcoholic beverages may not affect the finances of the poor as much as the lawmakers claim it would. Research published by Korea Alcohol Research Center in 2010 shows the real and more substantial culprits of Korea’s binge drinking culture are the wealthy.

As income rises, so does alcohol consumption, frequency and the likelihood of binge drinking. In other words, the wealthy tend to spend more money on drinking than the poor. Even in the United States, studies show that raising the price of alcoholic beverages has little effect on the poor.

Alcoholic drinks only represent 0.4 percent of household consumption expenditure, according to a study by Jung Young-ho, a researcher at Korea Institute for Health and Social Affairs. This means a higher duty on alcoholic beverages is likely to have a limited economic impact on ordinary households.

Raising the tax on hard liquor like soju could help target alcoholics while leaving moderate drinkers relatively unaffected. According to a study by the Korea Alcohol Research Center in 2010, whiskey and soju account for more than 60 percent of alcoholics’ preferred drinks, while moderate drinkers tend to opt for wine and beer.

Jang has also argued that the low price of soju also facilitates teenage drinking.

“The sentiment that soju is a consolation for the poor has led to an unnaturally low price for the drink, and this has resulted in many harmful consequences such as teenage drinking,” he said.

By Kim Jung-ho (

jungho1991@gmail.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)