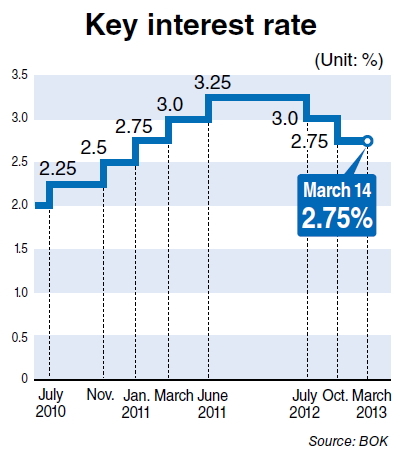

The Bank of Korea froze its key base rate at 2.75 percent on Thursday for the fifth consecutive month as indicators show that the U.S. and China, the country’s two biggest export destinations, are heading for a full recovery this year.

The U.S. created a number of new jobs to push down its unemployment rate to a four-year low at 7.7 percent last month as its Federal Reserve reaffirmed that it will carry out its easy money policy until the job market improves, while China continued to show solid data in both domestic consumption and exports.

The BOK said Korea’s exports will rebound going forward, though domestic conditions are between stable and lackluster. Outbound shipments in February slowed due to the Lunar New Year holidays, which cut working days, and consumer prices remained stable with the inflation rate reaching 1.4 percent last month, well below its target level of 2.5-3.5 percent.

“The central bank expects the inflation rate to be below 3 percent over the next three years,” BOK Governor Kim Choong-soo said, noting that this is closely aligned with the Park Geun-hye administration’s 2 percent target goal.

Also, a slight improvement in investments in the construction sector, a key driver for domestic growth, was one of the BOK’s reasons for keeping its key rate unchanged.

However, the central bank said U.S. across-the-board spending cuts following its sequester and the ongoing fiscal crisis in the eurozone cast a shadow over the Korean economy.

It expects the downturn in Europe to slow global demand as well as recovery in Korea, which currently faces low employment, consumption and facility investment. The central bank said that such low macroeconomic data figures are temporary, and are mainly due to the Lunar New Year holiday.

Analysts are divided over the central bank’s next move -- whether or not it will cut the key interest rate.

Given that the Park Geun-hye’s administration has not yet fully drawn up its economic policy, including fiscal measures, the central bank seems to be in a “waiting mode,” they said.

An analysis report by Hyundai Securities suggested that it could move to cut the rate in the next monetary policy meeting to back President Park’s stimulus plans that include boosting jobs and welfare spending as governor Kim said that it will implement a “policy mix” that effectively combines both monetary and fiscal policies so that Korea will not fall behind the global economy.

Also, a rate cut could be considered if Korea’s first-quarter GDP growth falls short of expectations, which Kim suggested may happen, saying that “it may be below 2 percent.”

A number of Korean securities companies forecast that Korea’s first-quarter growth will be around 1.6 percent to 2.2 percent.

KDB Daewoo Securities came out with an expectation of the country’s GDP at 1.6 percent in the first quarter, while Hana Daetoo Securities and Shinhan Investment forecast 1.9 percent.

On the other hand, increased fiscal spending in Korea and global economic recovery will likely pose an inflation risk.

“Inflation is currently low but will accelerate in line with Korea’s growth as the year progresses. Inflation will be a bigger issue later in 2013,” Moody’s Analytics said in a report.

This could compel the central bank to raise its key rate as South Korea would be able to contain risks concerning a strong won, household debt and North Korea, it added.

By Park Hyong-ki

(hkp@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)

![[Graphic News] International marriages on rise in Korea](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050091_0.gif)