More than 200 Koreans, including corporate executives and conglomerate owners, are expected to come under scrutiny by state tax auditors after being exposed as holding offshore accounts and assets in tax havens.

The Korea Center for Investigative Journalism, a non-profit, independent news agency, said Wednesday that 245 Koreans currently owned paper companies, or ghost assets, in the OECD-designated tax havens, including the British Virgin Islands and the Cayman Islands.

It disclosed in its first report that most of them were “well-known” members of the so-called chaebol or family-run conglomerates.

Lee Soo-young, chairman of OCI, a listed industrial materials manufacturer, and his wife were reported to hold a ghost company in the Virgin Islands.

The center’s list also included family members of Cho Choong-keon, a former president of Korean Air, and Cho Wook-rae, chairman of DSDL, a real estate developer.

|

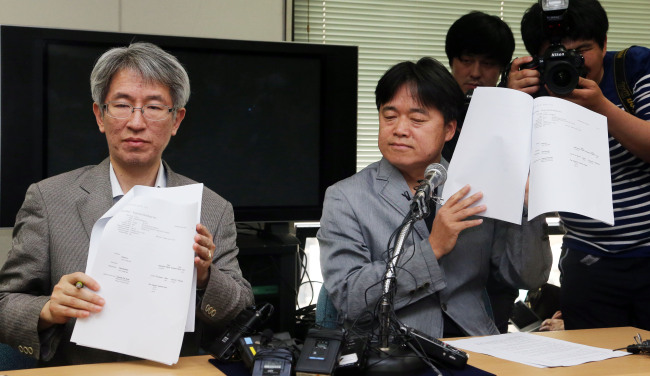

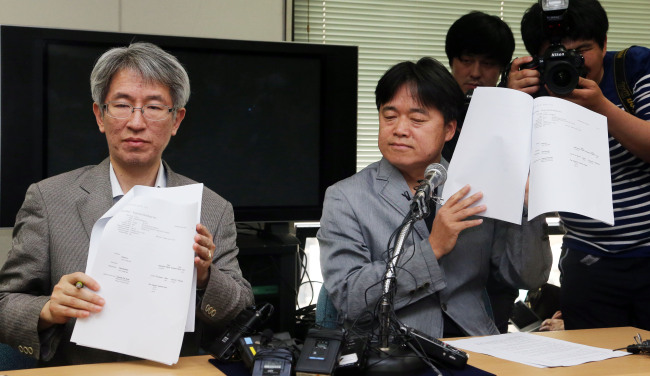

Kim Yong-jin (left), head of the Korea Center for Investigative Journalism, and producer Choi Seung-ho make public the list of Korean businessmen and their families suspected of having slush funds in overseas tax havens at a news conference in Seoul on Wednesday. (Yonhap News) |

Cho Choong-keon is the uncle of Cho Yang-ho, chairman of the national flag carrier Korean Air, and younger brother of Cho Choong-hoon, the founder of Hanjin Group.

Cho Wook-rae is the younger brother of S.R. Cho, chairman of Hyosung Group.

Shares of OCI and Hyosung dipped following the disclosure, with OCI ending down 1 percent, or 1,500 won, at 148,500 won and Hyosung finishing at 58,000 won, a drop of 4.29 percent, or 2,600 won. Korean Air was the only one that was able to withstand the news.

Korean Air ended up 0.54 percent, or 200 won, at 37,000 won.

The center, which worked with the International Consortium of Investigative Journalists to uncover tax haven assets, plans to reveal more findings on a regular basis after further confirmation over the next month.

It plans to disclose names of corporate executives in addition to conglomerate owners and their relatives owning offshore ghost companies.

It added that there could be someone from Samsung, Korea’s biggest conglomerate, but the center would have to check its findings.

It noted that some of those holding offshore accounts recorded their domiciles as Hong Kong or Singapore, and that some may have set up ghost companies legitimately.

The center seeks to uncover accounts that have not been reported to the country’s tax authorities. All holders of foreign accounts and assets are by law required to report their earnings to the authorities, regardless of their locations.

Seven tax havens designated by the OECD exempt individuals or companies from paying a variety of taxes, making it unnecessary to file reports to their respective homeland governments.

These accounts can be used to store slush funds, and personal wealth and savings.

The center previously reported that about 34 conglomerates owned about 160 subsidiaries in those seven tax havens, while the ICIJ reported that about 70 Koreans held accounts in the British Virgin Islands.

The center and ICIJ said they were not working with the National Tax Service on the matter.

This latest development will likely push the NTS to closely scrutinize those exposed by the two independent news organizations as the state tax regulator vowed to bring anyone suspected of holding offshore accounts and not filing reports to justice.

This is in line with the Park Geun-hye administration’s goal to secure some 135 trillion won over the next five years to finance welfare expansion.

By Park Hyong-ki (

hkp@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)