|

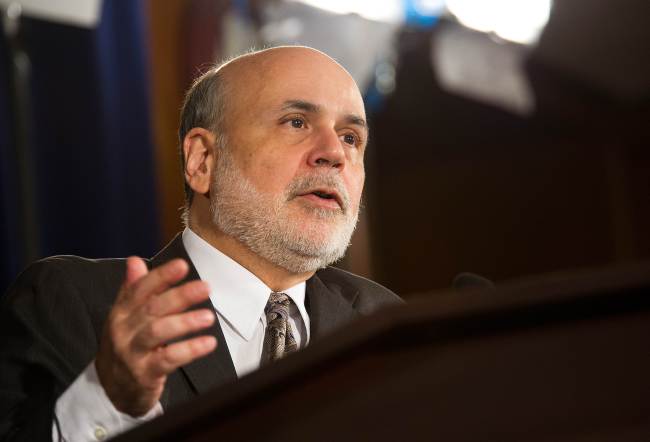

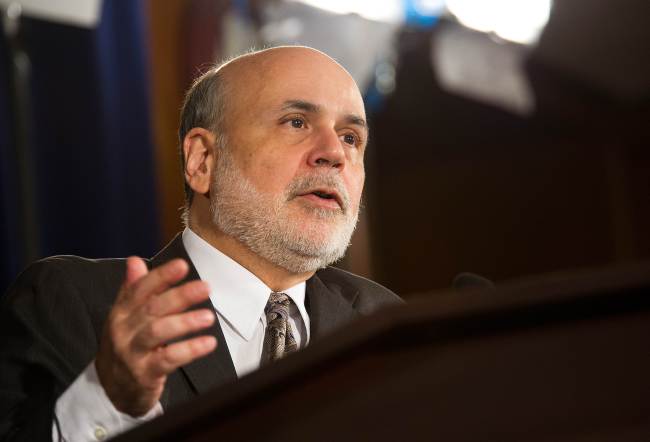

U.S. Federal Reserve Board Chairman Ben Bernanke speaks during a news conference after a Federal Open Market Committee (FOMC) meeting Wednesday at the Federal Reserve in Washington, DC. (AFP-Yonhap News) |

The Federal Reserve has decided to reduce its stimulus for the U.S. economy because the job market has shown steady improvement. The shift could lead to higher long-term borrowing rates for individuals and businesses.

The Fed's decision amounts to a vote of confidence in the economy six years after the Great Recession struck. It signals the Fed's belief that the U.S. economy is finally achieving consistent gains.

The central bank said in a statement after its policy meeting ended Wednesday that it will trim its $85 billion a month in bond purchases by $10 billion starting in January. At a news conference afterward, Chairman Ben Bernanke said the Fed expects to make “similar moderate” reductions in its purchases if economic improvements continue.

At the same time, the Fed strengthened its commitment to record-low short-term rates. It said it plans to hold its key short-term rate near zero “well past” the time when unemployment falls below 6.5 percent. Unemployment is now 7 percent.

The Fed intends its bond purchases to drive down borrowing rates by increasing demand for the bonds. The idea has been to induce people and businesses to borrow, spend and accelerate economic growth. The prospect of a lower pace of purchases could mean higher rates.

Nevertheless, investors appeared pleased by the Fed's finding that the economy has steadily strengthened, by its firmer commitment to low short-term rates and by the only slight amount by which it's paring its bond purchases.

The Dow Jones industrial average soared more than 275 points, well over 1 percent. Bond prices fluctuated but by late afternoon, the yield on the 10-year Treasury note was unchanged at 2.88 percent.

The Fed's move “eliminates the uncertainty as to whether or when the Fed will taper and will give markets the opportunity to focus on what really matters, which is the economic outlook,” said Roberto Perli, a former Fed economist who is now head of monetary policy research at Cornerstone Macro.

But Perli noted that the Fed has hardly withdrawn its support for the economy. It will continue to buy bonds every month to keep long-term rates down and remains strongly committed to low short-term rates. By keeping interest rates historically low, the Fed “will continue to remain very supportive of risky assets,” Perli said.

The economy is improving consistently, and the Fed is “now recognizing the trend and decided to go with the flow,” said John Silvia, chief economist at Wells Fargo.

In updated economic forecasts it issued Wednesday, the Fed predicted that unemployment would fall a bit further over the next two years than it thought in September. And it expects inflation to remain below the Fed's target level.

The Fed expects the unemployment rate to dip as low as 6.3 percent next year and 5.8 percent in 2015. Unemployment has fallen faster this year than policymakers had predicted.

And Fed policymakers predict that their preferred inflation index won't reach its target of 2 percent until the end of 2015 at the earliest. For the 12 months ending in October, the index is just 0.7 percent.

The Fed worries about very low inflation because it can lead people and businesses to delay purchases. Extremely low inflation also makes it costlier to repay loans.

In its statement, the Fed says it will reduce its purchases of mortgage- bonds and Treasury bonds each by $5 billion. Beginning in January, it will buy $35 billion in mortgage bonds each month and $40 billion in Treasurys.

The bond purchases have helped keep long-term interest rates low to encourage more borrowing and spending.

The Fed's actions were approved on a 9-1 vote. The only member to object was Eric Rosengren, president of the Federal Reserve Bank of Boston. He called the move premature because unemployment remains high and inflation extremely low.

The Fed's action comes after encouraging reports that show the economy is accelerating.

Hiring has been robust for four straight months. Unemployment is at a five-year low of 7 percent. Factory output is up. Consumers are spending more at retailers. Auto sales haven't been better since the recession ended 4 and a half years ago.

What's more, the stock market is near all-time highs. Inflation remains below the Fed's target rate. And the House has passed a budget plan that seems likely to avert another government shutdown next year. The Senate is expected to follow suit. (AP)