The planned initial public offerings of Samsung Everland and Samsung SDS will allow Samsung Group chairman Lee Kun-hee’s three children to secure capital worth some 5 trillion won ($4.9 billion) to inherit wealth and ownership of Lee’s business empire.

Samsung Everland, the de facto holding company of the group, said Tuesday that it would go public by early next year, a widely expected move by the market following the announcement of Samsung SDS’ stock flotation plan last month.

The market has been expecting the group to further accelerate the equity restructuring of its affiliates as Lee remains hospitalized and unconscious after receiving heart treatment.

“The IPO of Korea’s largest theme park can also be seen as part of steps to simplify the group’s complex equity ties, and transform the group into a holding company with financial units under an intermediate holding company,” analysts said.

Samsung vice chairman Lee Jay-yong is expected to hold a controlling interest in the envisioned holding company that would line up Samsung’s electronics, construction, and theme park and resort businesses, they said.

The funds raised via the IPOs would pave the way for Lee’s children, especially his son Jay-yong, to pay for taxes after inheriting the chairman’s crucial shares in Samsung Electronics and Samsung Life Insurance worth some 12 trillion won.

Lee’s 20 percent stake in Samsung Life will be the key to allowing Jay-yong to maintain control over the group’s electronics and financial units, which he will lead, as the insurance company’s equity ties expand from Samsung Everland and Samsung Electronics to Samsung Card through a complex web of cross-shareholdings.

Chairman Lee has less than a 4 percent stake in Samsung Electronics, but he is the owner as he has significant interest in Samsung Life, which holds a 7.56 percent stake in the world’s largest consumer electronics company.

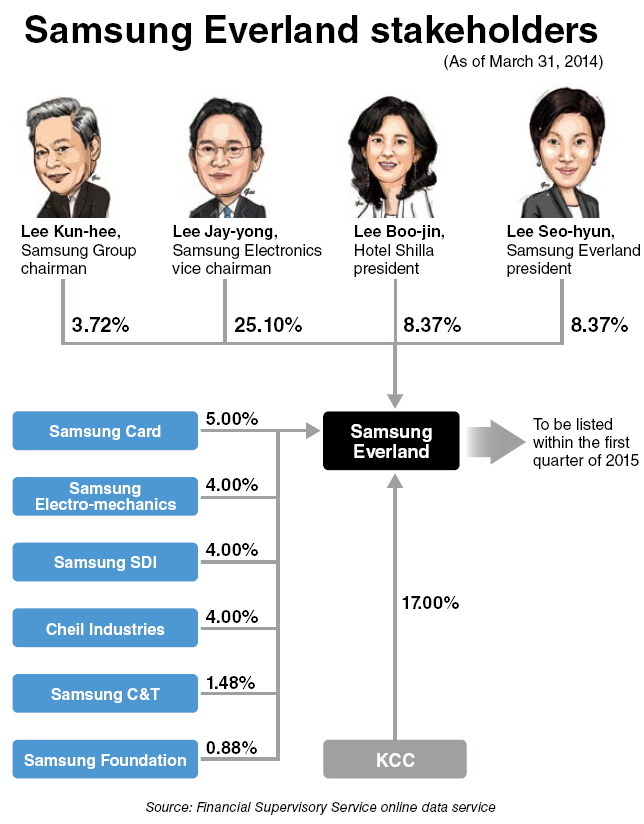

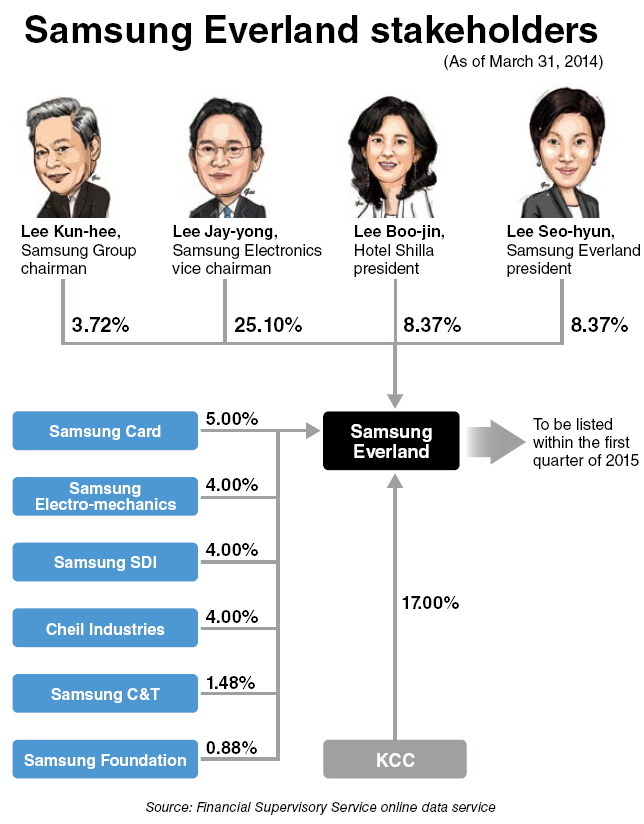

Jay-yong is currently the largest shareholder with a 25.1 percent stake in Everland, while his sisters Boo-jin and Seo-hyun both hold 8.37 percent. The Samsung chairman holds 3.72 percent.

KCC, a construction materials company whose owner is related to Hyundai Motor chairman Chung Mong-koo, has been highlighted as one of the main beneficiaries of Everland’s IPO as it is the second-largest shareholder.

Samsung Everland was founded in 1967 by late former chairman Lee Byung-chull as a real estate firm, which later expanded into a wide range of businesses from a theme park and golf resort to construction and food.

It has been streamlining its businesses and management to focus on fashion, resorts and construction, which was seen as a move by the Samsung vice chairman to take over the ownership of Samsung Group.

Samsung Everland sold its building management division to Samsung’s security unit S-1, and Samsung SDS acquired Samsung SNS. Samsung General Chemicals took over Samsung Petrochemical in April.

By Park Hyong-ki and Kim Young-won

(

hkp@heraldcorp.com) (

wone0102@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)