Digital wallets such as Apple Pay and Alipay are gradually replacing cash and credit cards with more and more people browsing and purchasing goods by tapping and swiping on their smartphones.

Kakao Pay, codeveloped by Internet giant Daum Kakao and ICT solutions developer LG CNS, is one of the services spearheading the mobile payment industry in South Korea.

After launching its mobile payment service Kakao Pay in October, Daum Kakao was able to attract 2 million subscribers in less than three months and the number is on the rise, according to the firm.

“Eliminating repetitive and troublesome procedures such as entering credit card numbers and installing financial authentication certificates on mobile devices is surely an appealing factor for users,” said Sonia Im, a spokeswoman of Daum Kakao, which also runs the Korea’s most-used mobile messenger KakaoTalk.

The financial authentication certificates often required in online financial transactions in Korea have been pointed out as being a barrier for the growth of online banking and e-commerce industries.

Instead of relying on complicated procedures to identify individuals, Kakao Pay allows registered users to make purchases on KakaoTalk and at online shopping malls just by typing in a six-digit passcode.

Despite the simplicity of the payment procedure on Kakao Pay, the mobile payment system’s security is airtight.

All user data is encrypted and stored separately in smartphones and LG CNS’ servers, and only one registered smartphone can be used for making purchases via Kakao Pay.

The mobile payment system received the industry’s highest security approval from the Financial Supervisory Service, the nation’s regulatory body for financial institutions.

Daum Kakao, which is currently in partnership with the so-called “big five” online shopping malls, including GS Home Shopping and CJ O shopping, and online book stores Kyobo Bookstore and Aladin, is planning to expand its mobile payment services to brick-and-mortar shops.

After Kakao Pay becomes available at traditional retail shops, Kakao users will be able to make purchases by scanning barcodes, and utilizing near-field communication chips installed in their mobile devices.

Daum Kakao is also working to integrate the mobile payment system in its other applications including Kakao Taxi, a taxi-hailing service to be launched in the first half of this year.

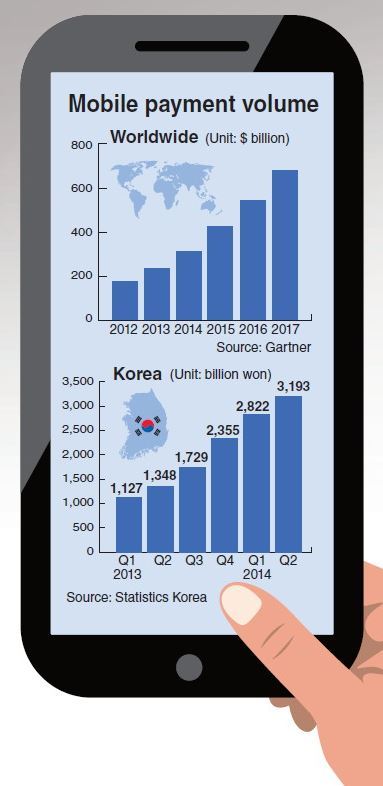

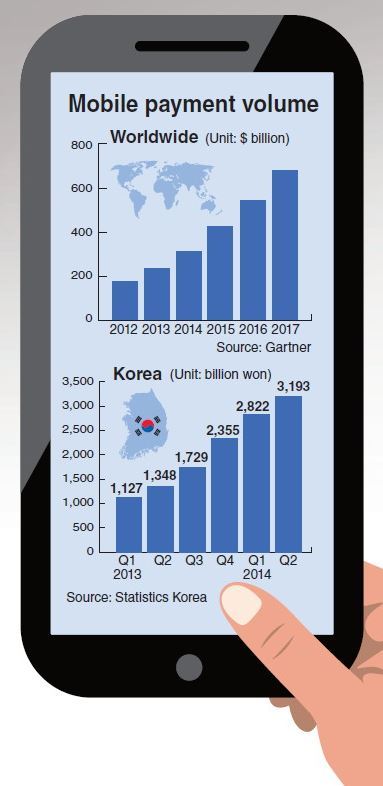

Korea’s mobile shopping industry more than doubled in value to 13 trillion won ($11.8 billion) in 2014, according to the Korea Online Shopping Association, which represents local online shopping malls.

Beyond just allowing messenger users to pay for their goods on mobile devices, Daum Kakao also lets users transmit a small sum of money deposited in their bank accounts to other users via Bank Wallet Kakao.

The company said the digital wallet was “hack-proof” thanks to its multiple security firewalls.

“Since user transaction data is encrypted throughout the entire process, even service operators cannot access the information,” an official from the firm explained.

The mobile payment market worldwide is expected to more than triple from $234 billion in 2013 to $721 billion in 2017 according to market researcher Gartner.

By Kim Young-won (

wone0102@heraldcorp.com)

![[Weekender] Korean psyche untangled: Musok](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/02/20240502050841_0.jpg)

![[Eye Interview] 'If you live to 100, you might as well be happy,' says 88-year-old bestselling essayist](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/03/20240503050674_0.jpg)