Samsung Electronics vice chairman and heir apparent Lee Jae-yong is betting big on biotechnology, a move reminiscent of his father, chairman Lee Kun-hee’s entry into the chip business almost 40 years ago.

In the 1970s, there was widespread skepticism about Samsung’s entry in the chip market that was dominated by U.S. and Japanese companies. But the company poured resources into ramping up quality chips at cheaper prices. Now the company is the No. 1 player in memory chips and the business unit is leading its growth amid sluggish device sales.

|

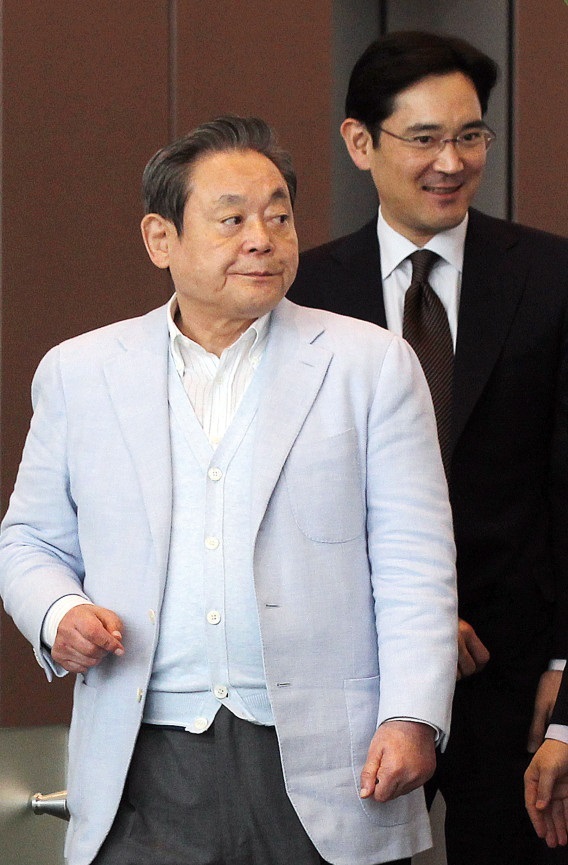

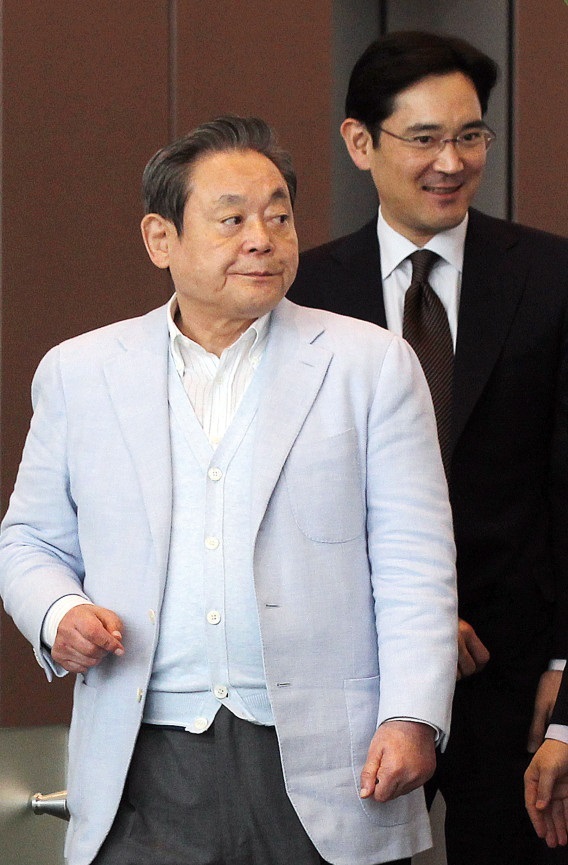

Lee Kun-hee (left) and Lee Jae-yong (Yonhap) |

Since 2012, Samsung has carried out business restructuring, combining overlapped businesses while selling off less profitable affiliates. Over the years, biotechnology has emerged as one of the key new businesses nurtured by the junior Lee, who has been the de facto leader of the nation’s largest conglomerate since the Samsung patriarch’s hospitalization in May last year.

Samsung has spent aggressively in the industry still in its infancy.

The company spent 1 trillion won ($849 million) to build two plants for Samsung BioLogics, which makes biologic drugs for global pharmaceutical companies. When the third one, at about 850 billion won, is completed by 2018, the company will become the world’s largest contract manufacturer of biologic drugs with a capacity of 360,000 liters per year.

The company also poured another 1 trillion won into Samsung Bioepis, a unit specializing in developing biosimilars, generic versions of biologic medicines.

“Samsung entered the semiconductor business 40 years ago despite resistance within and outside the company. The bio industry may also pose high risk, but the huge investment shows the company’s commitment to the business,” said an industry watcher.

The growth potential seems immense.

The global pharmaceutical market is about $781 billion as of 2014, of which 23 percent, or $179 billion, comes from biologic drugs, more than double the $82.5 billion memory chip market.

Especially, the market for contract manufacturing, a specialty of Samsung BioLogics, is expected to surge to $7.2 billion by 2017 from $4.6 billion five years ago.

And the two biotechnology units are willing to learn from the business know-how of by Samsung Electronics that has become a major force based on its speedy and efficient manufacturing process.

The plant construction for biologic drugs is also similar to that of clean rooms for chipsets. Small particles of dust can disrupt the whole production, while disposal of chemicals should be thoroughly controlled.

BioLogics and Bioepis are also operated separately to secure more clients. Similar to Samsung Electronics, which while being the world’s largest smartphone-maker is also a key supplier for archrival Apple.

“Samsung has clearly separated manufacturing and device sales business units. We will also seek to appeal to global drug makers through the same strategy,” said a Samsung BioLogics official.

On Monday, BioLogics held the ground-breaking ceremony of its third plant in Songdo, some 40 kilometers from Seoul. The company pledged to achieve 2 trillion won in sales and 900 billion in operating profits by 2025, when the three plants start full operations.

“We aim to repeat the success story of Samsung’s semiconductor business. We will ramp up efforts to produce quality products at cheaper prices,” said BioLogics CEO Kim Tae-han during the press conference.

By Lee Ji-yoon (

jylee@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)