This is the third installment of a three-part series looking into Korean companies’ dividend payout policies, the reasons behind them and future prospects. -- Ed.

Motivated by low interest rates and volatile markets, many more investors are flocking to dividend-paying stocks and funds as they look for stability in their portfolios.

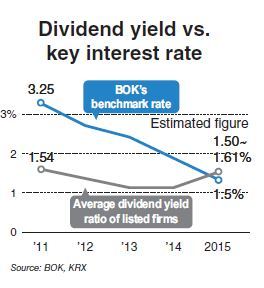

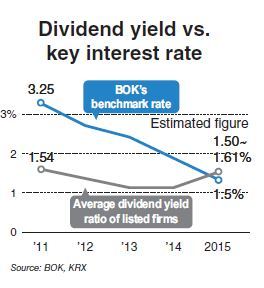

Income-oriented investors, who have been reluctant to move into dividend-paying stocks due to stingy returns, are now paying more attention as analysts expect the dividend yield ratio of Korean listed firms to exceed the country’s benchmark interest rate that stands at a record low of 1.5 percent.

According to Samsung Securities, year-end dividend yield of the KOSPI 200, Korea’s leading stock market index, is expected to stand at 1.64 percent, hitting a post-2010 high as companies have strengthened their shareholder-returns policies.

“As the low interest rate trend continues, investors started to regard dividend stocks as a mid- and long-term investment instrument, unlike previous years when only dividend hunters sought juicy yields,” said Cho Seung-bin, an analyst at Daishin Securities.

A total of 755 listed companies have given out or plan to distribute 18.3 trillion won ($15.2 billion) in cash dividends to shareholders for fiscal year 2015, up 28 percent from a year earlier, according to the bourse operator Korea Exchange.

When it comes to dividend yield ratio, Korean real estate developer Kwang Hee Reit, which paid 951 won per share, topped the list with 16.6 percent, nearly decuple that of local commercial banks’ average interest rate on fixed-term deposit products.

Among 165 large-cap firms, Lotte Group, the country’s fifth-largest conglomerate, boosted its dividends by a whopping 59.8 percent to 188.5 billion won, followed by SK Group, whose dividends shot up 57 percent.

As the performance of most dividend-oriented equity funds has been stable in falling markets, more retail investors are opting for the safe alternative even after the peak selling season.

According to Korea Fund Ratings, dividend stock funds had a yield of 1.4 percent in February, outperforming the main benchmark KOSPI, which was up 0.24 percent during the month.

While common stock funds suffered outflows of 49.9 billion won, dividend yield funds had inflows of 96.5 billion won last month to reach collective net inflow of about 308 billion won so far this year.

“Buoyed by companies’ dividend payout expansion, dividend funds are receiving keen attention as an investment alternative in the face of a stock market correction,” Lee Soo-hee, an official at Korea Fund Ratings, said.

Some analysts, however, have mixed views on whether dividend funds will maintain its popularity after the dividend payment season.

“To break away from seasonality, investors should move more money and the trend should stay longer. The inflow was picking up, but it was not a significant amount to create a “dividend funds boom,” Kim Hoo-jung, an analyst at Youanta Securities said.

By Park Han-na (

hnpark@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)