Cobweb, computer circuit board and maze.

These are some of the words that Koreans use to describe the baffling complexity of the share ownership structure at

Lotte Group, a conglomerate whose roots are in Japan but whose mainstay of business is in Korea.

By any standard, whether in Korea or Japan, where poor corporate governance is considered a major drag on corporate value, Lotte’s setup looks opaque, antiquated and subpar.

|

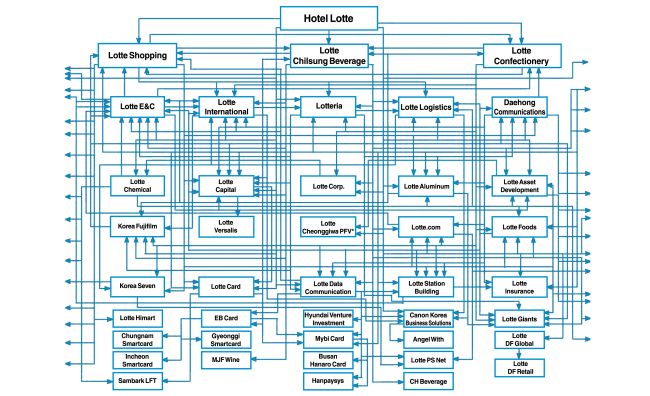

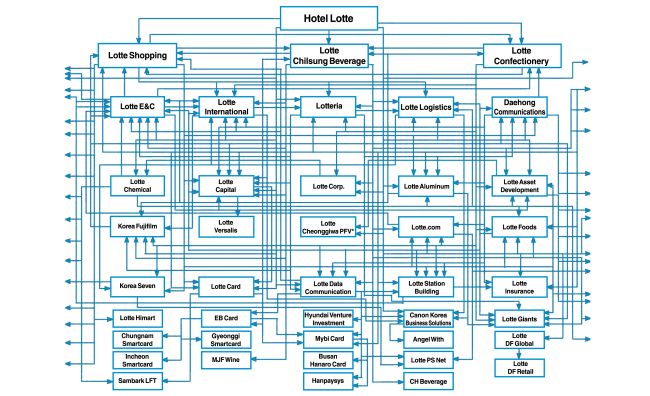

The image, prepared by professor Jang Ha-sung of Korea University, shows the complex share ownership structure of Lotte Group's Korean units. Lotte says it has reduced cross-shareholding deals to 67 from 416 since last year. |

“The group is the epitome of what’s wrong with corporate governance,” said Park Ju-gun, the head of CEO Score, a corporate research firm in Seoul.

According to him, Lotte’s founding family has pushed cross-shareholding -- common among Korea’s large family-owned conglomerates or chaebol -- to its extreme.

It organizes the group over 130 affiliates -- 86 in Korea and the rest in Japan -- in a dizzying network of cross-held companies.

This enables founder Shin Kyuk-ho, his wife and two sons to control the 90 trillion won ($77.5 billion) empire with just 2.4 percent of equity.

Although Lotte’s presence in Korea spans the gamut from chewing gum to a professional baseball team, little was known about the group’s power and ownership structure until last year, when the nasty power struggle between the 93-year-old founder‘s two sons came into the spotlight.

“Poor ownership structures are no news in Corporate Korea, but Lotte is an outlier for the messiness and opaqueness of its governance,” said Rep. Park Byeong-seug of the opposition Democratic Party. The lawmaker was the one who exposed key shareholding arrangements at the group’s core Japanese units, offering the first glimpse into how the group as a whole is run at a parliamentary audit of the conglomerate in September last year.

Despite its greater presence in Korea than Japan, Lotte at its core is controlled by a few Japanese companies, including Kojyunsya, a small packaging company near Tokyo, with reportedly just three employees, the lawmaker revealed then.

According to what is known so far, the Shin family -- the founder, his wife and sons Shin Dong-joo and Shin Dong-bin -- controls Japanese operations of Lotte through pyramids of cross shareholdings.

Kojyunsya, wholly owned by the four family members, is the largest shareholder of the unlisted Lotte Holdings, the holding company of the group’s Japan-based companies, with a 28.1 percent stake. The rest of Lotte Holdings’ shares are held by 10 “L Investment” companies, the group’s Japan-based investment arms that are little known in Korea.

Lotte Holdings, in turn, holds the largest -- 19.07 percent -- stake in Hotel Lotte, which sits at the top of the group’s Korean operations as a parent firm.

Tracing ownership from Hotel Lotte onwards is a lot easier, although the structure itself is not any less complex.

Hotel Lotte owns stakes in 27 Korean units, including 8.8 percent of Lotte Shopping, 3.2 percent of Lotte Confectionary, 43 percent of Lotte Construction and 12.7 percent of Lotte Chemical.

Shin Dong-bin, the younger of the founder’s two sons who took the reins from his ailing father last year in a rare filial revolt in Korea’s conglomerate scene, holds no share in Hotel Lotte.

This, according to experts like Yang Hyung-mo of eBest Securities in Seoul, is a strong motive for the self-appointed successor to break the status quo and try to untangle the group’s messy ownership profile.

|

(Yonhap) |

“Shin Dong-bin has won management control, but that is not securely backed by ownership of shares,” said Yang.

The 61-year-old chairman, after sacking his brother to become the sole leader of the group, had pushed for the initial public offering of Hotel Lotte, with a pledge to unravel cross-shareholdings and improve the group’s governance overall.

However, that roadmap, including the $4.8 billion IPO plan, is now shelved as the group faces stormy days ahead, with the Korean prosecution widening its investigation into the group to unearth corruption, shady intragroup deals and other legal breaches.

Some progress has already been made, Lotte officials tout.

They say that the number of cross-shareholding deals that tie Lotte units together was 416 last year, but is now 67, a decrease of more than 80 percent in less than a year.

Still, not many seem to be impressed.

“The number of cross-shareholding ties is drastically cut, but if you look at core units that matter most in the Shin family’s power over the group, little has changed,” CEO Score’s Park said.

The planned IPO of Hotel Lotte would have been a step toward unravelling the tangled ownership of Lotte. Without it, the likelihood of a meaningful improvement taking place is low, he added.

According to the Fair Trade Commission, Lotte’s 67 cross-shareholding deals make up 71.3 percent of the total tally of all large conglomerates in Korea.

By Lee Sun-young (

milaya@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)