[THE INVESTOR] A group of opposition lawmakers have revived legislation that would force Samsung Life to drastically reduce its equity holdings in affiliates, including

Samsung Electronics, potentially threatening Samsung Group’s de facto chief

Lee Jae-yong’s control over the top conglomerate.

The original legislation, frequently referred to as “the Samsung Life” or “anti-Samsung bill,” died at the previous, conservative Saenuri Party-controlled parliament amid heavy lobbying from Samsung.

The revival came after a swing of the parliamentary pendulum toward the liberal opposition more critical of chaebol, the powerful family-run conglomerates.

|

Samsung Group's de facto chief Lee Jae-yong (left) |

“Through discussions at the 19th parliament, I came to believe there is a shared understanding (across political parties) for the need to plug the loophole in the existing insurance law that has been exploited by some companies,” said Rep. Lee Jong-kul, floor leader of the main opposition The Minjoo Party of Korea, who submitted the bill. A total of 11 lawmakers -- all from the opposition side -- signed the bill.

According to the lawmaker’s office, the “loophole” is in the equity investment cap currently imposed on insurers, and it undermines the rule’s intended effect of preventing cash-rich insurers from being used by their controlling owners as a vehicle to obtain equity control over affiliates.

Currently, the rule bans insurers from holding securities of affiliate companies worth more than 3 percent of their total assets, but allows them to state the value of their share or bond holdings in original purchase prices, not market prices.

Rep. Lee’s proposal would make book prices the unified assessment methods of both securities holdings and total assets. The new bill, however, seeks to give firms more time to prepare, extending the grace period by two years to seven years from the original draft.

The change, if realized, would mean a lot for Samsung Group.

“If the bill passes, Samsung Group will have to change the current ownership arrangement that uses Samsung Life to gain control over Samsung Electronics,” said Oh Jin-won, an analyst at Hana Financial Investment in Seoul.

Samsung’s owner family controls the conglomerate through a combined 31 percent stake in

Samsung C&T, which holds 19.34 percent of Samsung Life. Chairman

Lee Kun-hee, bedridden since a heart attack in 2014, personally controls 20 percent of the insurer.

Samsung Life then holds shares in 10 other Samsung companies, including the group’s crown jewel Samsung Electronics. The insurer is the second-largest shareholder of the global electronics giant, holding a 7.75 percent stake worth 15.5 trillion won ($13.1 billion) as of June 24.

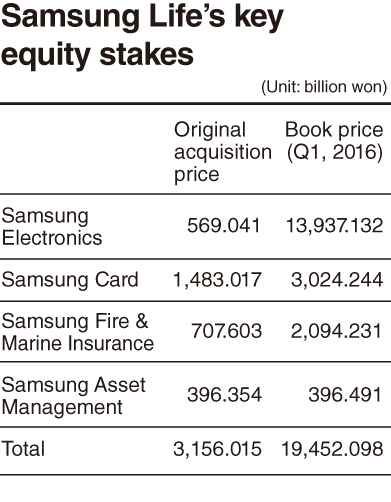

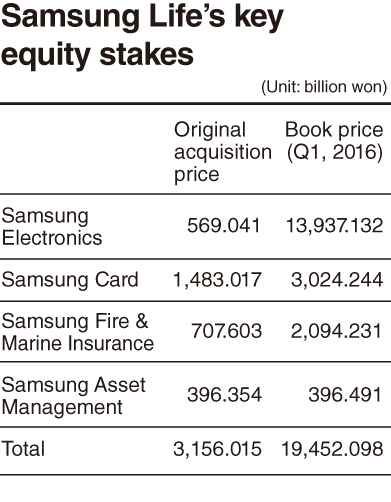

Samsung Life’s total equity holdings in affiliates were worth 3.5 trillion won at the time of their original purchase, below the investment limit, which was 4.6 trillion won based on the firm’s 2013 balance sheet.

The book value of those shares was over 20 trillion won at the end of March this year.

“The bill would force Samsung Life to dispose of shares in affiliates worth nearly 15 trillion won,” said Oh.

The motion’s revival adds weight to speculation that the group would seek to turn Samsung Life into a holding company for financial units in the mid to long run, he added.

The legislation, however, is unlikely to glide through the current parliament, observers said, even though it is majority-controlled by opposition parties. Samsung won’t sit idle, they said.

“Lawmakers won’t hasten dealing of the bill, whereas Samsung reorganization may take place faster than what we expect,” an industry source said.

Aside from its effect on the country’s most powerful conglomerate, some lawmakers see flaws in the bill itself.

“Insurers made legitimate investments based on the law. But they will be forced to terminate them, amounting to such large sums, if the insurance law is amended. In that case, the principle in law that confidences should be protected could be breached,” said Rep. Kim Yong-tae of the ruling Saenuri Party.

By Lee Sun-young (

milaya@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)