After our recent earnings reviews for the sector, we have concluded that the current consensus operating profit estimates for 2016 and 2017 look aggressive, considering: 1) tougher comps heading into 2H16; 2) limited room for further gross profit margin expansion; and 3) stiffer competition.

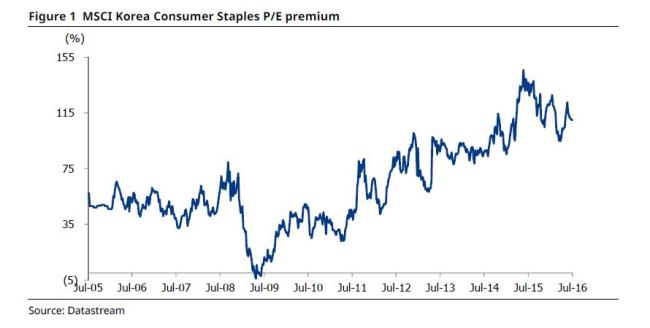

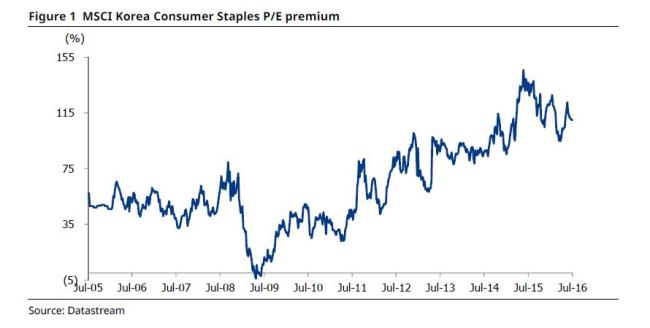

We think it will be difficult for the current 110% premium to the Korean stock market (KOSPI) P/E to expand further from the current levels.

Expect weak 2Q16 earnings

Excluding KT&G and CJ CheilJedang, we expect major F&B companies to report weak 2Q16 operating profits. We expect KT&G’s 2Q16 consolidated operating profit to reach KRW344.1bn (+11.4% YoY), in line with our and

consensus estimates, and CJ CheilJedang to report operating profit of KRW221.9bn (+15.7%), roughly in line with market expectations.

Meanwhile, 2Q16 results for Nongshim, Lotte Chilsung, Binggrae, and Orion should be weaker than expected, due to slower-than-expected recoveries in their respective core operations and stiffer competition.

Slowing earnings momentum in 2H16 and 2017

We expect the average YoY operating-profit growth of major Korean F&B companies under our coverage to be modest, at 9% YoY in 2016 (versus 24% in 2015). We think the current consensus operating profit estimates for

2016 and 2017 look aggressive, considering: 1) tougher comps heading into 2H16; and 2) limited room for further gross profit margin expansion.

Our current average 2016 and 2017 EPS estimates for F&B companies under our coverage are 8.6% and 7% below consensus estimates,respectively.

Less attractive than global peers in valuation

From a global perspective, the Korean F&B sector is trading at par with, or a slight discount to, its US/Europe peers. However, with Korea and US/Europe having approximately the same prospects for market growth, we think a discount is reasonable for Korean F&B companies, considering their less efficient cash management and lower margin/ROE/dividend yields, compared with US and European F&B companies.

Downgrade to NEUTRAL

We downgrade the Korean F&B sector to NEUTRAL from Overweight. Alongside our bearish view on the sector, we downgrade KT&G and Nongshim each to HOLD from Buy, due to: 1) limited share price upside, following recent share price strength (for KT&G); and 2) slowing earnings growth momentum and weaker earnings visibility (for Nongshim).

Although we maintain our BUY ratings for Lotte Chilsung, Orion Corp, and Binggrae, we cut our earnings estimates and target prices for the three companies, reflecting slower-than-expected recoveries in their respective markets (Chinese confectionery, domestic ice cream, and liquor).

Downgrade to NEUTRAL

We downgrade the Korean F&B sector to NEUTRAL from Overweight. The Korean F&B stocks under our coverage are currently trading at an average of 20x 2016 P/E, which translates into a 110% premium to the Korean stock market (KOSPI) P/E.

From a bottom-up perspective, we expect the average YoY operating-profit growth of major Korean F&B companies under our coverage to be muted, at 9% YoY in 2016 (versus 24% in 2015).

We think current consensus operating profit estimates for 2016 and 2017 look aggressive, considering: 1) tougher comps heading into 2H16; and 2) limited room for further gross profit margin expansion.

Our current average 2016 and 217 EPS estimates for F&B companies under our coverage are 8.6% and 7% below consensus estimates, respectively. Lastly, as evidenced by the continued delays in beer price hikes, due to intensifying competition in the beer market, Korean F&B companies have found it difficult to pass on raw material cost hikes to end-product prices.

Therefore, we see limited room for margin expansions from product price hikes in 2H16 and 2017, except in the non-alcoholic beverage market, where we expect competition to continue to remain soft.

From a global perspective, the Korean F&B sector is trading at par with, or at a slight discount to, its US/Europe peers. However, with Korea and US/Europe having approximately the same market growth prospects, we think a discount is reasonable for Korean F&B companies, considering their less efficient cash management and lower margin/ROE/dividend yields, compared with US and European F&B companies.

Along with our bearish view on the sector, we downgrade KT&G (033780 KS) and Nongshim (004370 KS) each to HOLD from Buy, due to: 1) limited share price upside, following recent share price strength (for KT&G); and 2) slowing earnings growth momentum and weaker earnings visibility (for Nongshim).

Although we maintain our BUY ratings for Lotte Chilsung (005300 KS), Orion Corp (001800 KS), and Binggrae (005180 KS), we cut our earnings estimates and target prices for the three companies, reflecting slower-than-expected recoveries in their respective markets (Chinese confectionery, domestic ice cream, and liquor).

Source: Mirae Asset Securities

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)