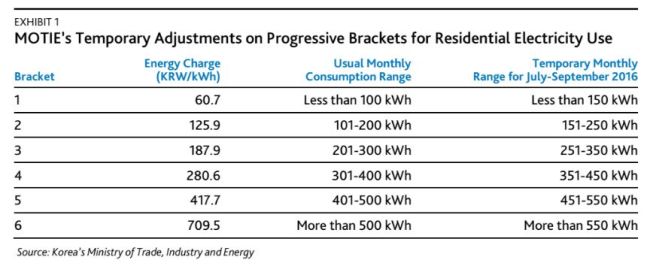

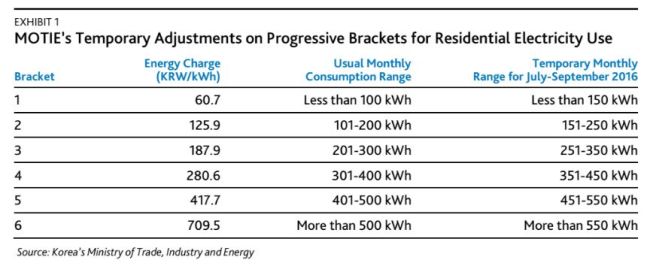

Last Thursday, amid scorching summer temperatures, Korea’s Ministry of Trade, Infrastructure and Energy (MOTIE) raised the electricity range that households can consume at given progressive rates by 50 kilowatts per hour (kWh) from July to September this year. The adjustment effectively reduces tariffs for Korea Electric Power Corporation (KEPCO, Aa2 stable), which will constrain the company’s operating profit growth and weaken its profit predictability, a credit negative.

The higher limits under Korea’s progressive tariff system for residential use (see Exhibit 1) are aimed at limiting the increase on household electricity bills from rising electricity use during the hot summer months. The government estimates that the temporary adjustment will reduce residential users’ aggregate electricity bills by KRW420 billion. We estimate that KEPCO’s operating profit will decline by a similar amount.

We expect MOTIE’s adjustment to weaken KEPCO’s funds from operations/debt on a consolidated basis by around one percentage point to 27%-29% over the next 12-18 months, compared with our previous projection. Any unexpectedly strong rebound in fuel costs, material tariff cut, and/or material reduction in coal-fired power plants’ capacity utilization (90% in 2015)during the period would affect actual results.

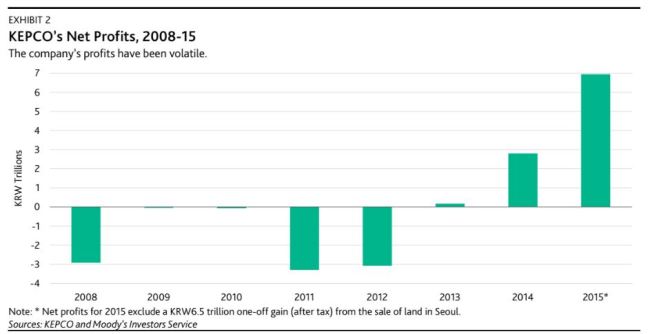

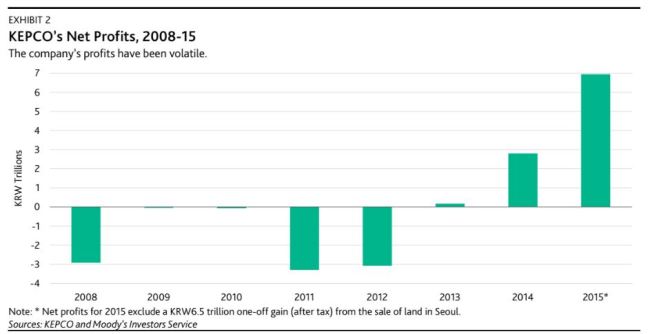

The government’s surprise move highlights the tariff system’s weak transparency. The absence of an automatic, transparent fuel-cost pass-through tariff mechanism is a fundamental credit weakness for KEPCO. Tariff adjustments are subject to MOTIE’s approval. Consequently, the predictability and stability of KEPCO’s cash flows from operations and profitability will remain low, given the inherent volatility in the cost of imported fuels and the government’s continued intervention on tariffs (see Exhibit 2).

KEPCO recorded net losses in 2008-12, when fuel costs rose but the government did not allow sufficient tariff increases to cover the higher fuel costs because of its concerns that inflation would follow a large rise in tariffs, increasing consumers’ financial burden. Since 2014, KEPCO has benefited from steady tariffs and a decline in fuel costs.

However, we do not expect the weak transparency in KEPCO’s tariffs to materially affect the utility’s credit quality over the next 12-18 months. We assume a modest recovery in fuel costs from the current low level and also expect increased power generation from KEPCO’s cost-competitive baseload nuclear reactors and coal-fired power plants as new baseload power plants with an aggregate capacity of around 11.3 gigawatts are scheduled to begin operations in 2016-17.

Source: Moody’s Investors Service

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)