[THE INVESTOR]

Samsung Electronics' semiconductor business has gained growth momentum in the April-June period on the back of its robust NAND flash memory business, latest data shows.

According to a report by market research firm IHS, Samsung gained a 11.3-percent market share in the global market for integrated device manufacturers, including memory and non-memory chip companies, chip design houses, and foundries, in the three-month period.

The figure is the second highest, behind US chip powerhouse Intel which attained 14.7 percent market share.

|

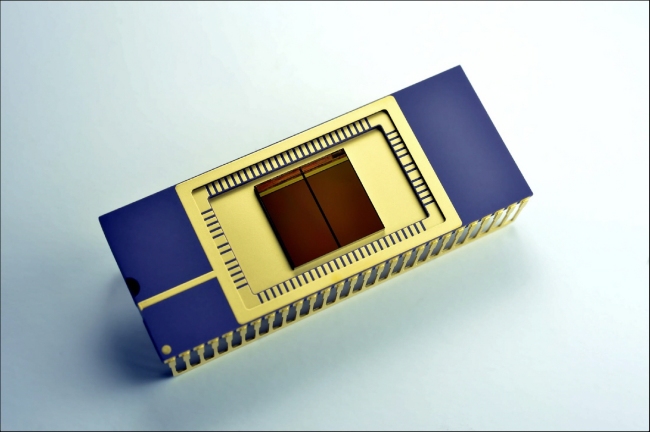

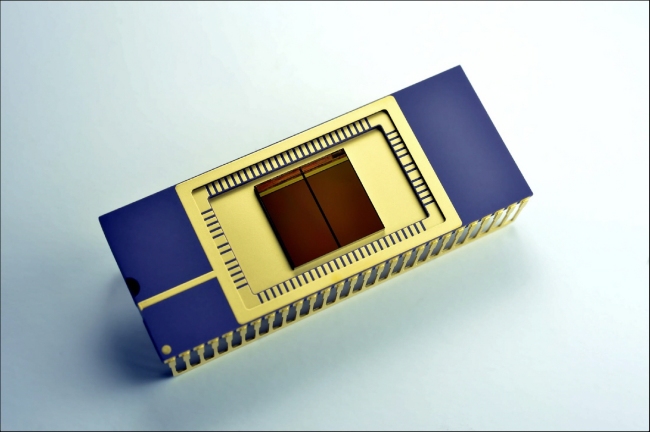

Samsung Electronics’ vertical NAND flash memory chip. Samsung Electronics |

As a result, the gap between Samsung and Intel decreased from 4 percent in the first quarter to 3.4 percent in the second quarter.

The gap has been constantly dropping every year: 5.3 percent in 2012, 4.2 percent in 2013, 3.4 percent in 2014 and 3.2 percent in 2015.

Samsung has been able to narrow the gap below 4 percent again in the second quarter thanks to the robust sales of its NAND flash memory chips.

The Korean tech firm's NAND flash business unit saw its second-quarter sales increase 5.4 percent on-year while the NAND flash memory sales of Intel whose flagship business is still that for non-memory chips for PCs and laptops dropped 1.2 percent during the same period.

Samsung’s supply of NAND memory chips for Apple’s new handsets iPhone 7 and iPhone 7 Plus and its own Galaxy Note 7 reportedly boosted its revenue in the memory chip segment.

The two companies were followed by Qualcomm, Broadcom and

SK hynix, which secured 4.6 percent, 4.3 percent, and 4.0 percent, respectively, in the second quarter.

Although the US chip company has been ramping up its efforts to increase its presence in the global memory market, transforming its chip manufacturing factory in Dalian, China to one tailored for NAND flash chips, for example, it has not produced outstanding results in terms of sales yet.

“In a bid to take the lead in the NAND flash memory market, Samsung could increase the production capacity by building more manufacturing facilities,” Hwang Min-seong, an analyst from Samsung Securities, anticipated in his recent financial report.

By Kim Young-won (

wone0102@heraldcorp.com">

wone0102@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)