● On a US non-deal roadshow with NHN Entertainment over Sep 6-9, investors asked about: 1) the direction of web-board game regulations and chances of new mobile titles driving growth at the game division; 2) Payco’s core competitiveness and earnings model; and 3) potential M&As and how the firm plans to use its assets.

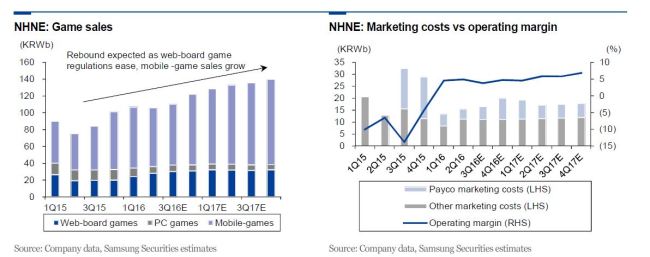

Web-board game regulations and new mobile games: Many investors expressed their satisfaction with NHN Entertainment’s 2Q sales growing 20% y-y thanks to web-board game regulations easing.

They were also keen to hear management’s thoughts on the timing of additional easing and its likely effects. Regulations should remain relaxed until early 2018.

Thereafter, their direction should be determined by who come to power in the next presidential election (Dec 2017). Mobile games should drive game sales growth, and such games are more likely to be successful thanks to their being based on intellectual property (IP) that has already proven popular in other media.

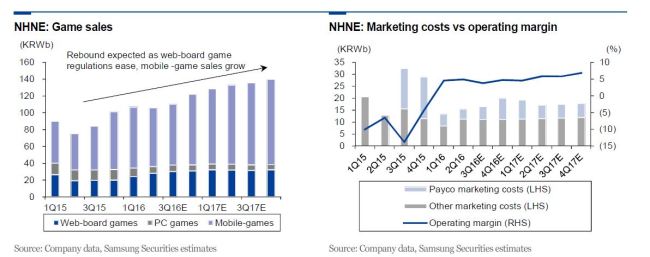

Payco—core competitiveness and earnings model: NHNE fielded a number of questions about the competitiveness of the Payco payment service vs Naver Pay or Samsung Pay.

Naver Pay focuses on smaller merchants (though it does boast sizeable transaction value). Samsung Pay is weak among online merchants and used only by those with one of Samsung Electronics’ latest flagship smartphones.

Thus, Payco can be said to be better than rival services in terms of its online presence and ability to expand its user base. While Payco should not contribute to NHNE’s sales for the time being, its user and payment data should help the firm generate earnings from an ad-exchange model.

Uncertainty over McDonald’s bid: Investors aired concerns over NHNE’s bid to acquire McDonald’s Korea, with some arguing that the firm should be able to expand its Payco service via partnerships—ie, without making equity investments.

Moreover, they saw that any investment through NHN Investment would be risky as well. NHNE responded that it has yet to determine its commitment to the acquisition, and that even if it opts to take part in such an acquisition, the size of its investment would not be large.

Shares to rise if risk eases: We attribute a recent dip in shares to the McDonald’s Korea bid highlighting Payco-related uncertainty.

The investors generally seemed to lack confidence in a Payco-led ad business succeeding, but tended to agree that the game business has strong growth potential. As large F&B players (such as CJ Foodville and Maeil Dairy Industry) and overseas PEFs are also bidding for McDonald’s Korea, we believe NHNE has little chance of acquiring the chain. If its bid fails, shares should benefit.

We reiterate BUY on the stock to reflect the growth potential of the game business (which has benefited recently from the launch of games based on proven IP).

Source: Samsung Securities

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)