The Korea Herald is publishing a series of articles on moves made by the companies and governments of South Korea, China and Japan in entering the new Industry 4.0 era. This is the third installment. -- Ed.

Shenzhen, CHINA -- Displayed in front of the main building of the BYD Auto headquarters in Shenzhen, China, are the company’s signature lineups: the Tang SUV, Qin compact sedan, compact crossover E6, pure electric busses K8 and K9, as well as its latest brainchild, the Skyrail monorail.

BYD’s best-selling products are undoubtedly the Tang and Qin, named after two Chinese dynasties.

“What’s very Chinese can also be very global,” a BYD public relations manager said, adding that the company aspires to redefine the concept of “Made in China.”

|

BYD electric vehicles are displayed at its headquarters in Shenzhen, China. (Park Ga-young/The Korea Herald) |

Wang Chuanfu, 50, founded BYD -- short for “Build Your Dream” -- in 1995 as a battery company. It entered the auto market in 2003 by acquiring a 77 percent stake in Xi’an Qinchuan Auto.

In 2008, Warren Buffett bought 10 percent of the company in the same year that it introduced its first plug-in hybrid vehicle. The company’s vehicles now run in 240 cities in 50 countries and includes London’s iconic double-decker buses.

With sales of 61,722 units last year, the company became the world’s largest electric vehicle maker, followed by US electric car maker Tesla with 50,557 units.

And the company is set to double its sales this year. In the first half of this year, it already sold about 90,000 units worth 72.7 billion yuan ($10.53 billion), compared to 77.6 billion yuan for the entire 2015.

“We expect to sell as many as 120,000 cars this year and to make 100-120 billion yuan in sales with a net profit of 5 or 5.2 billion yuan,” said Li Yunfei, deputy general manager of the firm’s branding and PR division.

|

BYD’s headquarters in Shenzhen, China. (Park Ga-young/The Korea Herald) |

Behind the company’s success in the EV business, according to Li, are the battery and electronics technologies the company has accumulated. BYD has provided batteries and handset components for companies such as Samsung and Huawei.

There is also the bigger trend in the global auto industry which is emphasizing new energy vehicles with the support of the government.

Beijing has the goal of having 5 million new energy vehicles on the roads by 2020 as part of its attempt to mitigate pollution and to become a leading country in the EV market. The government spent $4.5 billion in subsidies last year and has stepped up building charging infrastructure.

The EV market is set to grow rapidly throughout the world and especially in China. More than 300,000 cars -- or 1 percent of total cars sold in China -- were electric cars last year.

“It took eight years to make that 1 percent, but this 1 percent is a watershed (moment) that will change (the) public’s perception of electric cars.” Li said.

The company’s ambition to become a leading EV maker was well met by the local government’s ambition to become a green city. In 2010, the company, in tandem with the Shenzhen government, began an e-taxi initiative with 40 all-electric units of E6 taxis going into use in the city. The number of e-taxis running in the city now exceeds 850 and is expected to increase to as many as 4,000, according to the city’s plan.

That might have led to the choice of Jeju Island for the firm’s regional office rather than a location closer to the capital Seoul.

“The island has preferential policies and supports for Evs,” said another PR manager.

BYD’s priority in South Korea will be public transportation in line with its broader overseas strategy focusing on public transportation. Korean companies in recent months have unveiled plans to bring BYD electric buses to Jeju next year.

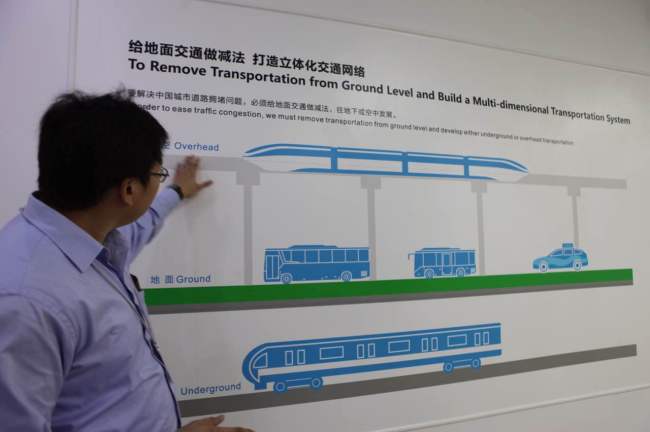

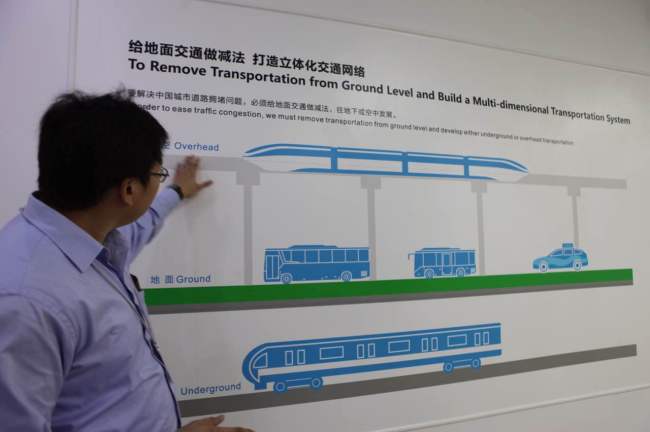

|

BYD’s public relations manager explains the company’s monorail project. (Park Ga-young/The Korea Herald) |

The company, however, has to overcome some challenges.

Both traditional and electric car makers as well as tech firms have been eying this growing new energy vehicle market, making the competition fierce.

At the same time, the Chinese government will also phase out its subsidy programs in the next few years and the company may not be eligible for subsidies in foreign countries. Under the current subsidy program in South Korea, BYD’s best-selling vehicles would not be subject to government subsidies, making its cars less appealing to customers.

To win over customers in the competition against companies like Tesla which offer premium EVs with futuristic designs, BYD acknowledged that it needs to ramp up its efforts in design. It hired Wolfgang Egger, a former design chief for Audi, in November.

However, the company might have one edge over others. It is also looking to expand into areas that other carmakers are not as interested in such as monorails.

“The potential market for mass public transit with clean energy is huge -- 3 trillion yuan in China -- as traffic jam and air pollution are serious problems,” Li said. “The company has already invested 5 billion yuan in the past five years in the monorail project, with the participation of 1,000 engineers.”

By Park Ga-young (

gypark@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)