South Korea’s exports jumped 72.8 percent from a year earlier in the first 10 days of this month, the latest customs data showed, continuing an upward trend since November.

The on-year growth in the country’s outbound shipments accelerated from 2.5 percent in November to 6.4 percent in December and 11.2 percent last month.

|

(Yonhap) |

Attributed partly to a base effect reflecting underperformances the year before, the recent stretch of increase should be good news for trade officials here, who have been striving to boost exports to offset the negative impact of weak domestic demand on the country’s economic growth.

What complicates their efforts to ramp up exports is the need to reduce the country’s trade surplus with the US and manage its current account surplus at an appropriate level in order to avoid being hit by protectionist actions under President Donald Trump’s administration.

According to the US Commerce Department, the world’s largest economy suffered a trade deficit of $502.3 billion in 2016, the highest in four years. The figure is likely to play into Trump’s anti-trade narrative.

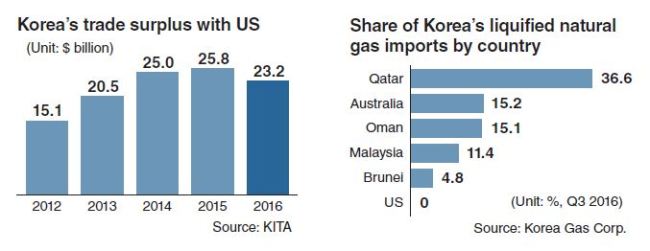

Korea’s trade surplus with the US amounted to $23.2 billion last year, accounting for more than a quarter of its overall surplus, showed figures from the Korea International Trade Association.

The country saw its trade surplus with the US hovering above $20 billion for four consecutive years since 2013.

Korea’s exports to the US fell 1.8 percent from a year earlier in January. This modest decrease stemmed from temporary factors, such as a halting of the production of a Samsung smartphone prone to catching fire, rather than significant changes in the bilateral commerce conditions.

Experts here say Korea needs to make pre-emptive efforts to prevent the trade imbalance from prompting the Trump administration to designate it as a currency manipulator and push for a renegotiation of a bilateral free trade pact that came into force in 2012.

The Trump administration has not yet pointed the finger at Korea while blaming China, Japan and Germany for devaluing their currencies to gain profits from trade with the US.

But Korea is in no position to be sure it will not be branded as a currency manipulator when the US Treasury Department issues a biannual report on foreign currency policies in April.

The country was placed on the Treasury Department’s monitoring list in October last year, meeting two of the three standards for being labeled a currency manipulator -- a trade surplus with the US above $20 billion and a current account surplus exceeding 3 percent of the gross domestic product.

The appreciation of the won in the wake of being designated a currency manipulator would not only hurt Korea’s exports but also destabilize its financial markets.

Korean trade officials have tried to bring US attention to the mutual benefits that have been reaped from the bilateral free trade accord. A possible renegotiation could also serve as an occasion to upgrade the pact, based on the accurate assessment of its achievement, some experts say.

But it may still be hard for Korea’s position to be persuasive unless substantive measures are taken to reduce the large trade gap between the two sides. The US’ share of Korea’s trade surplus at 26 percent in 2016 is disproportionately large, considering Korean companies depend on the US market for less than 14 percent of their exports.

Experts suggest increasing imports of US shale oil as an effective way to redress the trade imbalance.

“The government needs to be more active on increasing energy imports from the US as a strategic option for easing pressure from the Trump administration,” said Kim Jae-kyung, a researcher at the Korea Energy Economics Institute.

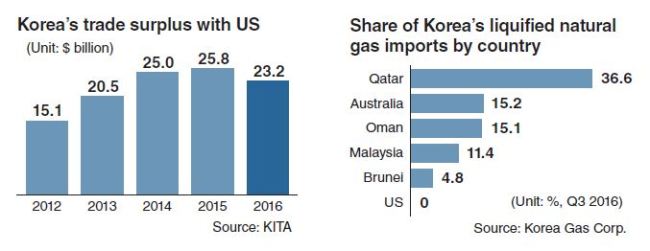

The state-run Korea Gas Corp. plans to import 2.8 million tons of shale gas from the US annually over the coming 20 years. In addition, two local energy companies are preparing to import a combined 2.8 million tons of shale gas starting from 2019. With the planned imports, Korea will import about 20 percent of its annual liquefied natural gas supply, at 30 million tons, from the US.

Importing an additional 1 million tons of shale gas would help reduce Korea’s trade surplus with the US below $20 billion, experts note. In this regard, speculation has been raised that KOGAS will replace a contract with Brunei with a deal with the US when it expires next year.

Korea has relied on Middle East and Southeast Asian countries for most of its LNG imports. By country, Qatar accounted for 36.6 percent of Korea’s LNG imports during the third quarter of last year, followed by Australia at 15.2 percent, Oman at 15.1 percent, Malaysia at 11.4 percent and Brunei at 4.8 percent.

Along with increasing shale gas imports from the US, the government needs to shift its energy policy to enhancing the use of LNG and renewable energies in power generation and eliminate regulations that ban private companies from selling gas imported by them in the domestic market, experts note.

By Kim Kyung-ho (

khkim@heraldcorp.com)

![[KH Explains] Hyundai-backed Motional’s struggles deepen as Tesla eyes August robotaxi debut](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/05/16/20240516050605_0.jpg)