Markets in South Korea took a downturn Monday in the wake of the most powerful nuclear bomb test by North Korea on Sunday, drawing a mixed forecast on the aftereffect from local analysts.

The main bourse index Kospi closed at 2,329.65, down 1.19 percent, while the tech-heavy secondary Kosdaq tumbled 1.68 percent to 650.89.

|

(Yonhap) |

Market bellwether Samsung Electronics‘ stock price fluctuated, starting 2.02 percent lower in the opening and closing at 0.95 percent lower.

Of the Kospi-listed top 20 players in market capitalization, SK Innovation, a local refiner, was the only firm in upturn.

The North’s sixth nuclear test Sunday involved an underground detonation of a hydrogen bomb that the North claimed is missile-ready.

Despite such a declaration of advancement in the North‘s nuclear program, foreign investors took a moderate stance. Offshore net purchase of Kospi stocks stood at 4.4 billion won ($3.9 million). Individual investors in South Korea net sold stocks worth 343.3 billion won.

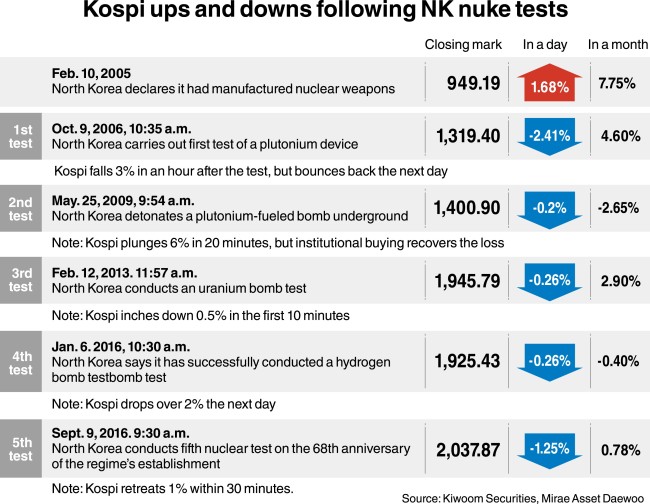

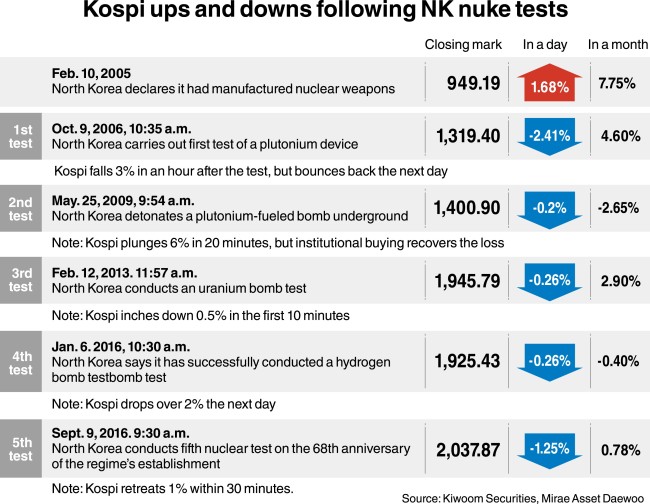

Not all previous five nuclear tests had exerted lingering impacts on the first-tier stock market. Out of five nuclear tests, only two dragged down the Kospi a month after -- 2.65 percent from the second nuclear test and 0.4 percent from the fourth. The Kospi gained a month after the other three detonation tests.

“Stock markets will pick up the pieces soon after short-term impacts this time as well, with exports-related US data forecast to be in favor of the markets,” Seo Sang-young, a strategist at Kiwoom Securities, wrote in a Monday note, citing a possible rise in manufacturing index by the United States’ Institute for Supply Management.

However, the markets might suffer from persisting geopolitical tension, as North Korea provocations are forecast to last longer, according to Ma Ju-ok, an analyst at Hanwha Investment & Securities.

“The continuing geopolitical crisis will trigger South Korean markets’ repeated adjustment,” Ma wrote. “The North sees the US military action not on the cards and will exert threats until it resumes talks with the US.”

|

(Yonhap) |

South Korea‘s treasury yield went bearish Monday. The 3-year sovereign bond yield came to 1.78 percent, up 0.035 percentage point from Friday, while the 10-year government bond yield reached 2.31 percent, up 0.034 percentage point.

Local currency weakened by 10.2 won against the greenback, with US dollar ending at 1,133 won, up from 1,122.8 won on the previous trading day.

The South Korean won is subject to widening volatility, as the North Korea risk “is entering in the next phase,” wrote Jeon Seung-ji, a foreign exchange analyst at Samsung Securities, in a report.

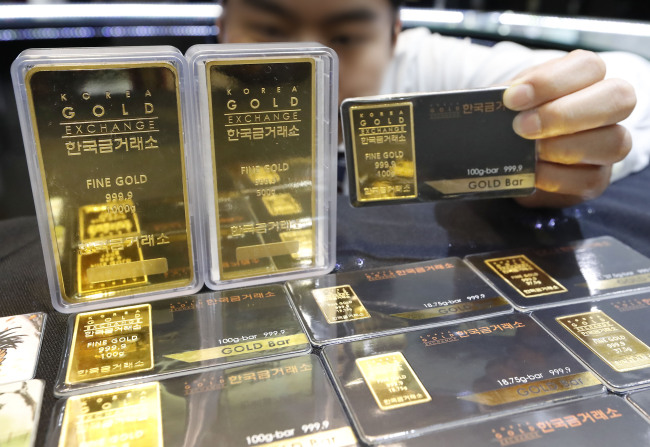

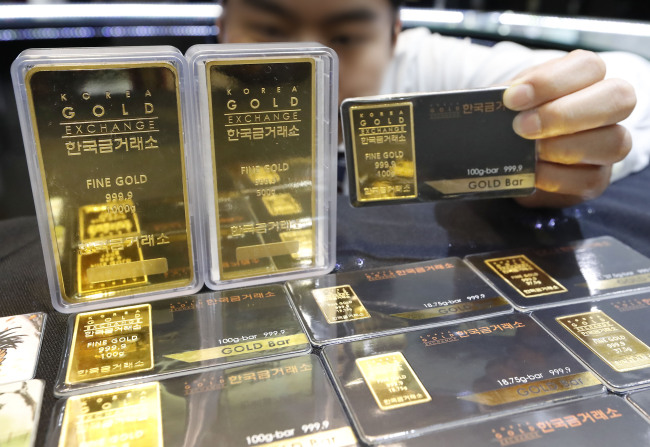

Gold rose 1.74 percent from Friday and was being traded at 48,400 won per gram, marking the highest in about 10 months, according to the Korea Exchange.

|

(Yonhap) |

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)