Vying for the bigger pie in the lucrative and fast-growing anti-aging cosmetics market, Korean companies are spewing out reinvented products and brands using more natural ingredients and less chemicals.

According to data compiled by the Ministry of Food and Drug Safety, the production volume of functional cosmetics products by Korean cosmetics companies in 2016 increased by 15.3 percent on-year to reach 4.4 trillion won ($3.9 billion).

Of the total functional cosmetics production, the production of multi-functional products accounted for 17.1 percent, while cosmetics with lifting effects accounted for 8.8 percent.

“There are more multi-functional cosmetics coming in the market as there is a limited number of ingredients that could help protect the skin from signs of aging,” said Mike Sohn, a researcher at the Foundation of Korea Cosmetic Industry Institute.

“There is a growing demand for anti-aging cosmetics at home, as well as abroad. Demand for cosmetics using natural ingredients or less-chemicals, in particular, is growing as people tend to think they are relatively safer” he added.

Companies including Amorepacific and LG Household & Health Care are leading the trend with their top-tier brands, while such biopharmaceutical firms as Celltrion have joined the market of cosmoceuticals, cosmetic products with bioactive ingredients claimed to have medical or drug-like benefits.

Amorepacific Group‘s Sulwhasoo brand has a lineup of products that are renowned for using natural ingredients.

With the company’s own bioconversion technology that it first started to develop some 50 years ago with the ABC Ginseng Cream, Sulwhasoo turns ginseng saponin into active ingredients that can be applied to skin. The company’s ginseng extract, Compound K, is globally renowned for its anti-aging properties.

Sulwhasoo brand‘s top-selling anti-aging product is Concentrated Ginseng Renewing Cream. The fine-textured cream is marketed to have a lifting effect with functions helping to rid dryness and improve skin elasticity and firmness. The cream’s Ginsenoside Re ingredient, which is extracted from ginseng flower, also works to improve skin protection.

|

Concentrated Ginseng Renewing Cream (Sulwhasoo) |

Concentrated Ginseng Renewing Creamy Mask is Sulwhasoo‘s other signature anti-aging product that shares the ginseng components. The anti-aging creamy sheet mask is recommended for use overnight to removes impurities.

|

Concentrated Ginseng Renewing Creamy Mask (Sulwhasoo) |

LG Household & Health Care’s History of Whoo brand is another luxury Korean skincare brand using Korean herbs.

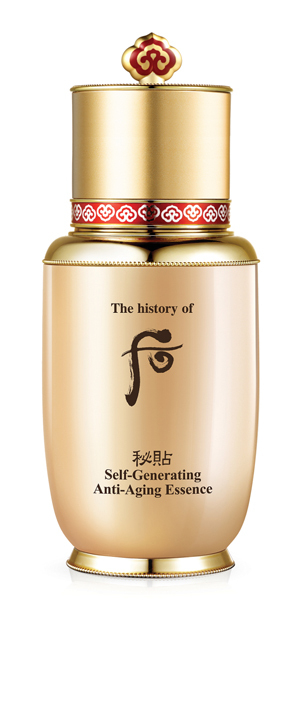

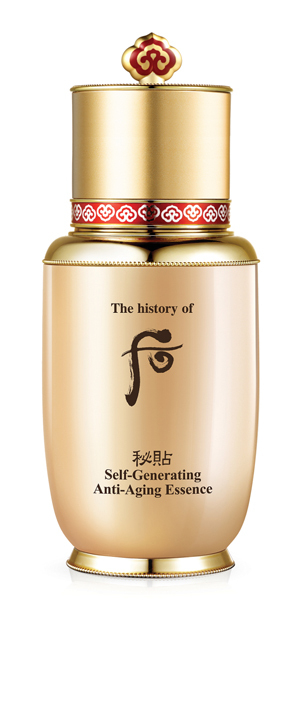

Bichup Ja Saeng Essence is the brand‘s signature product, which is popular at home and abroad. As of end-2016, the combined sales volume of the product reached 600 billion won since its launch in 2009.

|

Bichup Ja Saeng Essence (LG Household & Health Care) |

The product uses medicinal herbs and plant placenta derivatives to help activate skin cells to repair themselves. The essence is also marketed for modernizing Korea’s traditional beauty treatments used at imperial courts hundreds of years ago.

Korean biopharmaceutical firm Celltrion, meanwhile, has advanced into the cosmeceuticals market. The company in 2013, acquired Hanskin for 300 billion won and later renamed the brand to Celltrion Cellcure. The pharmaceutical firm’s cosmetic brand aims to provide functional cosmetics applied with drug-developing technologies. Biocosmetics brand Celltrion Skincure this year launched Duo-Vitapep essence that uses the company‘s own components that is purported to interrupt melanin production and carry both lifting and skin-lighting effects. The company also says that its Flexible Liposome technology also helps the components to effectively penetrate into skin.

|

Duo-Vitapep (Celtrion Cellcure) |

Celltrion Skincure plans to launch another makeup product lineup highlighting on skin-lightening effect, as well as anti-wrinkle effect, in October.

According to Korea Cosmeceutical Education Center’s data, the global cosmeceuticals market size is estimated to reach some 40 trillion won as of 2015, accounting for almost 13 percent of the entire cosmetics market. The domestic market for cosmeceuticals is sized at around some 500 billion won, posting around 15 percent in annual growth.

By Shim Woo-hyun (

ws@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)