South Korean brokerage KTB Investment & Securities is on track for a transition in leadership to incumbent Vice Chairman Lee Byung-chul, in the wake of a series of scandals involving Chairman Kwon Sung-moon.

|

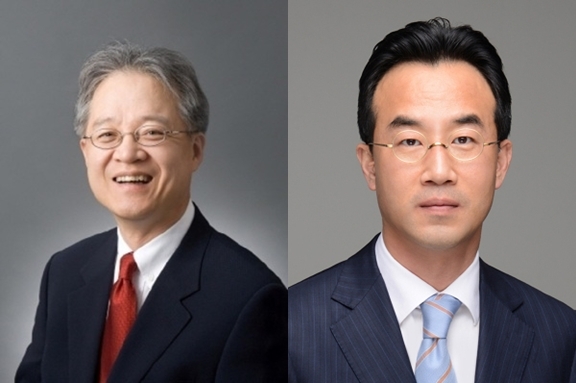

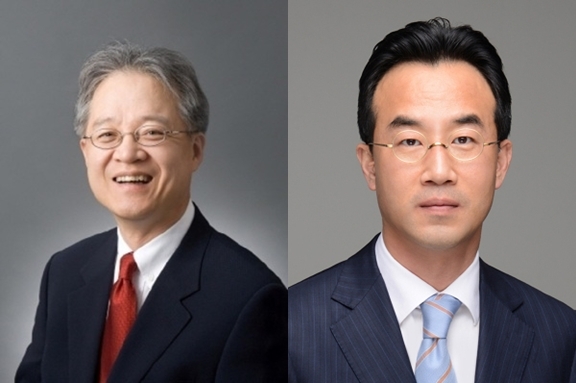

KTB Investment & Securities Chairman Kwon Sung-moon (left) and Vice Chairman Lee Byung-chul |

Lee, 48, announced Tuesday in a regulatory filing that he would exercise his right of first refusal on 18.76 percent of shares worth 66.2 billion won ($62.2 million) in the securities firm, which the 55-year-old Kwon waived in December 2017.

By exercising the right, Lee can purchase or pick a third party to buy the shares within two months.

If Lee buys the stocks and pays an additional 10 percent of the value of shares, Lee will become the largest shareholder of KTB Investment & Securities with a 32.76 percent stake, while the former largest shareholder Kwon will own 5.52 percent.

But the deal between the two has not settled due to discrepancies in details of the deal, according to a disclosure Wednesday by the securities firm.

Lee, a former expert in properties investment, became vice chairman of the brokerage that specializes in corporate investment banking in July 2016.

Lee’s stock ownership will translate into the end of Kwon’s leadership in KTB Investment & Securities, which lasted for about two decades.

Formerly a venture capitalist and merger and acquisition specialist, Kwon acquired in 1999 the state-led venture capital firm Korea Technology Banking, the backbone of KTB Investment & Securities.

Kwon, however, has been embroiled in scandals, including an incident in which he inflicted physical violence on an employee of his company in September 2016, which was revealed through a CCTV recorded clip in 2017.

The employee was also found to have been forced to remain silent about the incident. Kwon was also accused of breach of trust and embezzlement by the Financial Supervisory Service in March 2017.

By Son Ji-hyoung

(

consnow@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)