Korea is moving to free itself of the possibility of being designated by the US as a currency manipulator, which remains an uncertain factor for its exporters after the two countries this week reached an agreement on amending their bilateral free trade deal and exempting Korea from US steel tariffs.

The Ministry of Strategy and Finance and the Bank of Korea said in a joint statement earlier this month they had studied plans to advance the foreign exchange market in the country.

No decision has been made on details of such plans, according to the statement.

But officials at the ministry and the central bank suggested consideration was being given to disclosing records of the authorities’ intervention in the foreign exchange market.

|

(Yonhap) |

Concerns over mounting household debt and a slowdown in job creation have left the BOK cautious about raising its key rate, which has been kept at 1.5 percent since November, despite the US Federal Reserve’s decision last week to jack up its policy rate by a quarter percentage point to 1.5-1.75 percent.

The three criteria for designation as a currency manipulator are an annual trade surplus with the US above $20 billion; a current account surplus surpassing 3 percent of gross domestic product; and a persistent one-sided engagement in the currency market with a net purchase of foreign exchange exceeding 2 percent of GDP.

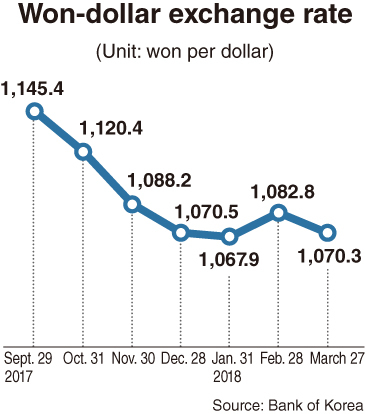

Korea, which has met the first two requirements, has been nervous about the possibility of the US judging it to fall under the third category.

According to official data, Korea’s net purchase of foreign currencies hovers around 0.3 percent of its GDP.

If this is the case, disclosing records on currency intervention would help erase the possibility of the country being named as a manipulator.

Among the Group of 20 economies, only Korea, China and Turkey have not made intervention records public.

Most countries disclose records one month after intervention, with India and the US revealing them two and three months after, respectively.

“Given various conditions, consideration (of disclosure) is underway in a positive direction,” said a BOK official on condition of anonymity.

The measure also needs to be taken if Korea intends to join the revived Trans-Pacific Partnership trade accord, which the US is moving to re-enter, as all of its 11 members make public records on currency intervention.

But some experts here raise the need for the country to be more cautious about taking the step.

They note Korea is in a different situation from countries that enjoy reserve currency status or suffer from large trade deficits.

“What the US raises issue with is trade surplus rather than foreign exchange intervention,” said Sung Tae-yoon, a professor of economics at Yonsei University.

In the worst case, Korea might end up losing a policy tool to help ease burdens on local companies and economic management, while also failing to provide a satisfactory answer to the US, he said.

By Kim Kyung-ho (khkim@heraldcorp.com)