Recent economic data have pointed to the weakening vitality of the Korean economy, raising questions about the possibility it will grow more than 3 percent this year as predicted by policymakers.

The country saw all economic indicators except for retail sales take a negative turn in March, the latest month for which official data are available.

Economists here caution that the supply side of the Korean economy is falling apart as its key traditional manufacturing industries are losing competitiveness amid an absence of efforts to push through drastic corporate restructuring and regulatory reforms.

|

(Yonhap) |

Whatever measures are taken to boost demand, said Lee Phil-sang, a professor of economics at Seoul National University, it would be impossible to resolve the underlying problem of declining production potential, if the competitiveness of the supply side continues to weaken with no structural changes.

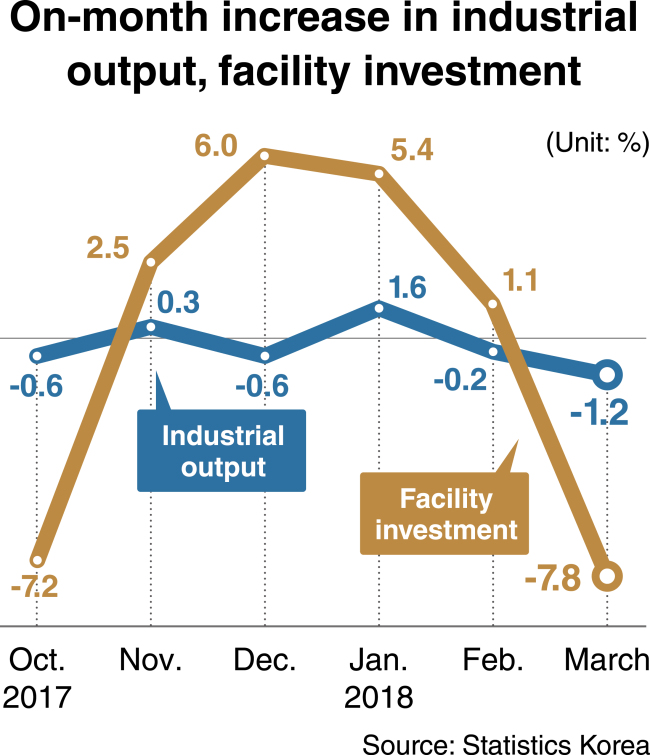

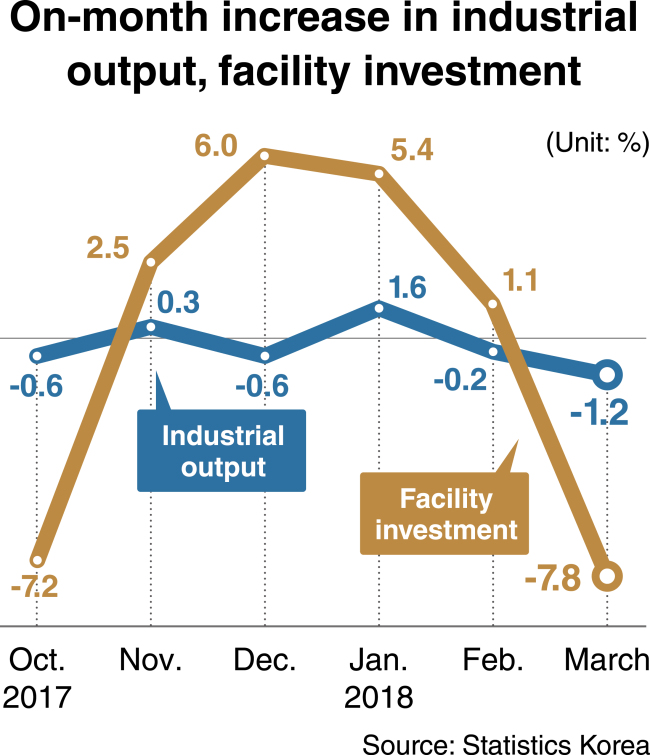

According to data from Statistics Korea, the country’s industrial production fell 1.2 percent from a month earlier in March, the steepest decline in five years.

The output in the mining and manufacturing sector contracted 2.5 percent, with the production in the service sector edging up 0.4 percent. The figure for the construction industry recorded an on-month decrease of 4.5 percent in March.

An increase in semiconductors production was more than offset by a fall in the production of cars and machinery equipment to drag down the overall manufacturing output.

Accordingly, factories around the country ran at 70.3 percent on average of full capacity in March, down 1.8 percentage points from the previous month. The rate marked the lowest since March 2009 when the corresponding figure fell below 70 percent as manufacturers were struggling to cope with the fallout from the global financial crisis.

In an indication of further reduction in industrial output down the road, facility investment decreased 7.8 percent on-month in March, taking the first negative turn in five months. The decrease was the steepest in 20 months since July 2016 when facility investment fell 8.3 percent.

Investment conditions have worsened due to corporate tax increases, reduced tax breaks and the growing prospect of additional interest rate hikes.

“The simultaneous drop in production and investment should be taken as a very dangerous signal,” said Lee In-sil, a professor of economics at Sogang University.

Lee warned that the Korean economy would face bigger problems unless measures were taken to enhance productivity through restructuring.

Retail sales remained the only bright spot, rising 2.7 percent in March, extending the streak of increases to three months.

But analysts note domestic consumption can hardly be expected to continue to grow throughout the year as household purchasing power is weakening amid deteriorating unemployment. Data from the Bank of Korea showed the consumer sentiment index dropped for five consecutive months in March.

Boosting employment is considered essential to spurring consumption spending, but measures taken by President Moon Jae-in’s administration to create more jobs have proved unhelpful.

The jobless rate stood at 4.5 percent in March, the highest for the month in 17 years, with the figure for people aged 15-29 climbing to a two-year high of 11.6 percent.

In April, the BOK revised down its estimate of the on-year increase in the number of employees this year to 260,000 from 300,000.

A downturn in exports last month increased worries over the prospect of the Korean economy, which has relied heavily on outbound shipments for growth.

According to government data, the country’s exports decreased 1.5 percent from a year earlier to $50.06 billion in April, marking the first dip in 18 months.

Trade officials attributed the decrease to a base effect, noting local shipyards exported offshore facilities worth $5.45 billion in April last year. In the first four months of this year, Korea’s outbound shipments were up 6.9 percent from a year earlier to $195.5 billion.

But analysts say Korea’s manufacturing exporters are facing deteriorating conditions such as the strengthening won, intensifying competition from Chinese rivals and escalating trade tensions between the US and China.

“The possibility cannot be ruled out that the won-dollar exchange rate will fall to the 900-won level seen last in 2008,” said Ju Won, a researcher at the Hyundai Research Institute, a private think tank.

He warned the steep appreciation of the won coupled with weakened competitiveness of key manufacturers could drastically reduce Korea’s exports.

Sluggish exports would cause a steep downturn in the economy, as the Moon administration’s income-led growth policy fails to boost employment and private consumption.

Lee said it was urgently needed to step up measures to develop new industries and make traditional manufacturing industries more competitive to reduce reliance on chipmakers.

The downward trend in industrial output, investment and exports has led a growing number of analysts to raise doubts about the possibility of achieving the government’s growth target of 3 percent.

According to BOK data, Korea’s economy expanded 1.1 percent on-quarter in the first three months of the year, exceeding market expectations, partly due to a base effect from a 0.2 percent negative growth in the October-December period of last year.

Economists caution that the economy could take a sharp downturn in the latter half of the year if the slowdown in investment and exports continues. Most local research institutes expect the growth rate to be around 2.8 percent this year, down from 3.1 percent last year.

By Kim Kyung-ho

(

khkim@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)