The nation’s fourth-largest conglomerate LG Group will face new management centering on its heir apparent Koo Kwang-mo after his adoptive father and group Chairman Koo Bon-moo died Sunday.

Koo Kwang-mo is the son of the late Koo’s younger brother Koo Bon-neung. Under LG’s strict principle of excluding women from the management, Koo Kwang-mo was adopted in 2004 by the late Koo.

The heir apparent, who is currently an executive at LG Electronics, was hurriedly appointed a member of the company’s board last week, when his adoptive father was hospitalized in a critical condition. Koo’s appointment has to be approved at an extraordinary shareholders meeting on June 29.

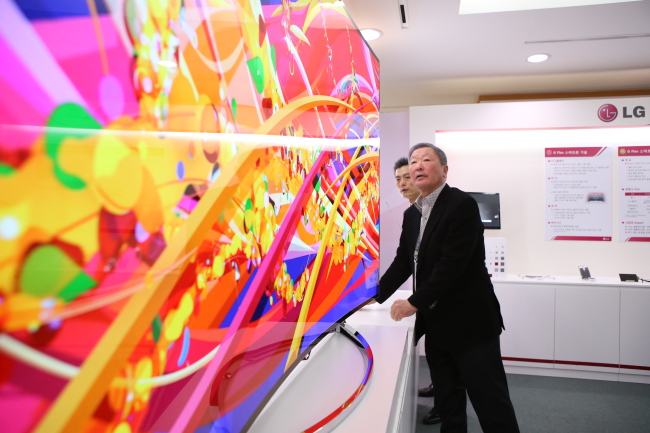

|

Koo Bon-moo, the late chairman of LG Group, inspects an organic light-emitting diode television at a R&D performance briefing in March 2014. (LG Group) |

“It is true the group will face new management centering on Koo Kwang-mo with six professional CEOs serving complementary roles. After certain procedures, he is expected to participate in key decision making of the group’s businesses,” said a senior official from LG on the condition of anonymity.

The six CEOs are LG Corp. Vice Chairman Ha Hyun-Hwoi, LG Electronics chief Jo Seong-jin, LG Display head Han Sang-beom, LG Household & Health Care leader Cha Suk-yong, LG Uplus CEO Kwon Young-soo and LG Chem CEO Park Jin-soo.

His future title and roles will be confirmed after the shareholders meeting in June. However, due to his relatively short experience, “it is doubtful he will be at the forefront of the group’s management immediately and dramatically,” said the insider.

Koo is in his early 40s and has been an executive for only five years. Given his experience, he is expected to focus on stable management succession and the group’s key businesses for the time being, industry watchers said.

He joined LG Electronics in 2006 and has since worked for its US office, home and entertainment division and home appliance division. He is currently chief of LG Electronics’ information display business division.

After a certain period of time, Koo might lead a separate affiliate as the former owners did. He may oversee a separate business from LG International Corp, the bio sector of LG Chem or LG Display, according to industry watchers.

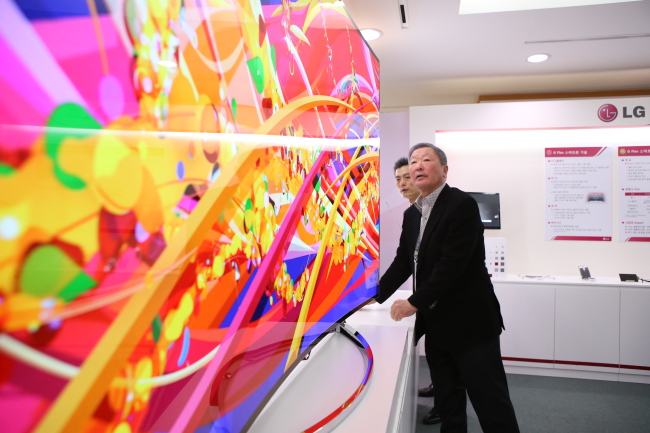

|

Late LG Group Chairman Koo Bon-moo (first row, far left) and heir apparent Koo Kwang-mo (second row, third from left) participate in the senior Koo’s father Cha-kyung’s 88th birthday party in April 2012. (Yonhap) |

LG Group is betting on organic light-emitting diode displays, automotive electronics and the bio area as its next-generation businesses.

As part of another aspect of LG Group’s traditional management succession, Koo Bon-Joon, current vice chairman of LG Group and younger brother of the late Koo, is expected to leave his post.

Under LG’s tradition so far, when an eldest son of the head takes over the management, other brothers leave the management. This is to prevent a feud among members of the owner family and back the eldest son to secure stable management rights.

Koo Bon-joon might become independent by separating an affiliate or a business division with his 7.72 percent stake of LG Corp. It is not certain whether he would do so immediately or after a two- to three-year transition period.

"For LG, there will seem to be little conflict in management succession, such as a feud between brothers for control, compared to other conglomerates. Even for the board of directors, more than 40 percent of them are management shareholders (familiar with LG’s leadership and tradition),” said Park Ju-guen, head of corporate analysis group CEO Score.

However, issues related to Koo Kwang-mo’s stake in the company and inheritance tax remain.

LG created a holding firm, LG Corp., in 2003 as the first conglomerate in Korea to simplify its corporate governance, having a vertical finance structure between a holding firm and affiliates. When Koo becomes the largest shareholder of LG Corp., he will gain control over the entire group.

The junior Koo is currently the third-largest shareholder of LG Corp., with a 6.24 percent stake. The late Koo Bon-moo held an 11.28 percent stake, while Koo Bon-joon holds a 7.72 percent stake.

When he inherits the entire stake of the late Koo Bon-moo, he will become the largest shareholder of the group, but the inheritance tax is estimated to be around 1 trillion won ($924 million), according to industry watchers.

Under the nation’s tax law, a 50 percent tax is imposed if the inheritance is more than 3 billion won. The value of the late Koo’s 11.28 percent stake is estimated to be around 1.9 trillion won.

By Shin Ji-hye (

shinjh@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)