Samsung Group acquired K-Twin Tower, 22-story twin buildings in central Seoul, for a whopping 720 billion won ($620 million) in February. It was a rare purchase for the nation’s largest conglomerate that has been busy selling off its own office buildings in the city center.

The central location and big name tenants like Microsoft and Kim & Chang, Korea’s top law firm, were attractive enough but industry sources say it was actually latecomer WeWork, the US co-working giant that helped reduce the vacancy rate to below 5 percent in a 35-year lease deal.

|

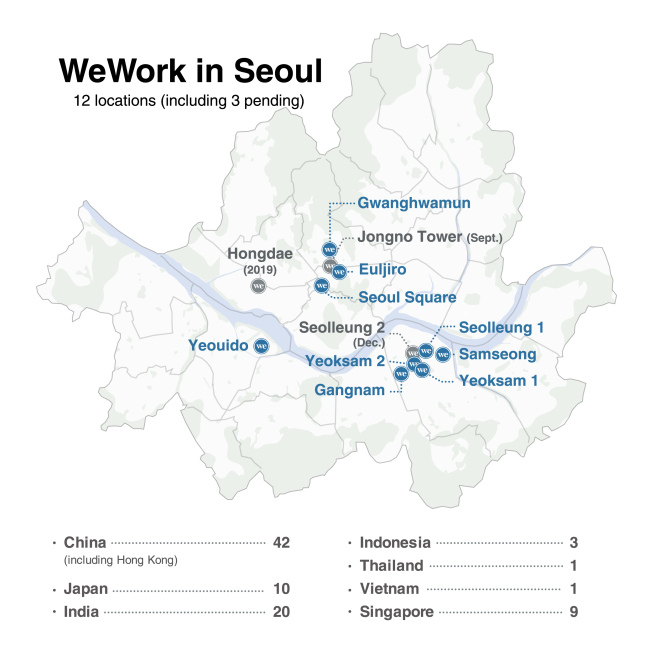

WeWork Yeouido in western Seoul |

Before the planned sale, the then building owners US private equity firm Kolberg Kravis Roberts and Hong Kong-based investment firm LIM Advisors reportedly lured WeWork with generous incentives, including months of free rent and financial support for refurbishment.

The deal price worth 28 million won per pyeong -- a unit of area used in real estate equal to 3.3 square meters -- was a record at the time and the owners earned more than 200 billion in just three years.

“It’s a win-win for both WeWork and building owners,” a real estate consultant who has knowledge about WeWork’s lease deals in Seoul told The Investor on condition of anonymity. “Having WeWork as a client helps raise both the occupancy rate and deal price. But for buyers, the price is sometimes a bubble.”

WeWork, a New York-based startup offering flexible and trendy workspace for startups and bigger firms, has become the hottest name in the city’s office lease market where big commercial buildings are desperate to fill their empty spaces.

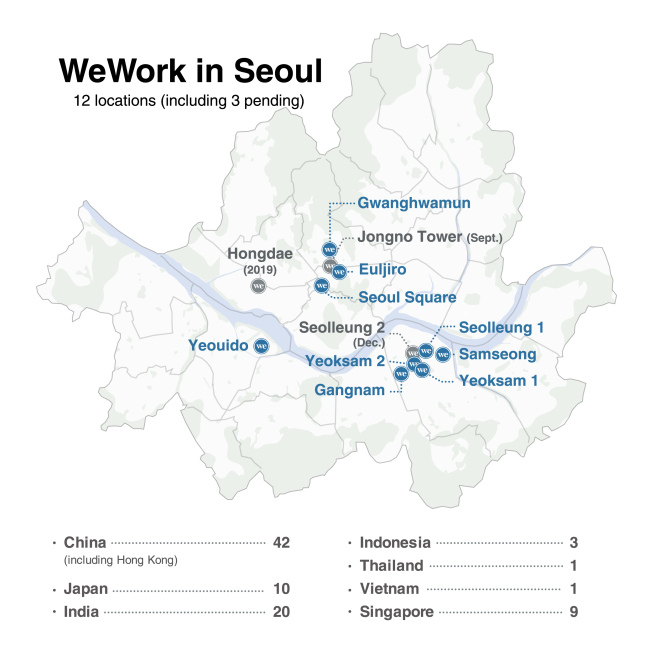

Since its debut in 2016 in Korea, a total of nine branches have opened, with three new openings in the coming months. Once the planned Jongno Tower branch opens in September, the total capacity is expected to reach 15,000 people across the venues.

The 12 locations are high-density even considering the firm’s aggressive expansion across the globe. It operates 42 locations in China, including Hong Kong, while there are 10 and eight in Japan and Singapore, respectively.

“Many startups and companies are interested in joining the WeWork network. Also, due to Seoul’s established infrastructure, transportation and high population density, we were able to expand faster at the city’s symbolic spots,” said a Seoul-based WeWork official who declined to be named.

“We sign a long-term lease, which is good for building owners because it keeps the occupancy rate high,” she added without further elaborating on more detailed contract terms citing a company policy.

More recently, WeWork played a key role in resuming the sales talks of Seoul Square, another landmark building in central Seoul whose anchor tenants include Mercedes-Benz, Siemens and LG. The building had been struggling to find a new owner for years as the occupancy rate showed no signs of recovery.

But the stalled talks gained fresh momentum early this year after WeWork signed a deal to lease the building’s four floors, or 20,000 square-meter space, for 20 years. With the new entry, the vacancy rate fell to less than 10 percent. Sources say Hana Financial Investment is seeking to acquire the building for about 1 trillion won.

It is common for a popular tenant to be provided some special favors like months of free rent. Sources say WeWork is taking full advantage of it, having being offered one to two years of free rent and support for interior costs worth hundreds of millions of won.

“Now building owners are willing to carry a huge WeWork logo atop their buildings, which was rare for other big tenants before,” the consultant said. “I wouldn’t say WeWork is a definitive factor behind the city’s office building boom but it is playing a role in fueling the latest bubble.”

With WeWork’s growing presence, the nation’s co-working office market is also heating up. Now co-working offices make up almost 10 percent of the city’s office leases. DigiEco, a think tank affiliated with KT, predicts the market volume to surge from 60 billion won last year to 770 billion won by 2022.

Along with local startups, chaebol affiliates such as Hyundai Card, LG’s Serve One and Shinsegae International who are the owners of landmark buildings in the city are increasingly jumping into the market to mimic the success story of the US startup and elevate the occupancy rate of their own buildings.

“The big firms may be able to mimic the trendy styling but it would be difficult to compete with WeWork on pricing,” said another source from the real estate industry who wished to remain anonymous. “WeWork usually leases a lot of larger spaces to attract more tenants while reducing construction costs by buying materials in bulk globally.”

In a recent report, real estate consultancy CBRE Korea forecast large operators could seek to acquire smaller rivals for further expansion, saying the current co-working boom could be extended outside Seoul to cover the metropolitan area in the coming years.

Why is it still losing money?

Amid its relentless expansion, WeWork is still unprofitable. The firm, valued at about $20 billion, is burning cash after getting funds from big investors like Japan’s SoftBank.

Earlier this month, it released its first-ever financial results, saying total revenue rose to $421.6 million in the second quarter from $198.3 million a year ago and memberships also more than doubled to 268,000 at the end of June.

Its net loss, however, also jumped to $723 million compared to $154 million a year earlier. Operating margins, stripping out expenses, rose to 28 percent from 26 percent.

The firm said a mismatch in its profit and loss is largely due to revenues from new sites that have not yet been reflected in the financial results while the expenditure is made now.

More recently, it is pouring resources into Asia, a precondition for SoftBank’s latest $1 billion funding. Korea is one of the key markets in its Asian push. It is getting a firm footing here but some branches like those in Seoul Square and Yeouido are struggling to raise their occupancy rate while spending big on hiring new sales people to attract tenants.

“Many industry people don’t understand why the firm is losing money here. It is getting months of free rent and support for construction costs. It may pay a deposit worth months of rents but that is refundable. The company is actually spending mostly on marketing and hiring people,” said Kim Ji-ae, CEO of Golden Planners, a real estate consultancy.

“Expectations are high on WeWork’s potential. It’s up to the firm to prove the sustainability of its business model.”

By Lee Ji-yoon and Ahn Sung-mi/The Investor

(

jylee@heraldcorp.com) (sahn@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)