Growing uncertainties in the external economic environment are posing greater downside risks to the Korean economy, which has already been held back by declining corporate investment and sluggish consumer spending.

The country’s export-heavy economy remains particularly vulnerable to the prolonged trade row between the US and China, widespread financial instability among emerging markets and soaring crude prices, experts say.

|

(Herald DB) |

Net exports made a 1.3 percentage point contribution to Korea’s economic growth in the second quarter of this year. The on-quarter growth rate for the April-June period stood at 0.6 percent, dented by slumping domestic demand.

Overseas shipments by Asia’s fourth-largest economy had increased for 17 consecutive months through March. But the figure underwent on-year decreases in April, June and September, with the US-China trade dispute escalating, according to data from the Korea Customs Service.

In the first nine months of the year, the nation’s exports increased 4.7 percent from a year earlier to $450.3 billion. Except for semiconductors, which account for more than a quarter of all the goods that Korea ships abroad annually, the country’s outbound shipments shrank 1.7 percent during the cited period.

“(Korea’s) export growth momentum has been weakening significantly this year,” said Lee Sang-won, a researcher at the Korea Center for International Finance, adding the impact of the trade spat between the world’s two largest economies will be felt more acutely over time.

The spread of financial instability among emerging economies could also reduce the country’s outbound shipments. Emerging markets’ proportion of Korea’s exports grew from 35.6 percent in 1995 to 57.4 percent in 2017. The figure surpassed 58 percent in the first half of this year.

With the country depending on imports for nearly its entire oil supply, rising crude prices will weaken the price competitiveness of local exporters by pushing up production costs. International oil prices, which recently hit a four-year high, are expected to exceed $100 per barrel within the year.

US pressure on China to stop “competitive devaluations” might result in the Korean won gaining value against the US dollar, making Korean products more expensive abroad. The won’s value is increasingly tied to the Chinese yuan as Korea relies on China’s markets for more than a quarter of its annual exports.

According to an analysis by the Hyundai Research Institute, a private think tank, a 1 percent rise in the value of the won against the dollar could result in a 0.51 percent reduction in Korea’s shipments abroad.

The prospects of weaker exports, coupled with decreasing investment and slumping consumption, has led economic institutes at home and abroad to cut their growth forecasts for Korea.

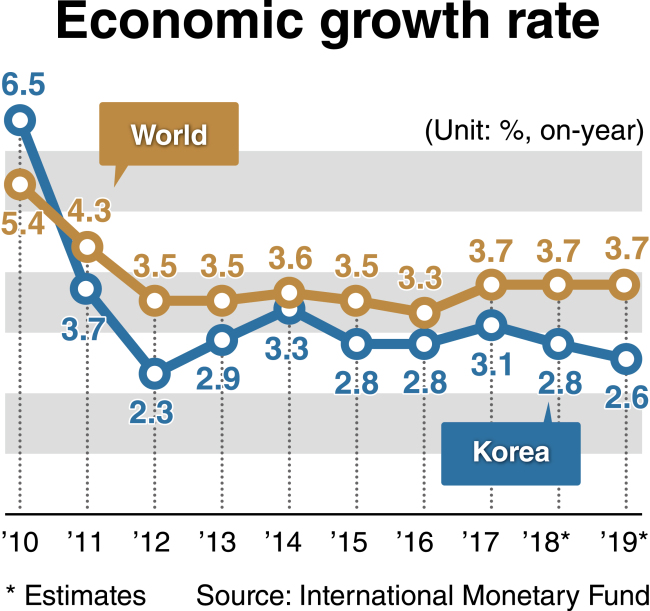

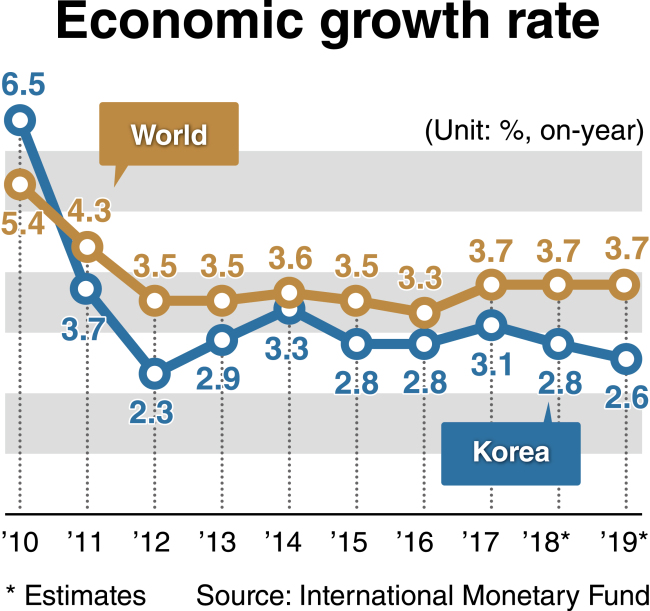

In its latest World Economic Outlook report released last week, the International Monetary Fund lowered its 2018 growth estimate for Korea to 2.8 percent from the previous projection of 3.0 percent. The multilateral lender also revised the nation’s growth outlook downward for next year, to 2.6 percent from 2.9 percent.

The Organization for Economic Cooperation and Development last month slashed its growth estimate for Korea this year to 2.7 percent from the previous forecast of 3 percent. Local research institutes and global investment banks also remain skeptical that the Korean economy will expand 2.9 percent as predicted by the government and the Bank of Korea.

Throughout the 2000s, Korea’s economy expanded at a faster pace than the global economy. Since 2011, however, the country’s growth rate has hovered below the global growth rate, with the gap continuing to widen in recent years.

Finance Minister Kim Dong-yeon, who doubles as deputy prime minister for economic affairs, last week suggested that the government would adjust its macroeconomic forecasts downward, including its growth outlook, to reflect mounting uncertainties surrounding the economy. Kim told reporters on the sidelines of the meeting of global finance chiefs in Bali, Indonesia, that external factors requiring adjustments to economic predictions have emerged.

His remarks marked a departure from the government insistence over the past 10 months that the country’s economy remained on the path to recovery.

Many economists express concerns that the Korean economy is entering an L-shaped long-term recession.

The business sentiment index for the fourth quarter, based on a recent survey of about 2,200 local manufacturing firms, remained at 75, down 12 points from the previous quarter. A reading below 100 means that pessimists outnumber optimists. The survey conducted by the Korea Chamber of Commerce and Industry showed that 72.5 percent of the companies believed the economy was entering a mid- or long-term downward cycle.

Under the circumstances, economists say, the government should focus on helping boost corporate investment rather than resorting to short-term stimulus measures.

“What is most needed is to foster future growth engines through regulatory reforms,” said Yoo Hwan-ik, a researcher at the Korea Economic Research Institute, a private think tank.

Analysts say the excessive weight of semiconductors in Korea’s industrial structure leaves its economy vulnerable to possible downturns in global demand. The country’s two chipmakers -- Samsung Electronics and SK hynix -- made up 40.2 percent of combined operating profits generated by Korea’s top 100 companies in the first half of the year, according to recent industry data.

Korea has so far remained largely immune from the effects of financial instability in emerging economies. But economists warn of the possibility of massive capital flight from the country if the interest rate gap with the US widens further.

Offshore investors sold a net 1.91 trillion won worth of local bonds in September, marking the first time since December last year that they were net sellers of local bonds, according to data released by the Financial Supervisory Service on Monday.

Foreigners remained net buyers of Korean stocks for a third consecutive month in September. But they were net sellers of local shares on every trading day so far this month.

By Kim Kyung-ho

(

khkim@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)