When the press show for YouTube Premium series “Top Management” was held in Seoul in October, it received a great deal of attention from local media outlets.

Starring up-and-coming actor and singer Cha Eun-woo of boy band Astro, the show’s pilot episode was watched nearly 1.7 million times in a week.

Nadine Zylstra, head of YouTube Originals for the Asia-Pacific region, said at the event that the company recognizes how influential South Korean pop culture has become on the global stage.

“Through the experience of launching ‘Burn the Stage,’ we really discovered just how global the fanship is for Korean content so we are really excited about Korean drama because we think it will have the same general global appeal,” she said, referring to the documentary “BTS: Burn The Stage.”

|

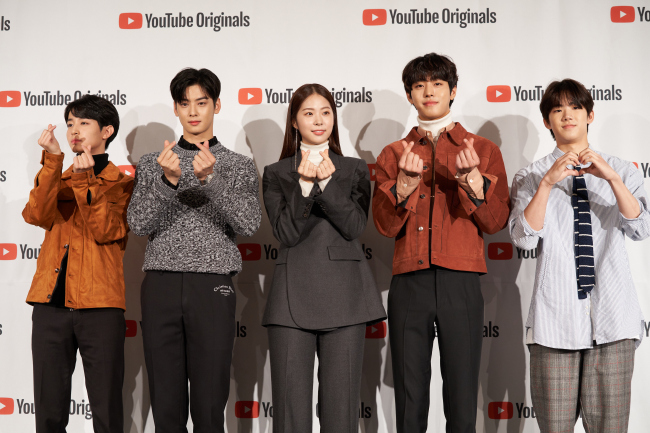

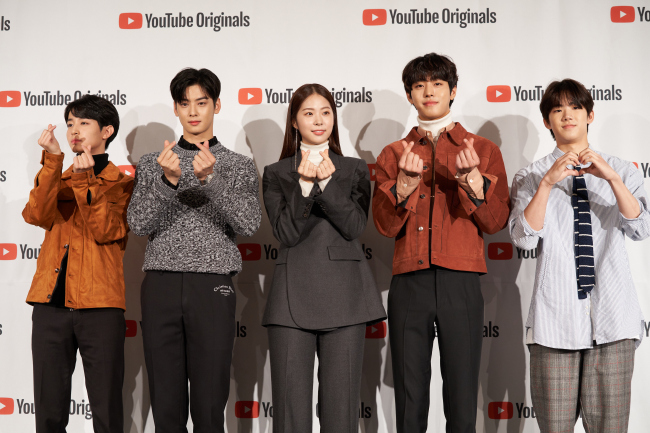

The cast of Youtube original series “Top Management” pose at a press conference in centralSeoul on Oct. 29. (Studio 329) |

The new YouTube Premium series is one of the many pieces of South Korean content released on subscription-based platforms in recent years.

The subscription economy is one of the hottest buzzwords in business at the moment. Coined by Tien Tzuo, CEO of US-based software company Zuora, the term refers to an economic model where people subscribe to a service rather than making purchases to acquire things.

According to Tzuo, while things mattered in “the old world,” more customers are opting for subscription whose experiences better meet their needs.

At the forefront of this business trend are global video streaming services, which are affecting South Korea’s pop culture industry both economically and culturally.

With subscription fees roughly around the price of a DVD, there is strong growth in the number of South Koreans using “over-the-top” services supplying subscription-based video on demand.

Over 36 percent of respondents said they used online video platforms in 2017, according to a study by the Korea Information Society Development Institute which surveyed nearly 7,400 people.

Jung Duk-hyun, a culture critic, said that streaming giants like Netflix are inspiring South Korea’s creative community with their generous budgets, a trend which translates into different stories, ideas and production styles.

“For instance, ‘Mr. Sunshine,’ with over a budget of over 40 billion won, would have been impossible for South Korea’s content production industry alone,” he said.

|

An official image of the high-budget hit TV series “Mr. Sunshine.” (tvN) |

Each episode of the hit TV series “Mr. Sunshine” was made available on Netflix just hours after it was first aired on the cable channel tvN, as the streaming service obtained the rights to broadcast the show in a reported multi-billion won deal.

According to an official at CJ E&M, the entertainment heavyweight behind “Mr. Sunshine,” the show was able to reach a wider audience thanks to Netflix’s big viewership pool.

“Though we can’t give you the exact figures for the positive impact of Netflix, it’s possible (that the show have reached a wider audience) given the platform’s significant number of subscribers,” the CJ E&M official said.

Culture critic Jung said that while production companies traditionally make drama series with Korean viewers in mind, working with Netflix means aiming at the audience in Asia and beyond.

“Once South Korean viewers get used to watching such shows, other South Korean drama series will have no choice but to change as viewers could acquire a taste (for high-budget shows),” he said.

Netflix is also making original content on its own with South Korea’s creative community.

Having released the film “Okja” in 2017, directed by Bong Joon-ho, Netflix has two original Korean series on the way including “Love Alarm” and “Kingdom,” both of which are set to be released in 2019.

“Love Alarm,” based on a popular South Korean online cartoon series, will focus on human relations in a world where there is an app that lets people know if there is someone with feelings for them in the vicinity.

“Kingdom,” which is scheduled for a global release on Jan. 25 next year, garnered attention when details were revealed at a Netflix event titled “See What’s Next: Asia” at the Marina Bay Sands in Singapore earlier this month.

During the event, screenwriter Kim Eun-hee said it would have been impossible to make the show on a traditional platform for a drama series as it contains a lot of graphic scenes that TV censors would have cut or blurred out.

|

A still image of the upcoming Netflix original series “Kingdom.” (Netflix) |

“Writing the script was tough despite having had plans for a long time. It was thanks to Netflix that I was able to do creative work with freedom,” Kim said. “If we blur out the zombies, a concept that everyone knows of, (viewers) can‘t relate well (to the show).”

Kim’s comment came after reports from earlier this year that the global video platform would spend nearly $8 billion this year alone to create some 700 new original shows and films.

Content creators working with Netflix have more room to maneuver when it comes to production time, compared with most South Korean producers who are pressed to follow a tighter schedule.

“If Netflix can spend two years making a six-episode show, writers, directors and actors involved in the show can work with more peace of mind, which will then raise quality and improve the work environment,” said Jung.

Though overshadowed by global video giants, homegrown video streaming platforms such as Watcha Play are also hoping to expand its presence.

Watcha Play began its service in 2016, the same year when Netflix was launched in South Korea, and managed to attract 640,000 users within a year, according to Watcha, the company that runs the service.

The service gained popularity on the back of its cheaper plans compared to competitors, but its lack of original content puts itself at a disadvantage when it comes to variety.

Though a late-comer, South Korea is being encouraged to come up with its own answer to Netflix, as it is warned the global streaming giant’s growth could be a double-edged sword for its entertainment industry.

“At the moment, Netflix sees South Korea as a strategic point in Asia and is investing in South Korean pop culture which in turn serves their purpose (of expanding its presence in the region).

“But given the prospect of foreign capital influencing the South Korean industry in the future, South Korea needs to come up with something, otherwise the industry could become financially dependent,” Jung said.

By Yim Hyun-su (

hyunsu@heraldcorp.com)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)