Financial Services Commission Chairman Choi Jong-ku said Wednesday more risk-bearing initial public offerings in the Korean stock bourse are prerequisites for a breakthrough in the growth of Korean companies, calling it an “elemental role of the capital market.”

“Ordinary companies draw investments through a cooperation between banks and a capital market,” Choi said in a meeting with representatives of Korean securities firms. “Startups and budding venture companies are bearing risks, and the capital market should share the responsibility by investing in such companies.”

Of the total finance to Korean midsized companies as of 2017, influx from the capital market accounted for 2.2 percent, far lower than loans at 73.4 percent and state funds at 23.4 percent, according to the FSC.

Stocks of a venture company devoted to pharmaceutical product development and the biotechnology business are considered assets with high risks and high returns, Choi added. He cited the growth potential of the domestic health care industry, which saw a 13.6 percent increase in exports over the past five years, as well as 33 export contracts valued at 10.4 trillion won ($9.2 billion) in the past three years.

“To develop a drug, at least 1 trillion won of investment for 15 years on average is required, and it has low possibility of success,” he said. “But the pharmaceutical industry will lead the next phase of growth of the Korean economy.”

As a way to help the industry, the regulator said it will give biotechnology and pharmaceutical firms leeway in listing rules, after having allowed them to voluntarily restate accounting errors in September.

He also promised that biotechnology and pharmaceutical firms will not be designated by the Korea Exchange as an “administrative issue” even if they post an operating loss for the fourth consecutive year.

|

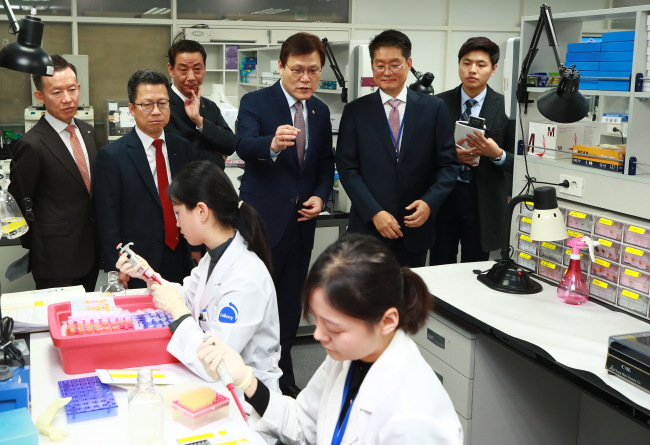

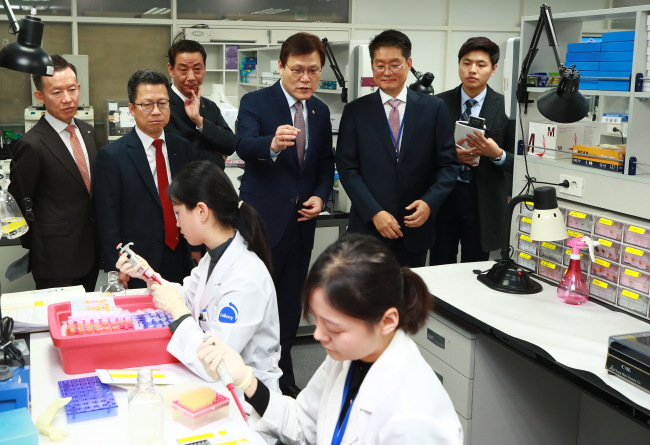

FSC Chairman Choi Jong-ku walks past a laboratory at Cellivery Therapeutics located in the Digital Media City Landmark Building in Seoul on Wednesday. (Yonhap) |

The remarks came during Choi’s visit to the Seoul-headquartered drugmaker Cellivery Therapeutics, which he cited as an example of a risk-bearing asset.

Founded in 2014, Cellivery Therapeutics, a developer of proprietary therapeutic molecule systemic delivery technology, has been trading on the second-tier Kosdaq since Nov. 9.

It is Korea’s first company that went through an abridged special listing procedure upon an underwriter’s recommendation. DB Financial Investment, a Korean securities firm, was the sole underwriter of the IPO.

The underwriter of the special IPO takes the responsibility of the public listing, as it is obliged to buy back stocks from IPO subscribers if the share price dips below 90 percent of the initially offered price within six months.

This is one of the options for privately held companies with low profitability to gain easier access to an IPO, alongside the “Tesla Policy,” another abridged listing procedure for companies with high growth potential based on technology prowess.

During the meeting, Choi called for the swift deregulation on the stock market, while urging for t he cooperation of market participants like securities firms.

“Private investment is playing a major part of the capital market, but it hasn’t played its elemental role, barred by regulations designed to protect investors.”

Choi hinted at a new set of special advantages to health care companies that have gone public. For example, a company that went public through the special procedure would be exempt from public delisting, even if the company fails to yield operating profit for four consecutive years.

By Son Ji-hyoung

(

consnow@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)