In line with the South Korean government’s push to strengthen diplomatic and economic ties with Southeast Asia, Korean entrepreneurs are increasingly seeking new opportunities in the region to benefit from its fast-growing economies, which have a combined population of 630 million and a combined gross domestic product of $2.4 trillion.

The New Southern Policy is the Moon Jae-in administration’s key foreign economic policy and reflects its strong commitment to prosper together with the ASEAN countries -- Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam.

In line with the policy, a special committee was launched within Cheong Wa Dae in August, comprising around 30 officials from 14 ministries.

Last week, the committee, led by Chairman Kim Hyun-chul, announced that it would provide a guaranteed 1 trillion won ($800 million) between now and 2022 to support small and midsized companies in advancing into the Southeast Asian market, with some 15 billion won allocated for next year.

The Ministry of Trade, Industry and Energy is currently participating in negotiations toward an ASEAN-led mega trade deal, called the Regional Comprehensive Economic Partnership. Separately, the ministry is also pushing for bilateral trade deals with Indonesia and Malaysia to intensify economic and investment cooperation.

“ASEAN and India are important to us to the extent that our future relies (on them) ... I found that the New Southern Policy is very important from the perspective of expanding mutual economic cooperation and diversifying our export markets,” President Moon said after his trip to attend the ASEAN and APEC summits last month.

He also called on ministries to work together to host the special Korea-ASEAN summit, to be held in Korea next year to mark the 30th anniversary of diplomatic relations between Korea and the ASEAN region.

|

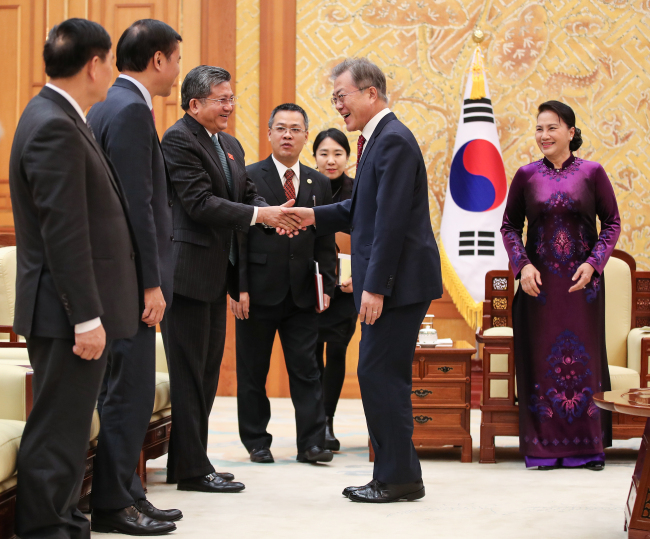

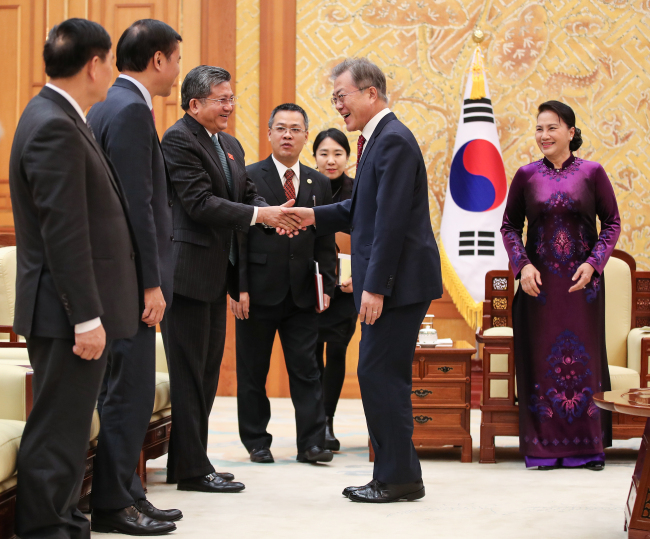

President Moon Jae-in (center) shakes hands with delegates accompanying Chairwoman of Vietnam’s National Assembly Nguyen Thi Kim Ngan (right) at Cheong Wa Dae during her visit to Seoul on Dec. 6. During the meeting, Moon emphasized the importance of Vietnam to South Korea and the need for wider economic and human exchanges. (Yonhap) |

The New Southern Policy is expected to accelerate the economic partnership between the two sides, which have seen a gradual rise in trade and investment in recent years.

In the decade ending last year, the trade volume between Korea and ASEAN went up to $149 billion -- from $61.8 billion in 2007, when the free trade deal first came into force. The trade volume is expected to reach $160 billion this year.

Among Korean exports to ASEAN, the value of all exports from new industries such as next-generation chips, displays and premium consumer goods stood at $37.4 billion last year, surpassing exports of traditional industry products such as cars, steel, ships, petroleum products and synthetic resins, which totaled $31 billion.

Many Korean companies are now enjoying business opportunities in the region thanks to its young, digitally connected population, its growing middle class and its rapidly urbanizing towns.

|

Kim Hyun-chul, presidential adviser for economic affairs, who heads the Presidential Committee on the New Southern Policy, speaks in Seoul on Wednesday during a seminar on economic cooperation with the region. (Yonhap) |

Tech firms going to ASEAN

Korea’s leading tech firms are not only providing advanced IT services and products for the Southeast Asian nations -- they also contribute directly to the host countries’ economic growth by making significant investments.

Ever since 2009, Samsung Electronics has operated the biggest mobile phone factory in Hanoi, Vietnam, producing most of the smartphone products that Vietnam exports worldwide. Two of Samsung’s factories in Vietnam combined make 240 million units a year.

In October in Kuala Lumpur, Malaysia, Samsung unveiled its newest Galaxy smartphone, the A9, with the world’s first rear quad camera. This was Samsung’s first “Unpacked” event in Southeast Asia.

LG Electronics, another Korean tech giant, makes television screens in a $1.5 billion factory in the port city of Haiphong. The region has also served as a global production hub for TVs, mobile phones, washing machines and air conditioners.

The home-appliance manufacturer is planning to invest a total of $1.5 billion from 2013 through 2028.

LG’s battery-making unit, LG Chem, is targeting the electric-vehicle battery and energy storage service battery markets in Vietnam as it is actively exploring new markets.

|

Samsung runs the biggest B2B exhibition hall in Vietnam, offering its Southeast Asian customers a chance to experience its products and solutions. (Samsung Electronics) |

The battery maker has forged a partnership with VinFast, Vietnam’s only automaker, to build an EV battery plant and supply batteries to nearby countries including Thailand, Singapore, Indonesia and the Philippines.

Mobile carrier KT is making aggressive inroads into the Southeast Asian region by helping provide ICT solutions for smart cities.

KT recently signed a partnership with Vietnam’s largest construction group, the Hoa Binh Corporation, to build artificial intelligence-enabled hotels and push for smart city projects in Southeast Asia.

In August, the telecom firm signed a 53 billion won contract with the Philippines’ Converge ICT Solutions Inc. to build an optical fiber network along some 1,570 kilometers of main roads in the northern region of Luzon.

Early this month, SK Networks, a trading unit of SK Group, announced that it would start a home-appliance rental business in Malaysia through its local office, SK Networks Retails Malaysia.

In the internet and mobile technology space, Naver is becoming more active within Southeast Asia, which is seen to have real growth potential.

The Line messenger service already has a foothold -- mostly in Japan, Thailand, Taiwan and Indonesia -- with more than 200 million active users per month.

In August, Naver invested $150 million in Southeast Asia’s ride-hailing giant Grab with Seoul-based Mirae Financial Group. Through Line Ventures, Naver has also made a strategic investment in iPrice, an e-commerce aggregation service in Southeast Asia.

|

E-mart’s Go Vap outlet in Vietnam (E-mart) |

Opportunities in ASEAN infrastructure

Alongside tech firms, Korean companies are also gearing up their efforts to capture the growing business opportunities in the areas of transportation, infrastructure and energy in the region.

In Indonesia in 2014, steel giant Posco opened Krakatau Posco, Southeast Asia’s first-ever integrated steel mill, with a production capacity of 3 million tons.

Posco and Indonesia’s state-run Krakatau Steel invested 70 percent and 30 percent, respectively, in the steel mill.

Last week, Posco subsidiary Posco Daewoo said it would conduct exploration drilling at an offshore well in Myanmar. The trading company said 105.3 billion won would be invested into the project from January 2019 onward.

Korea’s auto industry is also shifting its focus to Southeast Asia with the country’s No. 1 automaker, Hyundai Motor, pioneering the transition.

Last month, Hyundai and Kia invested $250 million in Grab, Southeast Asia’s leading online-to-offline mobile platform, eyeing Southeast Asia’s growing ride-hailing market. They also plan to pilot electric-vehicle programs across the region.

Korean auto parts manufacturer Hyundai Mobis opened a data center jointly with a local company at a science park in Ho Chi Minh City, Vietnam, last year, which will promote the development of self-driving cars, the company said.

Hoping to increase its presence in the Southeast Asian defense market, Hanwha System participated in Asia Defense and Security 2018 last month in the Philippines, the company said.

|

Since 2015, LG Electronics has produced TVs, smartphones, home appliances and infotainment systems in the northern port city of Haiphong, Vietnam. (LG Electronics) |

Advancing into finance sectorIn line with the government’s New Southern Policy, the number of local financial companies advancing into the Southeast Asian market has fast risen in recent years. According to the Financial Supervisory Service, the number of overseas offices of Korean financial companies has increased 20 percent -- to 431 last year, from 359 in 2011.

One of the champions of Southeast Asian market expansion is KB Financial Group, steered by its flagship KB Kookmin Bank.

In July this year, Korea’s leading bank signed a deal to acquire a 22 percent stake in Indonesia’s Bank Bukopin, rising as the local bank’s second-largest shareholder. Also, Liiv KB Cambodia, the bank’s local digital banking platform, launched in 2016, attracted over 34,000 users during the first 18 months of business.

Other Korean banks also plan to expand in the region. KEB Hana Bank has increased its presence in Indonesia to at least 59 offices in 11 provinces. KEB Hana Bank, Woori Bank, Shinhan Bank and the Industrial Bank of Korea are all operating in the Philippines.

Among asset management units, Mirae Asset Financial Group made visible progress this year.

Mirae Asset Global Investments Co. acquired a full stake in Vietnam’s Tin Phat Management Fund Joint Stock Company in February this year, becoming the first Korean asset manager to set up a legal entity in the Southeast Asian state.

Also, Mirae Asset Life Insurance, the group’s insurer unit, announced in May that it had purchased a 50 percent stake in Prevoir Vietnam Life Insurance and launched a joint corporation under the name Mirae Asset Prevoir Life Insurance.

By Shin Ji-hye (

shinjh@heraldcorp.com)

Joint planning with