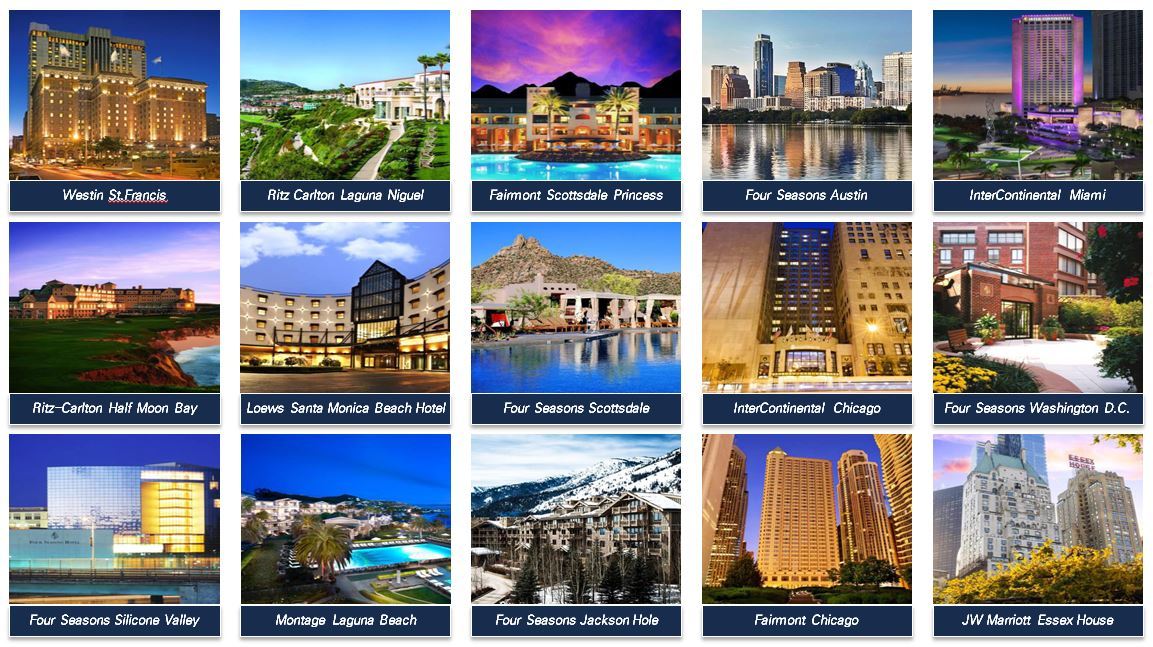

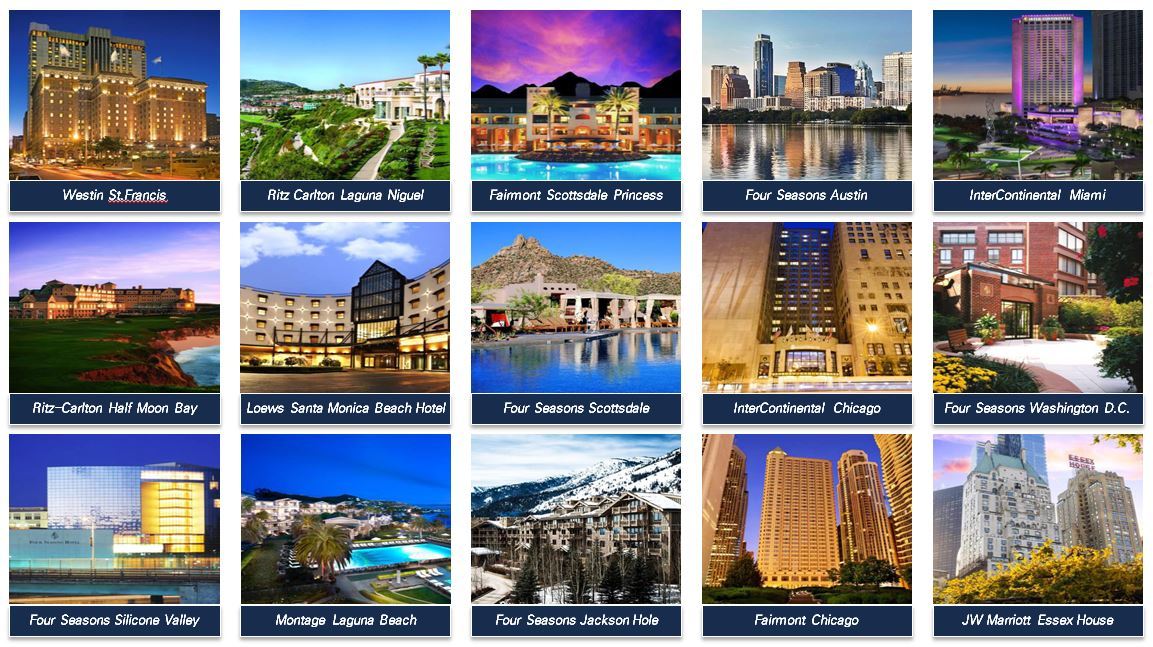

Mirae Asset Global Investments said Wednesday that it has acquired 15 premium hotels in the United States, marking the single highest number in overseas alternative investments by a Korean company.

The asset management unit of Mirae Asset Financial Group recently signed a contract with China’s Anbang Insurance to acquire 15 five-star hotels and resorts in key US cities, officials said. The total figure on the package deal was not revealed.

|

(Mirae Asset Global Investments) |

Competitors in the bid were top-tier global investors such as Blackstone, Brookfield, GIC and Host Hotels & Resorts.

The hotels included JW Marriott Essex House New York, The Ritz-Carlton Half Moon Bay, Montage Laguna Beach, Four Seasons Silicon Valley, Hotel Fairmont Scottsdale Princess, Four Seasons Arizona, Four Seasons Resort and Residences Jackson Hole, InterContinental Chicago, InterContinental Miami and The Westin St. Francis San Francisco.

All had been acquired by the Chinese insurer from the world’s largest private equity operator Blackstone in 2016 -- a transaction history that assures the quality of the assets, according to company officials.

“These hotels are located in nine key cities throughout the US, where the entrance barrier is high for investors due to the large investment sum and development restrictions,” the company said in a release.

The portfolio also offers diversity -- half of the buildings are registered as downtown hotels and the other half as vacation resorts -- as well as plausible profits in future sales.

“We should continue to invest into high-quality assets that create sustainable yields,” Mirae Asset Group Chairman Park Hyeon-joo told executive members and employees in a recent speech.

“It is now more important than ever to make diversified investments in a global scale, although such decisions may require more risks and efforts (than conventional investments).”

Mirae Asset has been a pioneering financial player here in terms of alternative investments since the early 2000s, expecting the low interest and slow growth trend to push investors’ appetite further towards lower risks and sustainability.

The company rolled out the country’s first real estate fund in 2004 and then moved on to purchasing prestige overseas buildings, starting with Mirae Asset Tower in Shanghai’s Pudong in 2006.

In June this year, it successfully exited from Taunusanlage 8, a prime office building in Germany, making about 160 billion won ($134 million) in profit in two years.

“The latest deal is the result of the recognition which Mirae Asset has earned since making its first overseas expansion back in 2003,” said Choi Chang-hoon, head of the company’s real estate unit.

“Under the slogan ‘Permanent Innovator,’ we shall continue to find high-quality overseas assets and offer diversity for investors here and abroad.”

By Bae Hyun-jung (

tellme@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)