YG Entertainment -- recently shaken by a police investigation into its former CEO Yang Hyun-suk -- is expected to return an investment worth 67 billion won ($56.5 million) related to redeemable convertible preferred shares to French luxury giant LVMH next month, local reports said Monday.

According to reports citing financial industry sources, the repayment date set for LVMH’s holdings of 1,359,688 redeemable convertible preferred shares of the entertainment agency is slated for Oct. 16. LVMH purchased the preferred shares in October 2014 via its investment unit World Music Investment.

|

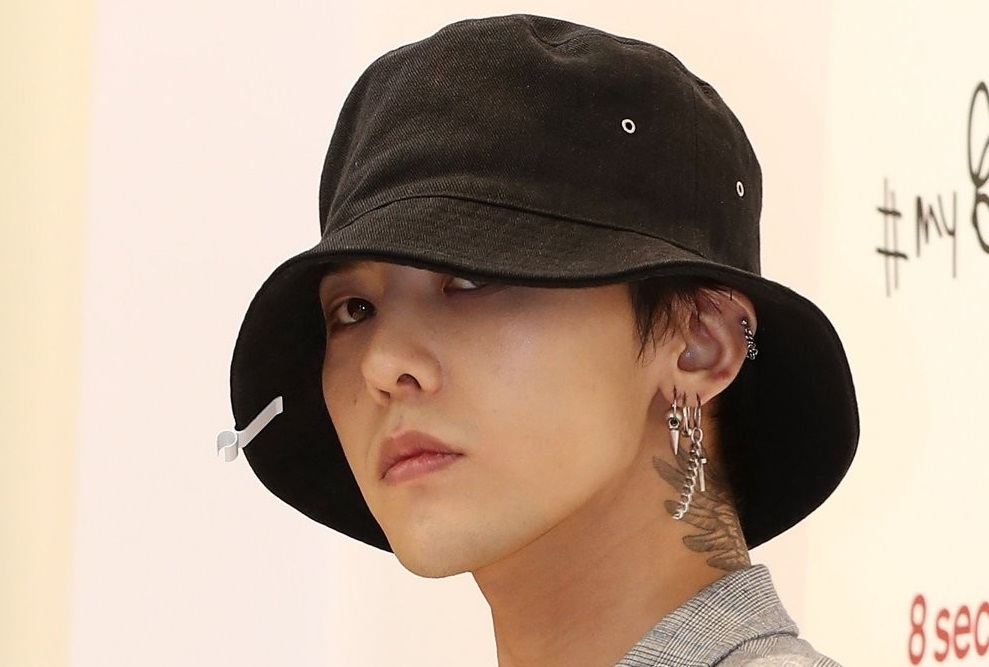

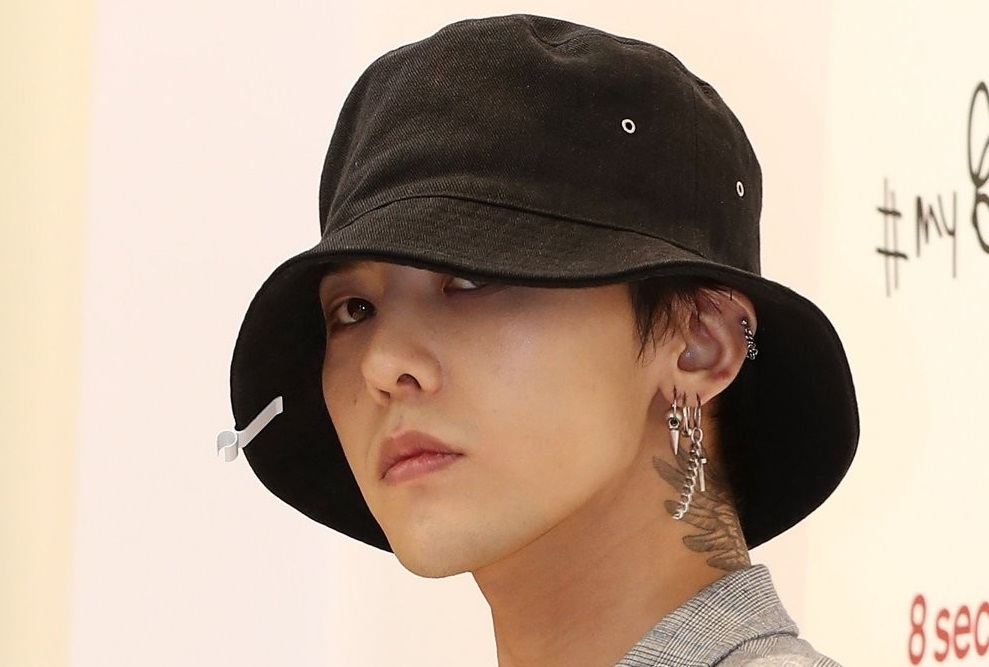

G-Dragon (Yonhap) |

The condition of the investment was that YG would convert the preferred shares to common stocks at the price of 43,574 won per share or return 67 billion won in cash if LVMH preferred such an option five years after the initial investment.

Since the 2014 investment, YG stocks have lost nearly half their value, trading at 22,950 won per share during Monday’s early trading hours, compared with 50,800 won on Jan. 7.

The company’s market capitalization and stock value have been dragged down by an industry-wide gambling, sex and drug scandal involving both Yang and its artists, which broke out earlier this year.

With the stock price required to spike 85.42 percent to meet LVMH’s condition, YG is likely to pay the French firm in cash. YG Entertainment could not be reached for comment on the matter.

By Jung Min-kyung (

mkjung@heraldcorp.com)