|

(Big Hit Entertainment) |

Judy Bae, 19, a member of the global fan club of South Korean boy band BTS known as ARMY never thought she would be exposed to financial fraud risks until she received a Twitter message from a fellow member asking for money in December last year.

Pretending as a teen ARMY member, the man who turned out to be in his 20s, claimed that he need money so that he could buy new albums or rare photo images of BTS members. He said he would pay her back soon, but never kept that promise.

Bae sent over 1 million won ($812) to her fellow BTS fan. But it was too late for her to realize the money she sent out of solidarity was irretrievable.

|

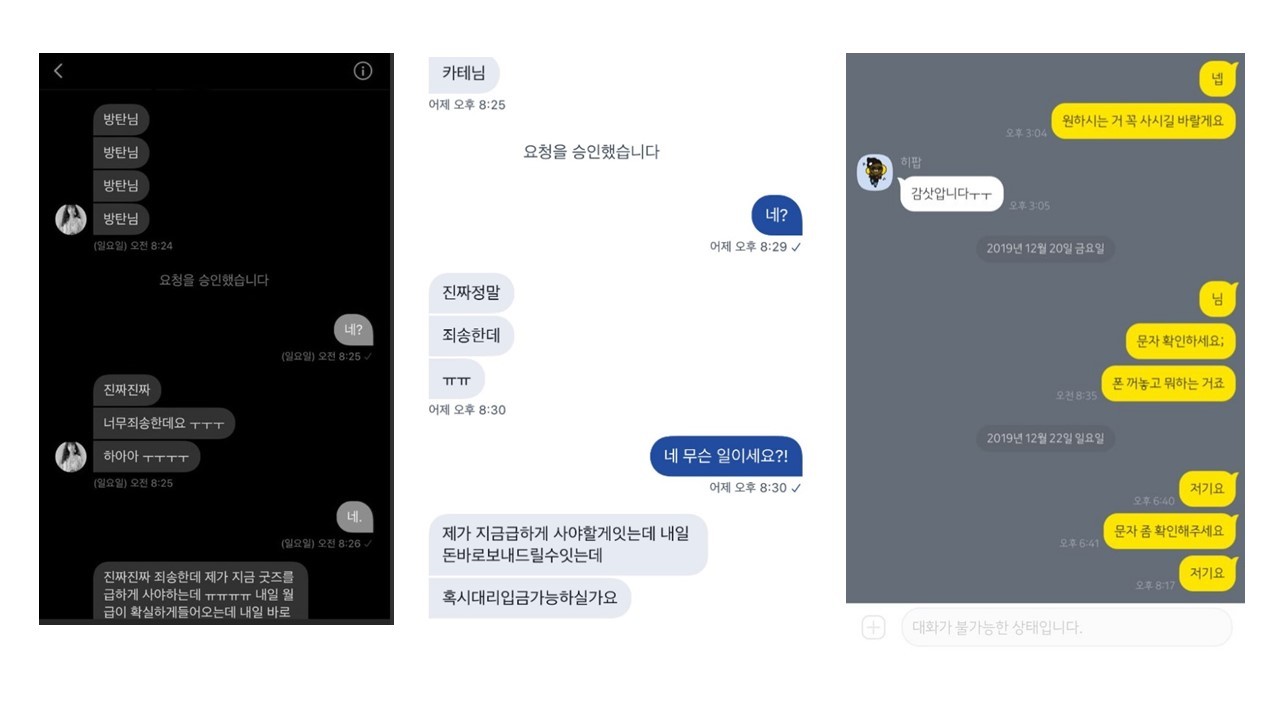

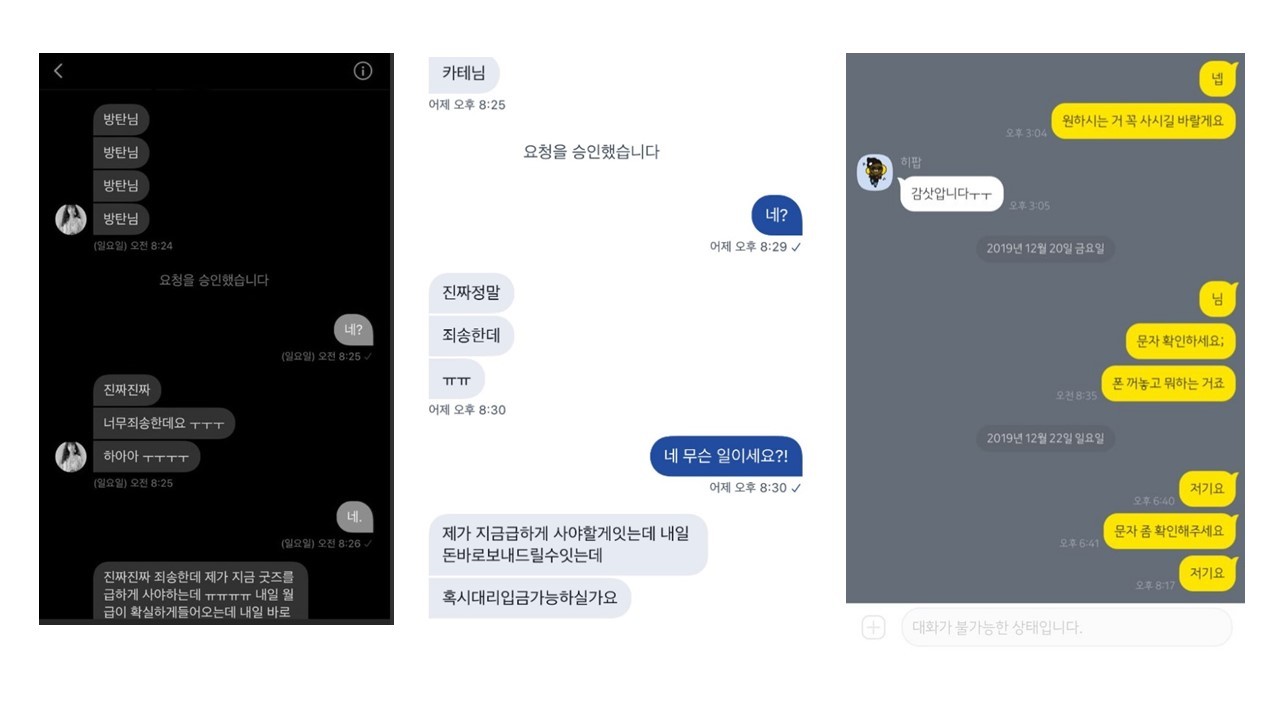

Screenshots of chat rooms on Twitter and KakaoTalk where BTS ARMY members receive money transfer request from adults who pretend to be teenagers. (The Korea Herald) |

“I trusted him and have sent the money in several installments so far, but he never paid me back, ignoring my calls and messages,” she said.

In fear of telling her parents of losing money, Bae researched online and discovered she was not the only one.

Bae is one of a number of teenagers who have been victims of financial fraud schemes targeted at young idol fans.

A 27-year-old youth counselor identified only by her surname Jung launched a Twitter community in March to seek relief measures for teen victims. The community now has around 30 members who claim to be victims of unexpected financial fraud. Around 70 percent of them are underage with the total damage reaching some 13 million won.

“There is a close bond between teenage fans and this makes it easy for swindlers to deceive them, posing as teenagers,” said Jung. “Starting this year, I even heard of many similar cases in which swindlers beg for money, saying they are in a bit of a tight spot financially due to the coronavirus outbreak.

|

(Yonhap) |

Young idol fans are often a target of such financial fraud as offenders take advantage of underage students’ inability to take legal steps to recover financial damages, according to local police.

“Teenagers cannot file a civil lawsuit without telling their parents. Even if they have legal representatives and pursue civil lawsuits to get the money back from offenders, it takes a long period of time while relevant legal expenses surpass 1 million won, even for minor thievery or fraud cases,” said Lim Pan-jun, head of cybercrime investigation unit at Dongdaemun Police Station.

Online money transfer scams targeting teenagers have been on the rise.

As of 2019, the number of SNS postings that involve illegal financial transactions with teenagers as well as college students reached 12,000, nine times higher than a year earlier, according to the Financial Supervisory Service.

“In some cases, individual lenders granted small loans worth less than 100,000 won to young students aged below 19 on SNS and then required interest rates as high as 10 percent a day,” said an official at FSS’ illegal private loans response unit, in charge of monitoring cyber financial frauds.

“Such new online scams have been on the increase recently, so we ask parents and school teachers’ special discretion to their students.”

Some financial authorities say an absence of mandatory finance education at public schools in South Korea could be one of contributing factors behind a surge in teenager-related money frauds.

In a recent joint survey released by Financial Services Commission and Gallup Korea, the amount of time spent on teaching financial matters at public schools in Korea reached merely nine hours on average last year. Not included in the official educational curriculum at elementary, middle and high schools, financial subjects have been covered in different courses like social studies.

Meanwhile, the finance education for teenagers is mandatory in many developed countries.

The US and Canada have implemented and operated curriculums covering financial topics at elementary schools since 2014 with an initiative to reduce the social costs of financial crimes involving teenagers.

“Quite a number of fraud cases here were caused by individuals’ lack of basic knowledge regarding finance,” said an official at the FSS Financial Education Department.

“Since there are certainly limits to the authorities’ preventative measures against financial crimes, relevant public education at an early age is indispensable.”

By Choi Jae-hee (

cjh@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)