|

Samsung‘s memory fab in Hwaseong, Gyeonggi Province (Samsung Electronics) |

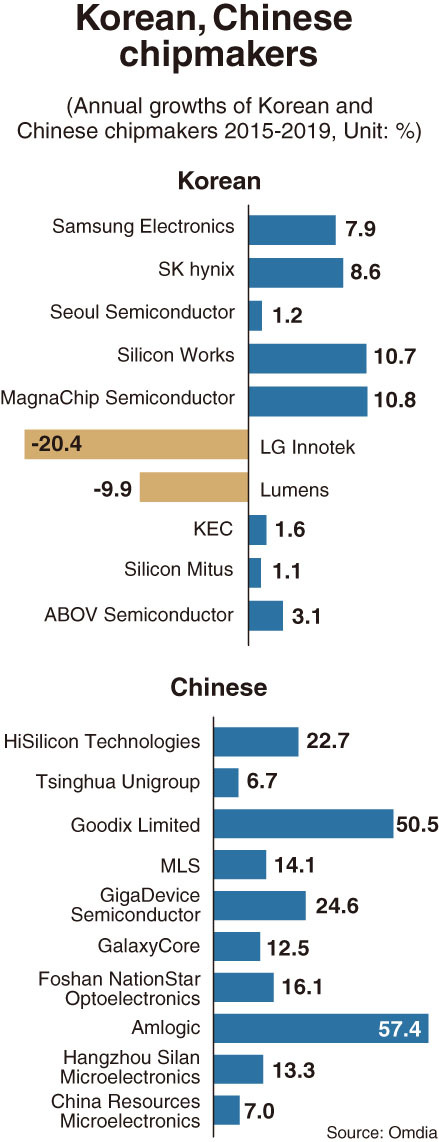

HiSilicon, the largest system-on-chip provider under Huawei Technologies, grew 22.7 percent during that period, leading China’s efforts to get a leg up in the semiconductor market since the government’s announcement to raise the country’s self-sufficiency rate of chips to 40 percent by 2020 and to 70 percent by 2025.

Korea’s Samsung and SK hynix recorded 7.9 percent and 8.6 percent growth, respectively, as they were confined to the memory market.

In the logic chip sector, it seems like China is taking advantage of economies of scale.

Benefiting from the vast size of its domestic market, it is easier for small fabless firms there to try designing and developing a variety of chips, contributing to a growth in quantity eventually.

The government-led plan to boost the semiconductor industry has given birth to more than a dozen unicorns -- startups worth over $1 billion -- that develop artificial intelligence-based chips, although some are thought to be overvalued.

Among the top 10 Chinese chipmakers by growth rate, just one, GigaDevice Semiconductor, is a memory provider, according to the Omdia data. The others provide logic chips, LEDs and sensors.

Some memory chip producers also showed remarkable growth with technological advances.

ChangXin Memory Technologies, the first Chinese memory provider, recently made it public that it would start mass producing DRAM on a 17-nanometer process within the year.

Industry experts speculate that the 17-nm DRAM manufacturing technology would be equivalent to the second generation of 17-nm DRAM by Samsung, which was commercialized in 2017.

That suggests that Korea is still three years ahead of China.

“Although China remains behind Korea in terms of both design and manufacturing technologies, it was noticeable that their memory fabs are filled with the latest equipment and equipped with cutting-edge solutions,” said Yoo Hoi-jun, professor at the electrical engineering department at Korea Advanced Institute of Technology, who had visited the CXMT plant located in Hufei, Anhui province, last year.

Earlier, another Chinese memory firm Yangtze Memory Technologies said it had completed development of 128-layer NAND Flash chips and will start churning them out this year, hinting that the technological gap is narrowing more quickly in the NAND market.

SK hynix aims to roll out the 128-layer NAND product in the second quarter of this year.

“Personally, I believe both Korea and China have many of the same market risks,” said Ron Ellwanger, senior analyst at Omdia.

“While Korea is very dependent on memory, logic markets are vulnerable to the economy and consumer confidence. So, the Chinese players are entering into the memory market. But we can’t discount brand trust and loyalty.”

“The Chinese do have a slight advantage because of the ‘big funds’ sponsored by the Chinese government,” he said, pointing out that the industry is very capital intensive.

By Song Su-hyun (song@heraldcorp.com)

![[Herald Interview] How Gopizza got big in India](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/20/20241120050057_0.jpg)

![[KH Explains] Dissecting Hyundai Motor's lobbying in US](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/20/20241120050034_0.jpg)