South Korea’s No.2 conglomerate SK Group had 125 companies as of May, more than any other conglomerate in the country.

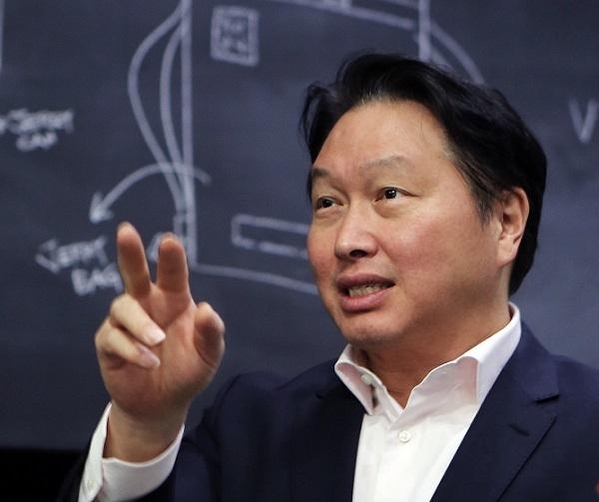

But under Chairman Chey Tae-won’s command, the group appears to have finally decided which branches to trim, and which seeds to sow, so that the whole field can flourish.

Through Chey’s “deep change” initiative, SK Group plans to liquidate its gas and lubricants businesses -- which guarantee stable profits but with little growth potential -- and use the cash to invest in booming batteries and chips businesses.

Simply put, SK Group is trying to solve its liquidity risk in the name of “deep change.”

SK Innovation represents SK Group’s liquidity challenges. Though it desperately needs cash for two battery plants under construction in the US and a hefty settlement in a legal battle against LG Chem, its petrochemicals business -- a cash cow of the company -- hemorrhaged 2.2 trillion won ($1.8 billion) in the first half of this year due to an acute demand crunch on oil amid the coronavirus outbreak.

SK Innovation, which needs about 4 trillion won worth of investment this year -- 60 percent of it allocated for battery and battery parts businesses -- found a branch to cut off: SK Lubricants.

SK Lubricants, a wholly-owned subsidiary of SK Innovation, is the No.1 lubricant maker in Korea, with a revenue of 3.3 trillion won and an operating profit of 293.9 billion won, as of last year.

SK Innovation is expected to sell off a stake of up to 49 percent in SK Lubricants.

“The sell-off is in an initial stage, so nothing has been decided yet. But the sell-off aims to secure funds for future business,” an SK Innovation official said.

Simultaneously, SK Innovation is preparing to take its rookie subsidiary SK IE Technology public by next year. SK IET manufactures separators -- one of the four key components of lithium-ion batteries -- and flexible cover windows that can replace glass displays for foldable and flexible smartphones.

After the initial public offering, SK Innovation is expected to sell off some 30 percent of the fully-owned subsidiary, which is expected to bring the company an extra cash flow of between 1 trillion won to 2 trillion won.

However, it would be unfair to discredit SK Innovation’s business transition as a simple liquidation process, as Chey’s “deep change” is happening all across the company.

SK Holdings in July invested an additional 100 billion won into Wason after a first round of 270 billion won in April last year.

Wason manufactures copper foils for electric vehicle batteries. Copper foils are in high demand in the electric vehicle market, as one EV needs 40 kilograms of copper foils, 10,000 times more than the 4 grams a smartphone needs.

Wason is the world’s No.1 copper foil maker with an annual capacity of 40,000 metric tons. With SK Holdings‘ investments, it is planned to increase the capacity to 140,000 tons by 2025. Once Wason goes public, it will bring immense profits to SK Holdings, the second largest shareholder of the company.

Moreover, SK not only invests in copper foil business but also runs a business of its own.

SKC in 2020 acquired copper foil company KCFT for 1.1 trillion won and then changed its name to SK Nexilis. SKC said in June that it will invest 120 billion won to build plant No. 6 with a capacity of 9,000 tons. After the completion, SK Nexilis’ production capacity will rise to 52,000 tons.

To raise the capital, SKC in July sold off its entire stake in SK Bioland -- a cosmetics subsidiary with annual operating margin of 16 percent – to Hyundai HCN. The sell-off brought SKC 120.5 billion won, just enough to build a new plant for SK Nexilis.

“SK Bioland has a competitiveness in the market, but its direction didn’t align with the business model SKC is pursuing,” an SKC official said.

Also, SKC has been busy in strengthening its semiconductor business by acquiring a 42.2 percent stake in its subsidiary SKC Solmics in July to make it a wholly-owned subsidiary. SKC Solmics uses silicon, quartz, alumina, and silicon carbide to produce ceramic consumables for semiconductor equipment.

Meanwhile, SK Engineering & Construction is committing to Chey’s deep change initiative by jumping into a green business.

On Wednesday, SK E&C decided to acquire a 100 percent stake in EMC Holdings, the largest operator of water and waste management firm here.

SK E&C said it has signed a share purchase agreement with Affirma Capital and will discuss the final price for the acquisition, which is expected to cost about 1 trillion won.

The acquisition will allow SK E&C to create synergies with petrochemical affiliates under SK Group by processing their wastes and secure a stable flow of income amid the prolonged COVID-19 outbreak.

“SK E&C has put a lot of effort in this deal, which will create both economic and social value” an SK E&C official said.

By Kim Byung-wook (

kbw@heraldcorp.com)