|

Postings on the window of a real estate agency in Songpa-gu, Seoul, show that asking prices of some apartment units in the district hover over 2 billion won as of Feb. 7. (Yonhap) |

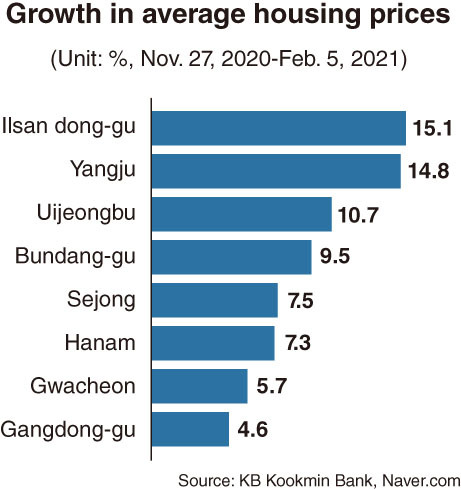

SEJONG -- Housing prices in many satellite cities around Seoul posted a growth of more than 5 percent in 10 weeks, with price increases in some cities surging 10 percent.

According to KB Kookmin Bank and Naver.com, Seongnam’s Bundang-gu saw the average trading price of homes climb by 9.5 percent from 31.97 million won ($28,800) per 3.3 square meters on Nov. 27, 2020 to 35.04 million ($31,600) on Feb. 5, 2021.

This means the average price of an 84-square-meter house, a popular size among Korean households, in Bundang-gu would cost around 892 million won. A same-sized flat in an apartment building in the same district would cost far more.

Bundang-gu outstripped major districts in Seoul in price growth over the corresponding period -- 4.6 percent in Seoul’s Gangdong-gu, 4.3 percent in Songpa-gu, 4.1 percent in Seocho-gu, 4.1 percent in Seongdong-gu and 3.1 percent in Gangnam-gu.

Properties in Yongin saw an 8.8 percent hike, trading at 21.18 million won per 3.3 square meters, followed by Namyangju with 7.5 percent, Hanam with 7.3 percent, Suwon’s Yeongtong-gu with 6.6 percent and Uiwang with 6.6 percent.

|

(Graphic by Kim Sun-young/The Korea Herald) |

Among the next rankers were Gimpo with 6.2 percent, Dongducheon with 6.2 percent and Gwacheon with 5.7 percent.

Six cities and districts in Gyeonggi saw the average home price rise more than 10 percent as skyrocketing prices in Seoul have pushed more of the younger generation in their 20s or 30s in the capital to actively purchase apartments in the surrounding Gyeonggi Province.

Goyang’s Ilsanseo-gu topped the list with an 18.8 percent increase, followed by Goyang’s Ilsandong-gu with 15.1 percent, Paju with 15 percent, Yangju with 14.8 percent, Goyang’s Deogyang-gu with 13.2 percent and Uijeongbu with 10.7 percent.

Of the above, Ilsandong-gu posted the highest average home price at 16.33 million won per 3.3 square meters, trailed by Deogyang-gu at 16.03 million won, Ilsanseo-gu at 13.95 million won. Paju’s housing price hit 11.02 million won, Uijeongbu at 10.85 million won and Yangju at 8.18 million won.

Gwacheon maintained the highest trading price of 49.89 million among Gyeonggi’s 28 cities and three “gun,” or counties. The figure far outstrips Seoul’s average of 34.98 million won.

In the nationwide rankings, Seoul’s Gangnam-gu was the highest at 61.67 million won, followed by Seoul’s Seocho-gu at 59.23 million won, Gyeonggi’s Gwacheon, Seoul’s Yeouido-dong at 48.87 million won, Seoul’s Songpa-gu at 48.74 million and Seoul’s Yongsan-gu at 43.85 million won.

Among the districts in Gangnam-gu, Apgujeong-dong saw the price come to 75.83 million won per 3.3 square meters, or 1.93 billion won for an 84-square-meter unit.

Sejong, which recorded a historic increase rate last year, saw its housing price continue to climb by 7.5 percent over the same Nov. 27-Feb. 5 period. Compared to a year earlier on Feb. 7, the price in the administrative city soared 65.6 percent to 21.15 million won.

The price in Sejong’s Dodam-dong, located near the Government Complex, reached 24.32 million won, or 619 million won for an 84-square-meter unit. The average asking price for 100-square-meter units in Dodam-dong has hovered at around 1.39 billion won.

Earlier, the government hinted that multiple home owners could face “aggravated” capital gains taxes unless they sell homes by May 31, 2021.

Nonetheless, many real estate agents predict that apartment prices in Seoul and Gyeonggi Province would continue to climb after the grace period.

An agent said that the government’s excessive intervention in the market involving tough regulations has further fanned prices since President Moon Jae-in took office in May 2017.

By Kim Yon-se (

kys@heraldcorp.com)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Exclusive] Hyundai Mobis eyes closer ties with BYD](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050044_0.jpg)

![[Herald Review] 'Gangnam B-Side' combines social realism with masterful suspense, performance](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/25/20241125050072_0.jpg)