|

A fuming white pipe on the background of blue sky (123rf) |

This article is part of analysis and interviews by The Korea Herald‘s finance desk staff exploring South Korea’s budding ESG investment market, as well as its potential, impact and challenges. -- Ed.

The sprouting demand for responsible investing options is reshaping the capital market landscape in South Korea, as financial products associated with environmental, social and governance factors are showing fast-paced growth.

The sharp upsurge in both demand and supply, on the other hand, highlights the lack of a system to ensure that companies allocate the proceeds of their green bonds or social bonds as promised, and that ESG-labeled equity funds differentiate themselves from mutual funds that invest in large-cap value stock portfolios in terms of their level of ESG commitment.

Experts have called for a concerted effort by ESG-aware capital market players, investment targets and regulators to keep their sustainable investing and fundraising activities in check and foster an ESG-inclusive ecosystem. Otherwise, sustainable investing will likely remain distant and elusive both for financiers and investment targets.

“We see a lot of vagueness in bonds for environmental and social purposes and in ESG-themed funds in Korea’s public capital market,” said Claire Seo, head of consulting firm ERM Korea.

Concerns are rising as demand for socially responsible financing is now coming in all shapes and sizes.

From January until March 19, 37 issuers floated a combined 16.6 trillion won ($14.6 billion) in environmentally or socially responsible bonds, according to data from the Korea Exchange compiled by The Korea Herald. The fixed-income products issued within less than three months represented 17 percent of the total issuance since 2018, in the form of either special bonds or corporate bonds. This accounted for 0.7 percent of the total bond issuance in Korea during the same period.

Twenty-seven issuers have made their ESG bond market debut this year, diversifying an issuer base here that was largely limited to state-run enterprises and financial companies until 2020. Beneficiaries of such bond deals for the first time this year include rent-a-car service operators in need of electric vehicles and hydrogen cars for inventory; cash-strapped shop owners who need their credit card income settled earlier than planned to avoid cash shortages and overcome COVID-19 stress; and a logistics firm that aims to establish a digital infrastructure.

This adds to the conventional green projects to which such capital goes, such as the construction of liquefied natural gas-powered vessels, the supplying of parts for offshore wind mills, sulfur recovery engineering and green transitions of the production line.

Relying on honesty

In contrast with the growing attention, the relatively short history of ESG investing exposes a situation under which post-issuance use-of-proceeds reporting has yet to undergo an independent assessor’s confirmation and instead relies on the honesty of the issuer. In Korea, domestic accounting firms including Deloitte Anjin and Samil PricewaterhouseCoopers, and credit ratings bureaus like the Korea Investors Service and Netherlands-based Sustainalytics have mainly served as independent evaluators of such fixed-income instruments in the pre-issuance stage.

“Korea has yet to fully adopt a system to confirm that the ESG bond proceeds were allocated as specified at issuance,” said Kim Sung-woo, head of the Environment and Energy Research Institute at Korean law firm Kim & Chang, adding that slow as it is, Korea’s capital market is evolving in the right direction.

In December, Korea’s Environment Ministry introduced green bond guidelines for investors and issuers, but they are largely nonbinding recommendations. The regulatory Financial Services Commission is still working on ways to force Korean listed firms to set up a corporate ESG disclosure framework starting in 2025.

“It is hard to wipe out ‘greenwashing’ concerns without a clear guideline to define what activities fall within ESG criteria and what do not,” Kim added, referring to the practice of deceptively creating an impression of environmental friendliness.

In addition, the fast-paced growth of the ESG bond market does not necessarily translate into the swift ESG integration of bond issuers and investors, considering the country-specific patterns in Korea.

Social bond issuance has greatly outweighed green bond issuance in Korea. Of the total 97.4 trillion won worth of ESG bonds issued from 2018 until March 19, social bonds accounted for 84.6 percent. Sustainability bonds and green bonds were next at 8 percent and 7.4 percent, respectively.

Most of the social bonds were floated by the state-run Korea Housing Finance Corp., the nation’s top ESG bond issuer.

The company is issuing all its covered bonds and mortgage-backed securities -- used to finance aspiring homebuyers -- in the form of social bonds. The KHFC’s social bond issuance came to 73.7 trillion won, or three-fourths of all environmentally or socially responsible bonds here.

To have more bond issuers involved in climate action, financiers are urged to swiftly adopt the respective ESG investing frameworks and have a uniform standard for them, experts say.

“It is imperative that financial institutions draw up internal ESG policies for their respective investing activities, to allow ESG bond issuers to determine if they are greenwashing,” Seo of ERM Korea said.

“Now, the financial institutions jump into ESG investing without preparing internal policies to keep their reputations afloat.”

‘ESG’ -- term that sells

In line with the sharp uptrend in the ESG bond market, Korea is brimming with ESG-themed stock investing opportunities for retail investors.

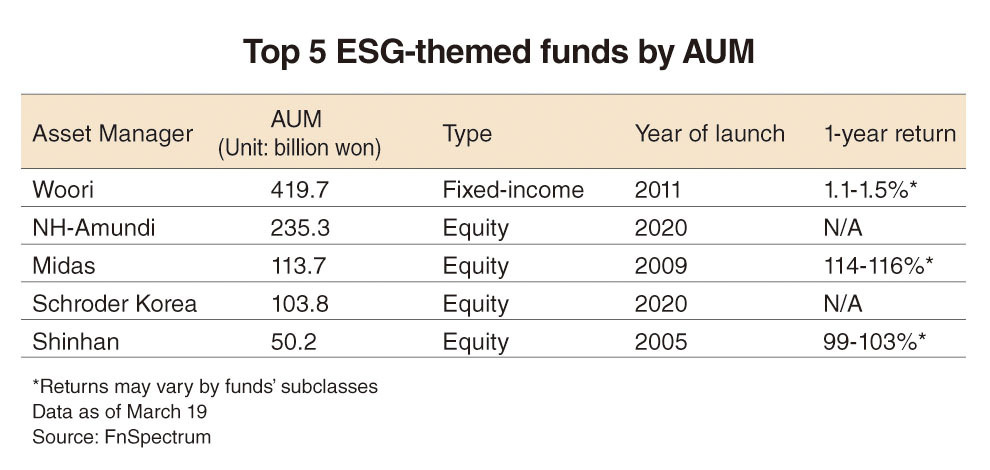

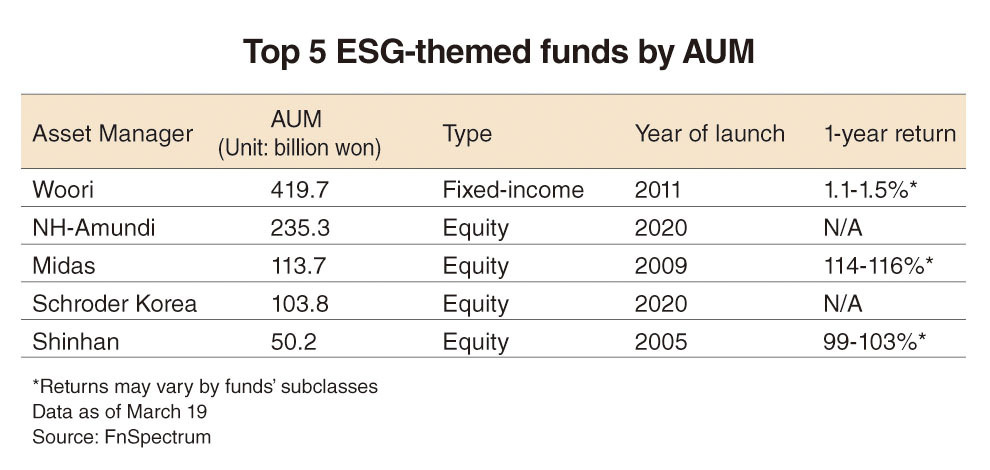

Korean asset management firms were overseeing 770.4 billion won in assets as of March 19 through their 30 ESG-themed equity funds, according to data from fund data tracker FnSpectrum. The assets under management doubled in the past six months, data also showed.

Moreover, Korea’s Green New Deal initiative coupled with the nation’s pledge to go carbon neutral in October 2020 is adding fuel to the ESG drive in the domestic financial market, allowing more asset management firms to churn out ESG-related products for retail investors to shore up digital and eco-friendly infrastructure.

But questions arise as to whether the ESG-themed funds differentiate themselves from active fund peers not labeled ESG-themed, either in terms of financial returns or the level of ESG commitment. This mainly stems from the fact that large enterprises here tend to receive high integrated ESG ratings, experts say.

“The ESG evaluators’ data shows the size of an enterprise is highly correlated with the ESG rating, so ESG equity funds will inevitably comprise large-cap stocks, but it does not necessarily mean the ESG funds themselves are problematic,” said Park Hye-jin, a research fellow at the Korea Capital Market Institute, a think tank.

Asset management firms here are striving to differentiate themselves instead of just hinging on the term that sells. For example, NH-Amundi Asset management’s ESG-themed equity fund blazed the trail by bringing in a globally recognized ESG scoring methodology from its shareholder France-based Amundi Asset Management. It also adopted the MSCI Korea ESG Universal Index, making it the first fund in Korea to use a benchmark index from a non-Korean index developer. Launched in September 2020, the fund oversees the most assets among Korea’s ESG-themed equity funds.

Meanwhile, Truston Asset Management is attempting to bring in an ESG investing strategy that is considered new here -- betting on ESG improvement instead of ESG outperformance. Truston’s recent ESG equity fund, launched in January, deliberately targets those with integrated ESG ratings below “B.” A company official said it was moving to influence undisclosed portfolio companies behind closed doors to improve their ESG performance.

By Son Ji-hyoung (

consnow@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)