|

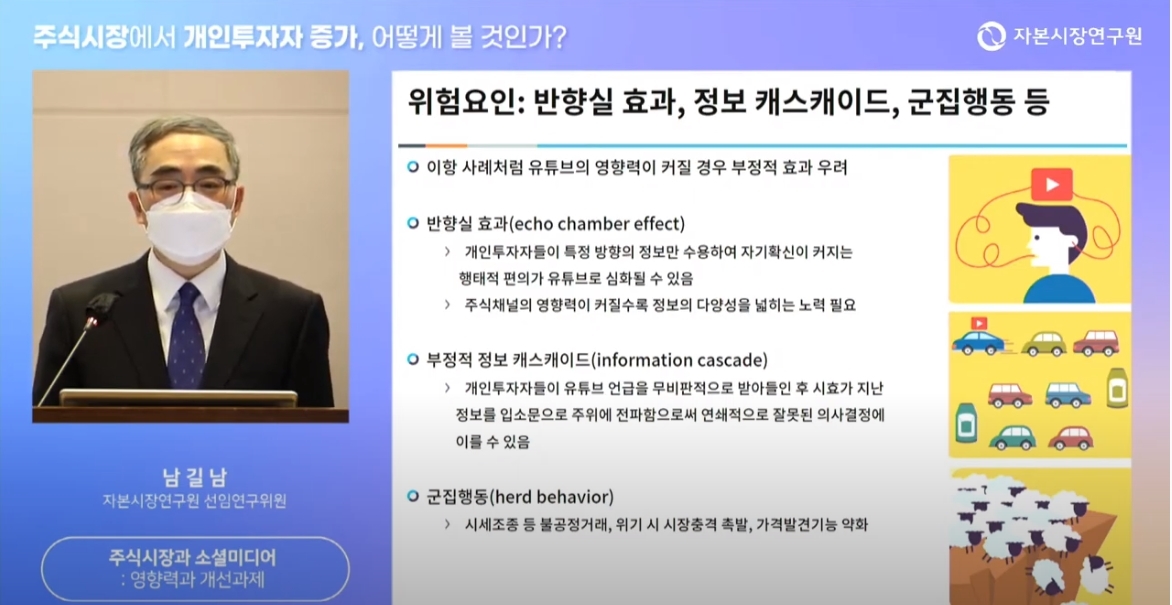

(Screenshot from Korea Capital Market Institute seminar) |

The growing influence of YouTube stock investing channels could have a negative impact on investors’ decisions as well as the stock markets, a study showed on Tuesday.

Nam Gil-nam, senior research fellow at Korea Capital Market Institute, said during a seminar titled “The implication of growing retail investors” that information from YouTube channels could distort investors’ decisions.

Using an analysis of two YouTube investment channels, Nam suggested that stock prices of companies mentioned in the videos outperformed the market on the same day by 0.82 percent on average while stocks that are negatively referred underperformed on average by 1.76 percent.

This could appear as if the YouTube channel owners are suggesting beneficial information to viewers, but they were in fact provided in obvious hindsight following news reports released on that day, he said.

Nam pointed out that it is dangerous for viewers to consolidate their beliefs by looking for the same perspectives and opinions on social media.

Nam went on to criticize the irresponsible behaviors of some YouTubers who even delete their content or remain silent when their forecasts turn out to be wrong.

“The case of Chinese drone maker Ehang Holdings is a good example of how YouTube channels behave irresponsibly after distributing reckless forecasts. This example raises alarm for investors’ protection,” Nam added.

On Feb. 19, Ehang shares fell 21 percent on Nasdaq after being targeted by short sellers holding the company responsible for allegedly making false reports on its revenue and business partnerships. Korean investors have reportedly injected a combined 609 billion won ($542 million) in the company’s shares as of Feb. 16.

By Park Ga-young (

gypark@heraldcorp.com)

![[Herald Interview] 'Korea, don't repeat Hong Kong's mistakes on foreign caregivers'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/13/20241113050481_0.jpg)

![[KH Explains] Why Yoon golfing is so controversial](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/13/20241113050608_0.jpg)