|

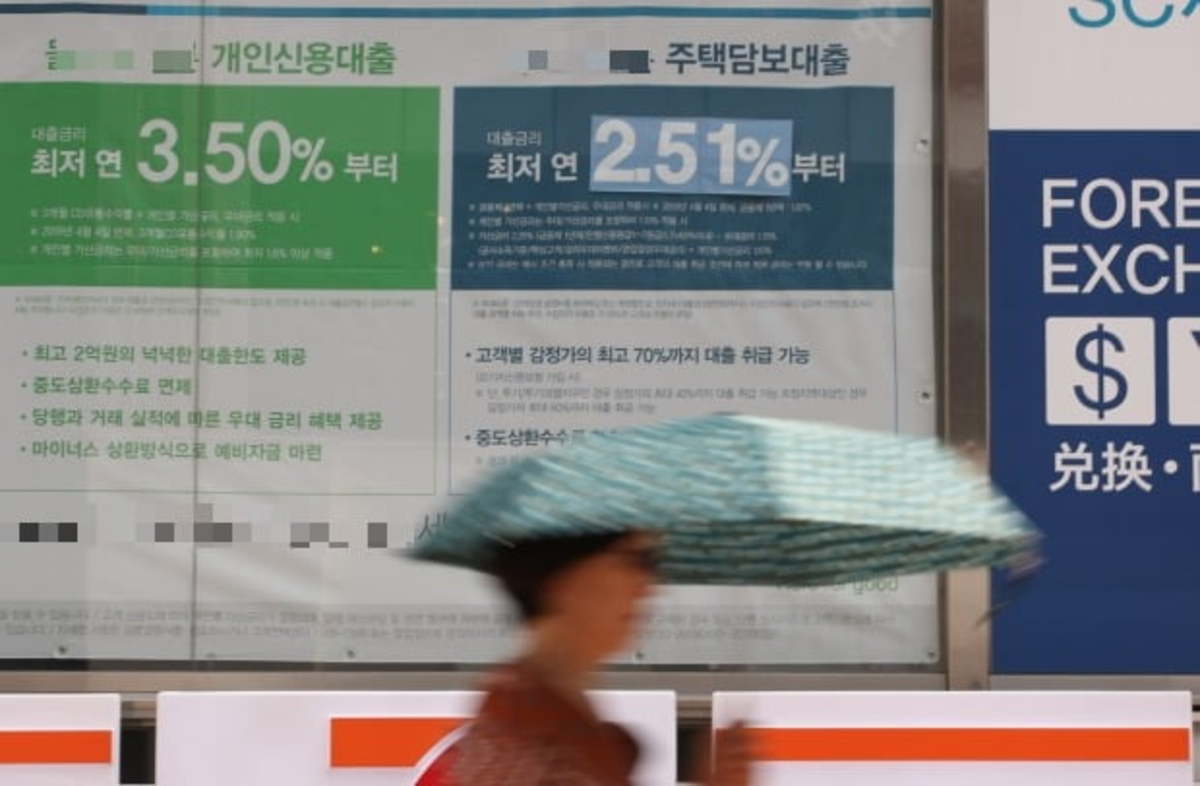

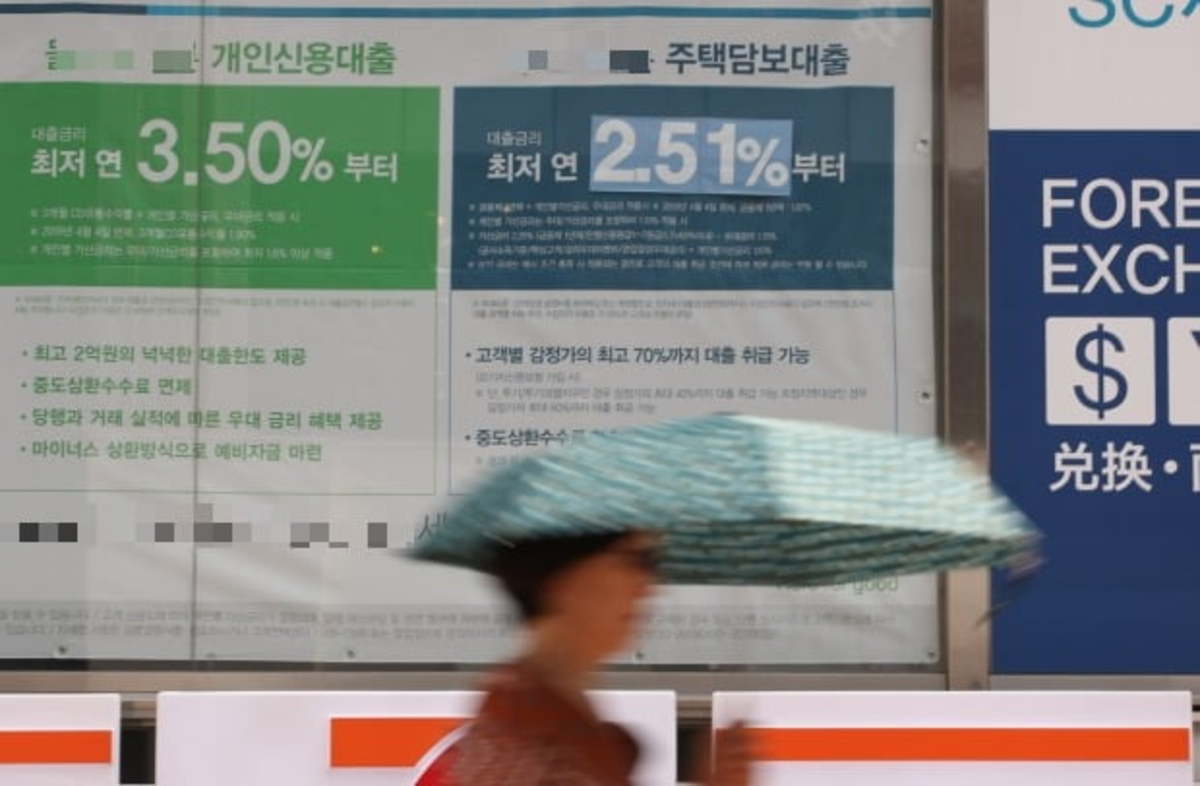

This undated file photo shows a poster at a bank in Seoul advertising personal and home-backed loans. (Yonhap) |

South Korea's household credit grew at a slower pace in the first quarter, as banks tightened rules on loans, central bank data showed Tuesday.

Household credit reached a record high of 1,765 trillion won ($1.56 trillion) as of March, up 37.6 trillion won from three months earlier, according to the data from the Bank of Korea (BOK).

Household credit refers to credit purchases and loans for households that have been extended by financial institutions, including commercial lenders and mutual savings banks.

The first-quarter tally compared with a 45.5 trillion-won on-quarter rise in the fourth quarter of last year.

Household lending extended by banks and other financial institutions reached 1,666 trillion won in the first quarter, up 34.6 trillion won from three months earlier.

Mortgage loans rose 20.4 trillion won on-quarter to 931 trillion won in the first quarter.

Credit purchases stood at 99 trillion won as of end-March, up 3.1 trillion won from three months earlier, the BOK said.

Korea's household debt has been repeatedly cited as the main drag on Asia's fourth-largest economy, as households' high indebtedness is feared to curb domestic demand and thus crimp economic growth. (Yonhap)

![[Herald Interview] 'Trump will use tariffs as first line of defense for American manufacturing'](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050017_0.jpg)

![[Health and care] Getting cancer young: Why cancer isn’t just an older person’s battle](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/26/20241126050043_0.jpg)