|

A promotional image of an educational content for kids released on Hana Bank's YouTube channel (Hana Bank) |

Tech giants such as Naver and Kakao have penetrated the financial sector by integrating “lifestyle” into their financial services, offering all-in-one services via a single platform or close connections to their users.

Kakao Corp., operator of the nation’s No. 1 mobile messenger in terms of users, for example, allows KakaoTalk users easy access to its financial services offered by KakaoBank. KakaoTalk users can use KakaoBank services at just a press of a button on the messenger app. KakaoTalk also now offers users mobile payment services, online shopping and entertainment options including games and webtoons, comprising a “lifestyle-in-one” package.

Eyeing Kakao Corp.’s active domain expansion, the five major banks here -- KB, Shinhan, Woori, Hana and NH -- have been upgrading their own online and mobile lifestyle services offered through apps and even YouTube.

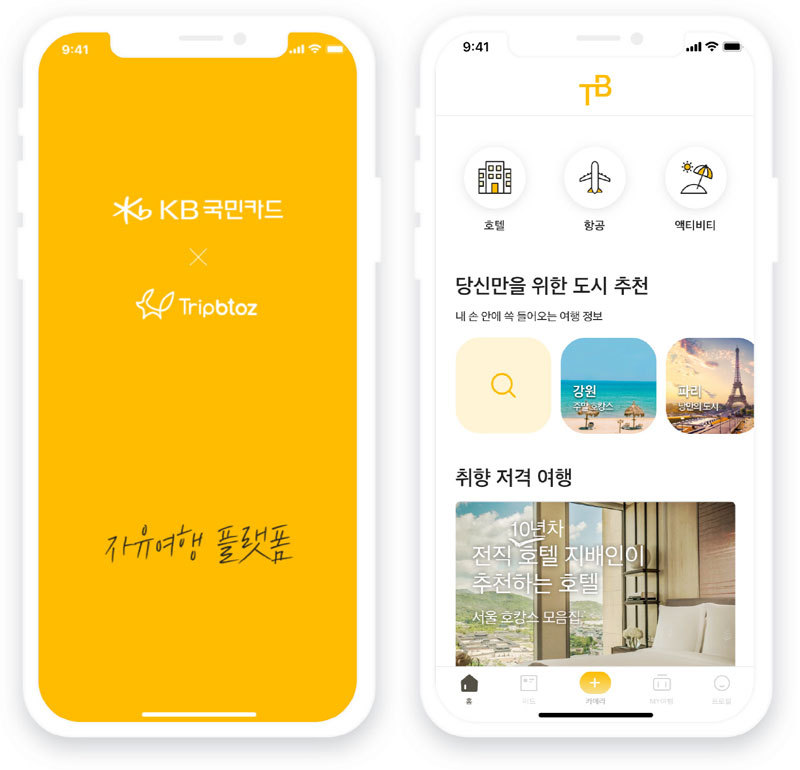

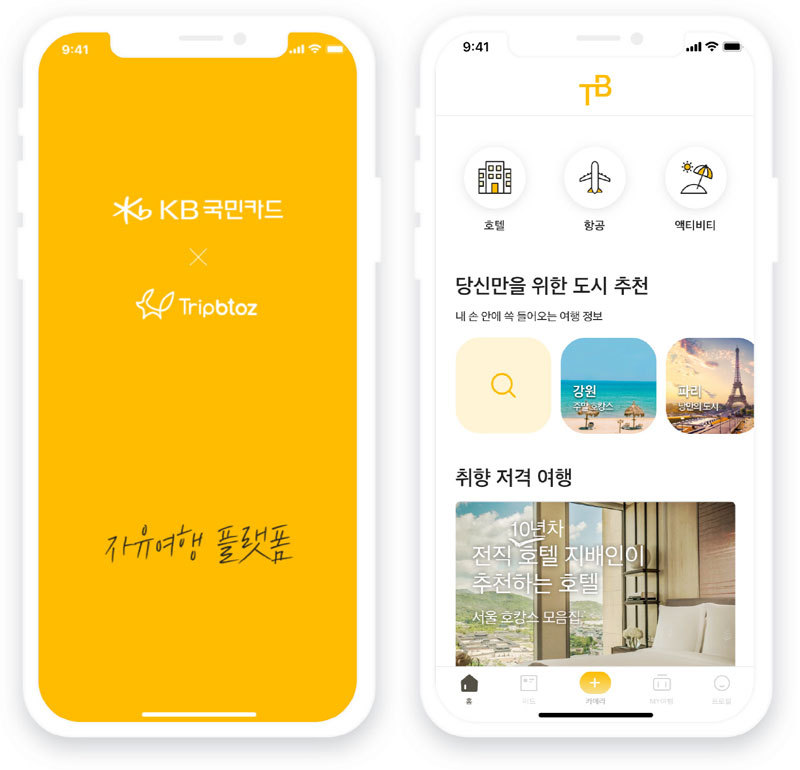

With the nation’s vaccination program gaining momentum, KB Kookmin Card, KB Financial Group’s credit card issuer, on Friday said it has upgraded its travel app, TTBB. TTBB now offers users blog-style travel stories to provide in-depth tips.

TTBB was launched last year by KB Kookmin Card in conjunction with local startup Tripbtoz, which operates a travel recommendation service. The platform caters to users seeking all-in-one services on travel information and the purchase of related programs and tickets.

Hana Financial Group’s flagship commercial lender Hana Bank, meanwhile, has made a foray into the education business. The bank said Friday it uploaded the second season of its financial education program for kids on its official YouTube channel. The program, first launched in December last year, informs children of basic finance concepts including where money comes from and the meaning of daily financial transactions. The message is conveyed through musicals and plays.

|

A promotional image of KB Kookmin Card's TTBB (KB Kookmin Card) |

Their efforts are reflected in sweepstakes as well. Shinhan Financial Group’s banking unit Shinhan Bank recently collaborated with LG Hausys, the industrial materials affiliate of LG Group, to offer prizes and gift certificates to customers. Users of Shinhan’s all-in-one banking app Sol are eligible for the sweepstakes if they have applied for kitchen and bathroom interior services by LG Hausys.

The banking giants’ efforts to mix lifestyle with finance are projected to be part of their long-term goals, along with changes in their main customer base.

Shinhan Bank earlier this month launched a special task force focused on fostering its nonfinancial services. The task force said it plans to pursue new businesses that are “closely connected” with their customers’ lifestyle.

“The financial market is likely to see an overhaul of services to cater to the interest and needs of millennials and Generation Z customers, which are to become their main customer base soon,” the Woori Finance Research Institute, a think tank under Woori Financial Group, said in a recent report.

“Personalized services will be a driving force behind the traditional financial institutions’ digital reform,” it added.

By Jung Min-kyung (

mkjung@heraldcorp.com)