|

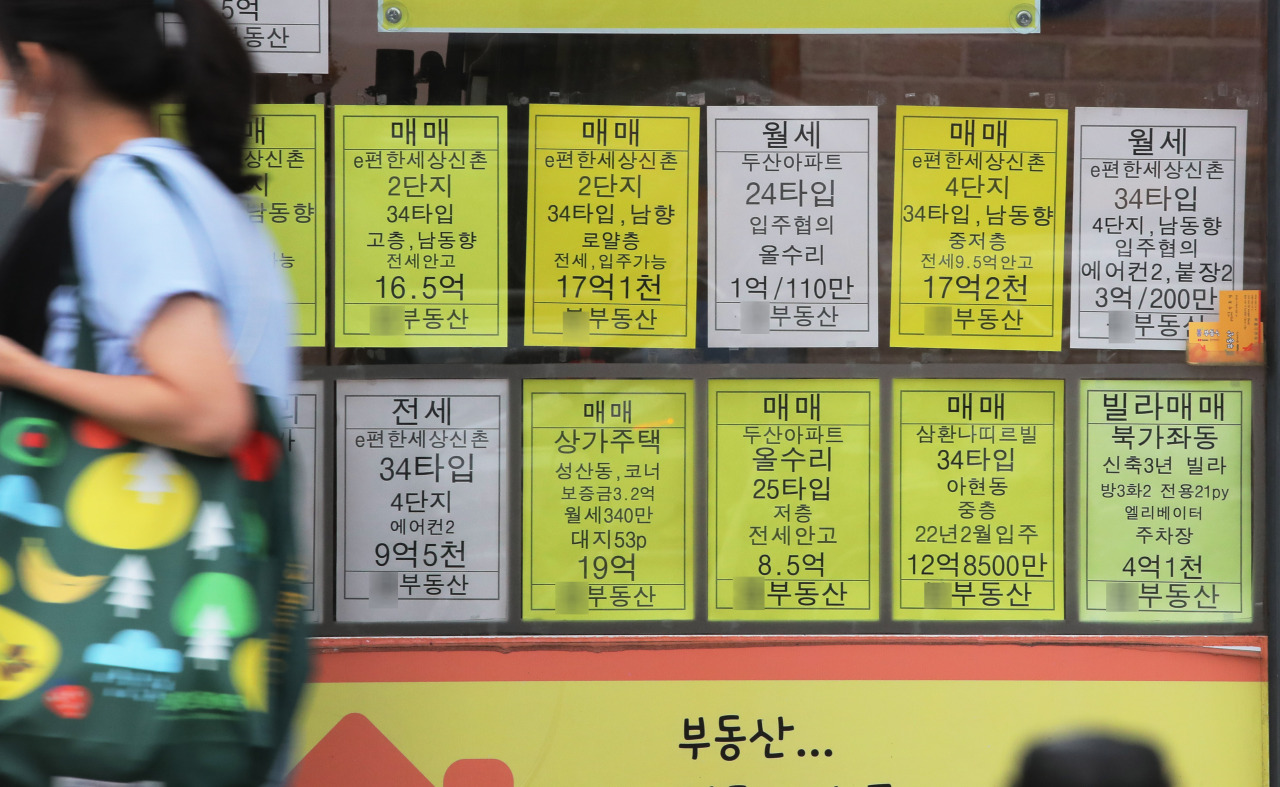

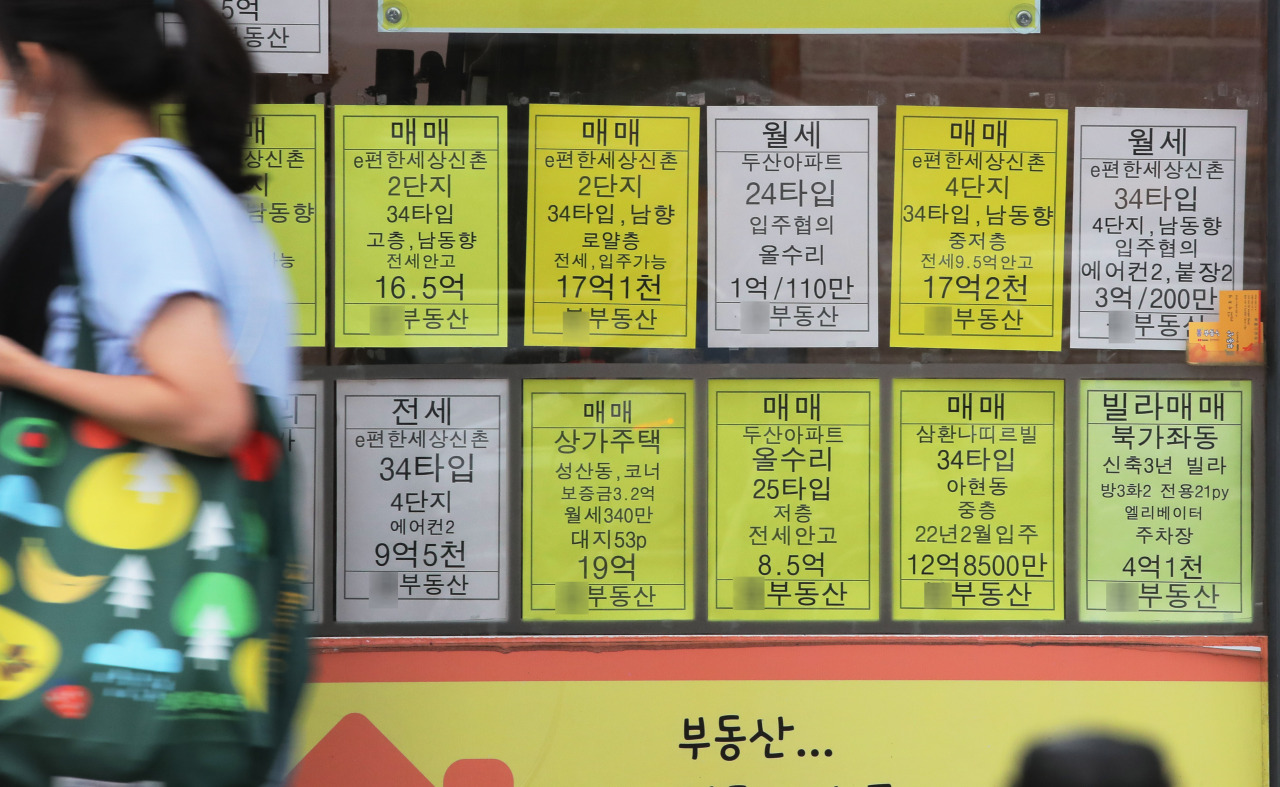

A pedestrian passes by a real estate office in Seoul, Wednesday. (Yonhap) |

Finance Minister Hong Nam-ki warned Wednesday that the housing market was overvalued, and that a scheduled tightening of loan regulations and a possible interest rate hike could see home prices fall.

During a government meeting on the real estate market, Hong urged market participants to refrain from buying homes based on expectations of future price increases.

“An inflow of liquidity into the housing market could slow down as the country is set to implement measures to slow the growth of household debts and the Bank of Korea hinted at a rate hike within this year,” Hong said in a meeting.

The minister also said that home prices in Seoul are higher than the long-term trend, suggesting an “overvalued” situation.

According to a real estate portal by KB Kookmin Bank on Wednesday, the average price of a small or medium-sized apartment in Seoul stood at 1.01 billion won ($894,000) in June, up 45.4 percent from two years earlier. It is the first time the figure has exceeded 1 billion won.

Small and medium-sized apartments are 60-85 square meters, the most popular size for newlywed couples and three- to four-person households.

The minister is banking on a slowdown in real estate as the government makes progress in its plan to increase supply in the broader Seoul area and clamp down on housing speculation.

Starting Thursday, the debt-to-service ratio rule -- which limits borrowing based on the ratio of annual income to debt servicing costs -- will be applied to a greater proportion of mortgage borrowers.

“We will consistently promote the ‘expansion of housing supply and protection of end-users’ policy. In particular, we will put utmost effort into yielding positive results in housing supply,” he said.

Some 4,400 housing units in Gyeonggi Province and Incheon will be up for presale subscriptions from July 15. In September, authorities will embark on the process of designating which of 24 candidate sites will host a planned district as a part of measures announced in February to increase the number of new homes by up to 836,000 nationwide in the next four years.

Monetary policymakers appear to be leaning toward a rate increase due to rising risks of financial imbalances stemming from growing household debt and a surge in asset prices across stocks and digital asset markets.

On June 24, Bank of Korea Gov. Lee Ju-yeol hinted at the need to raise interest rates within this year as the country’s consumer prices grew at the fastest pace in more than nine years, rising 2.6 percent on-year in May.

“The interest rate was lowered in response to concerns about inflation in the zero percent range and economic recession. ... We should normalize it in an orderly manner from an appropriate time within the year,” Lee said.

By Park Han-na (

hnpark@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)