|

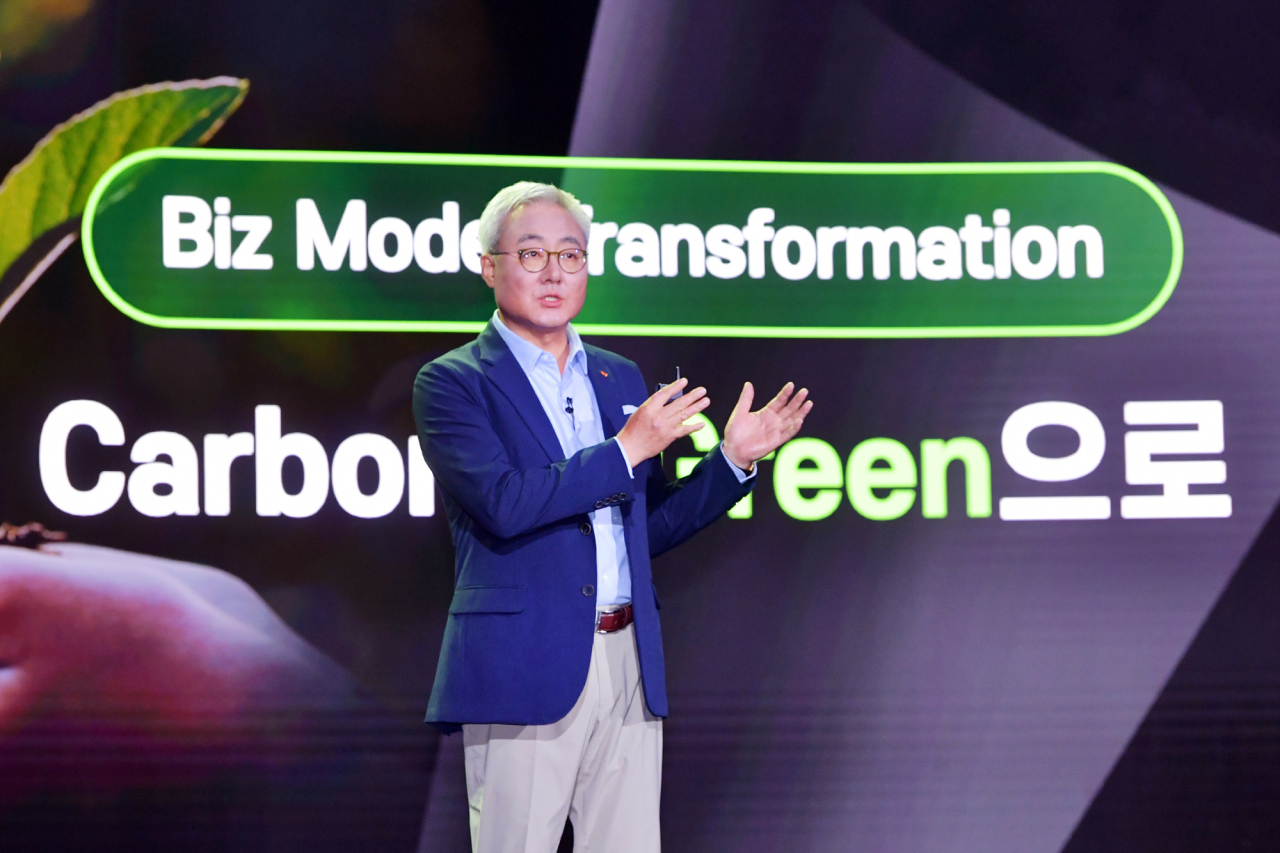

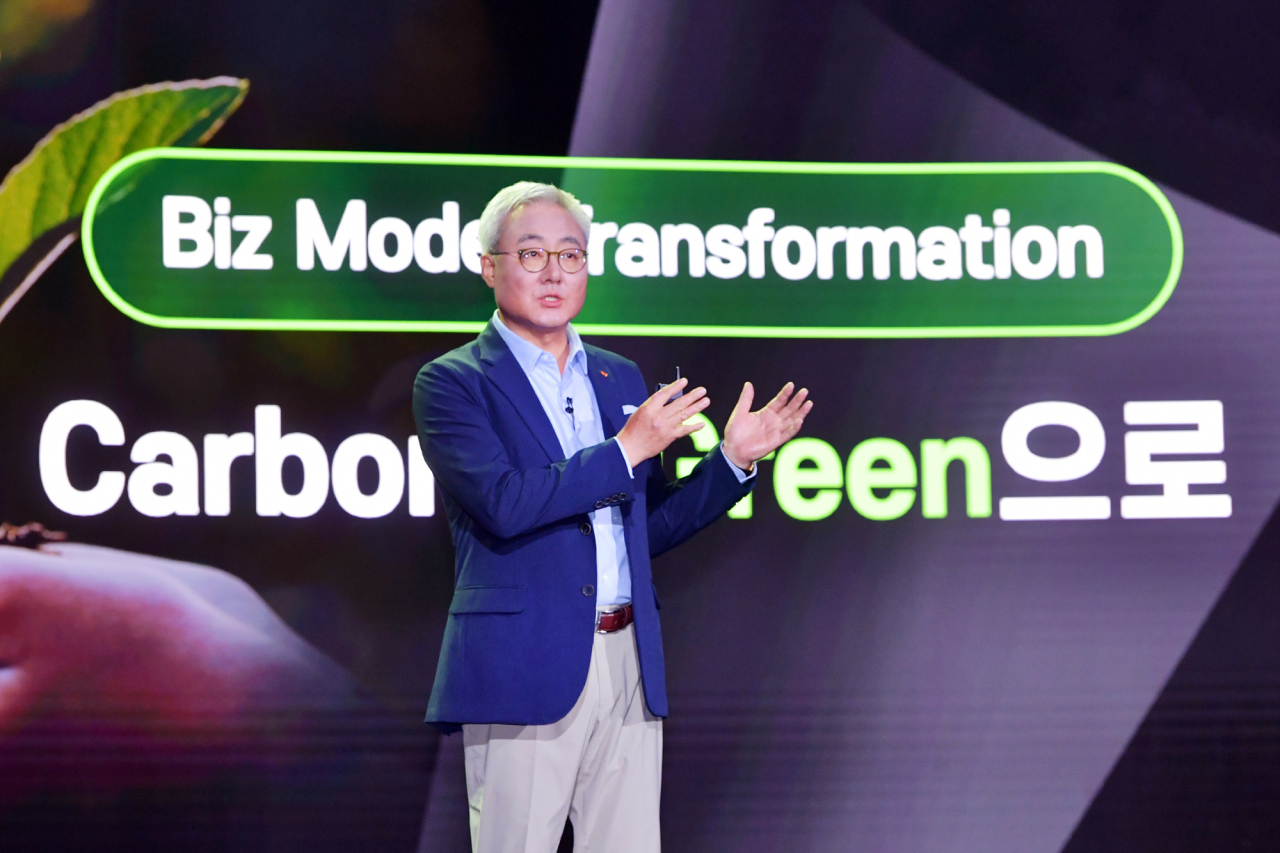

SK Innovation President and CEO Kim Jun explains the company’s financial story on how it will seek green transformation through 30-trillion-won investment in five years. (SK Innovation) |

SK Innovation on Thursday officially announced the split-off of its battery business, with plans to list the fast-growing business on the US stock market.

During a briefing session held at Conrad Seoul in Yeouido, western Seoul, SKI President and CEO Kim Jun said that the company is mulling an initial public offering of the envisioned battery-focused firm on Nasdaq, or both on Nasdaq and South Korea’s main bourse Kospi.

“The exact timing of the split-off and IPO hasn’t been decided yet, but it will be when the battery business unit can receive a proper market valuation,” Kim said.

SK Innovation’s battery business is expected to turn profit starting 2022 and register a high single-digit operating margin in 2025. The revenue of the battery business has doubled every year, with 3.5 trillion won ($3 billion) expected this year and 6 trillion won next year.

“SK Innovation is spending 2 trillion won to 3 trillion won every year for expansion. To not to miss (investment) timing, the sooner the better,” said Jee Dong-seob, head of SK Innovation’s battery business, regarding the split-off.

Over concerns that the split-off plan might undermine the SK Innovation’s shareholder value, Kim said that SK Innovation will “incubate” a battery recycling business as its next growth engine.

“SK Innovation is in talks with Umicore to extract metals inside batteries. There is already a technology (in the market) to retrieve nickel, cobalt and manganese 95 percent. The key is whether you can extract lithium in the form of lithium hydroxide. SK Innovation has the technology to do this. So SK Innovation is mulling how it can co-work with Umicore to retrieve lithium first and other metals later,” Kim said.

The battery recycling business is expected to recycle 30 gigawatt hours of batteries in 2025 and create EBITDA worth 300 billion won. SK Innovation owns 54 battery recycling patents. Extracting lithium can save carbon emissions as much as 70 percent compared to mining lithium from mines.

Kim further pledged to invest 30 trillion won to change SK Innovation’s corporate identity from carbon to green and increase the ratio of green assets to 70 percent, with 18 trillion won allocated for its battery business.

With the aim of taking a 20 percent share of the global electric vehicle battery market by 2030, SK Innovation laid out an ambitious expansion plan, from the current production capacity of 40 GWh to 85 GWh in 2023, 200 GWh in 2025 and 500 GWh in 2030. Such expansion will allow SK Innovation to meet order backlog which currently stands at more than 1 terawatt hour, which is worth approximately 130 trillion won.

Whether SK Innovation will develop different types of batteries for automakers such as Volkswagen, which plans to power 80 percent of its EVs with prismatic battery cells, Jee said the company will stick to pouch-type battery cells for the time being.

“There are many clients who prefer pouch cells. When we deal with automakers, we couldn’t feel the impact (of prismatic cells) in the market. SK Innovation has conducted a sufficient research on cylindrical and prismatic cells as well as different chemistries such as lithium iron phosphate batteries, and it’s under review to make a shift if necessary,” Jee said.

At the same time, SK Innovation will inject 5 trillion won to increase the production scale of its battery separator business from the current 1.4 billion square meters to 2.1 billion in 2023 and 4 billion in 2025.

By Kim Byung-wook (

kbw@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)