KakaoBank’s rapid growth underscores the threat Big Tech poses to incumbent banks in Korea, Moody’s Investors Service on Monday said.

The global credit rating agency said that local lenders face mounting competition and will have to strengthen their online platforms as KakaoBank expands its loan portfolio and capital base.

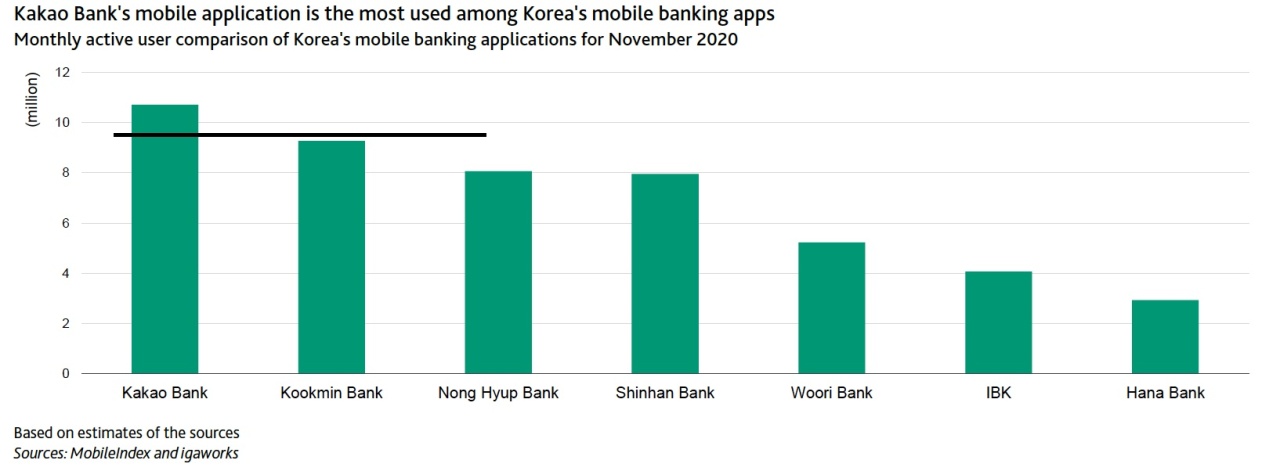

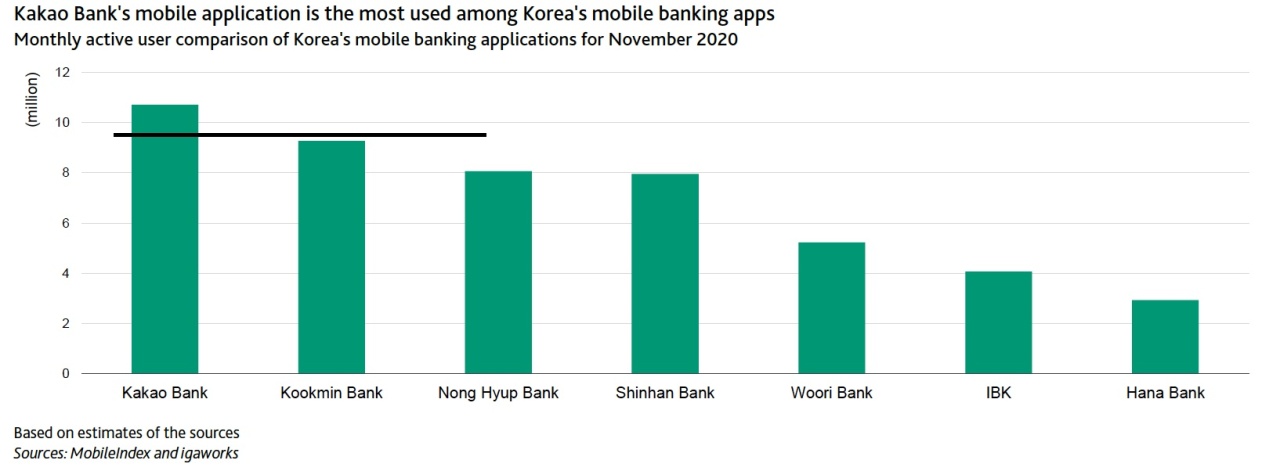

Moody’s said KakaoBank, the banking arm of mobile giant Kakao, now has the largest number of users and attributed the internet-only bank’s rapid asset growth to unsecured personal lending backed by a straightforward digital banking experience and lower costs by using advances in technology and operating without physical branches.

“Kakao Bank’s cost efficiency was better than most local bank peers in 2020, with its cost/income ratio 0.5 percentage points lower than the asset weighted average of the four largest banks and 3.9 percentage points lower than the six regional banks,” it said.

The competition will grow more intense as KakaoBank expands its loan portfolio and capital base, Moody’s also said.

With KakaoBank planning to launch mortgages and merchant loan products, the bank’s addressable market will expand to 65 percent of Korea’s won-denominated loans in the next 12-18 months from just 14 percent now, the agency said in the report.

An increase in competition in multiple loan segments will weaken profitability of the large incumbent banks that have large shares of household loans, it added. KakaoBank’s move will also reduce smaller banks’ already limited presence in these loan segments. In addition, following KakaoBank’s planned capital raising via an initial public offering in the second half of 2021, the bank’s capital could increase by around 76 percent-90 percent compared to the end of March, the rating agency added.

By Park Ga-young (

gypark@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)