|

Bae, Kim & Lee expert adviser Lee Yeon-woo |

The year 2021 is seen as a period of transition as markets recover in the post-COVID rebound. Among the areas that will see an economic boost is the mergers and acquisitions market. What companies must recognize is that the M&A market in the post-COVID era is likely to unfold a slightly different reality than in the past. There will be a more explicit and extensive embodiment of environmental, social, and governance values in M&A deals.

ESG and its impact on M&A

The COVID-19 pandemic raised worldwide social awareness on health, safety, well-being, and climate change impacts. Stakeholder activism has escalated, requiring corporate governance systems to practice improved diversity-equity-inclusion in management. Also, the growing demand from institutional investors like Blackrock and Vanguard has further catalyzed ESG as an integral lever in forecasting and preventing corporate risk.

The United Nations Principles for Responsible Investment triggered this movement in 2006 by establishing ESG principles to expedite socially responsible financial practices. Until now, fifty of the largest economies have prompted more than 730 regulations which include hard and soft laws that encourage investors to make long-term goals around ESG by examining sustainability risks, opportunities, and outcomes.

For companies, indirect impacts include corporate risk management, reputation, employee engagement, and consumer loyalty. Direct impacts are closely associated with cost savings from energy efficiency and waste and disposable management or revenue growth from having sustainable products and services.

Overall, these impacts are closely observed and tailored through impact measurement and management systems with different concerns and motivations. For instance, for limited partners, explicitly tackling ESG considerations becomes essential when aligning investments with the target company’s social responsibility strategies. Private equity funds, which previously had more short-term priorities, are now recognizing how ESG renders more short-term, positive impacts.

Embedding ESG into M&A strategy and process

Investors and investigators are implementing a carefully crafted checklist for the company’s ESG actions and verification criteria. New ESG provisions to agreements being formed include measurement, disclosure, and fiduciary duties.

According to the 2021 Mergermarket report, around 44 percent of the surveyed companies responded that ESG investment strategy has enhanced investment and M&A returns. This figure reached 60 percent for private equity firms. UNPRI reports that 33 percent of the deals have increased their valuation following a positive ESG assessment. In comparison, 18 percent have downgraded their view on ESG grounds.

Companies can utilize ESG to enhance business and their reputation by acquiring firms that have scored well on ESG due diligence. Accordingly, financial and legal ESG due diligence are becoming important from the early stages of a deal because overlooking ESG performance around climate change, workplace practices, data privacy, anti-competition, and board structure can turn into compliance and risk factors.

Buyers now examine acquisition impacts and use ESG elements to improve its ESG profile. The sellers also utilize the effectiveness of ESG factors to push the company’s mission and purpose to preserve their mission upon closing.

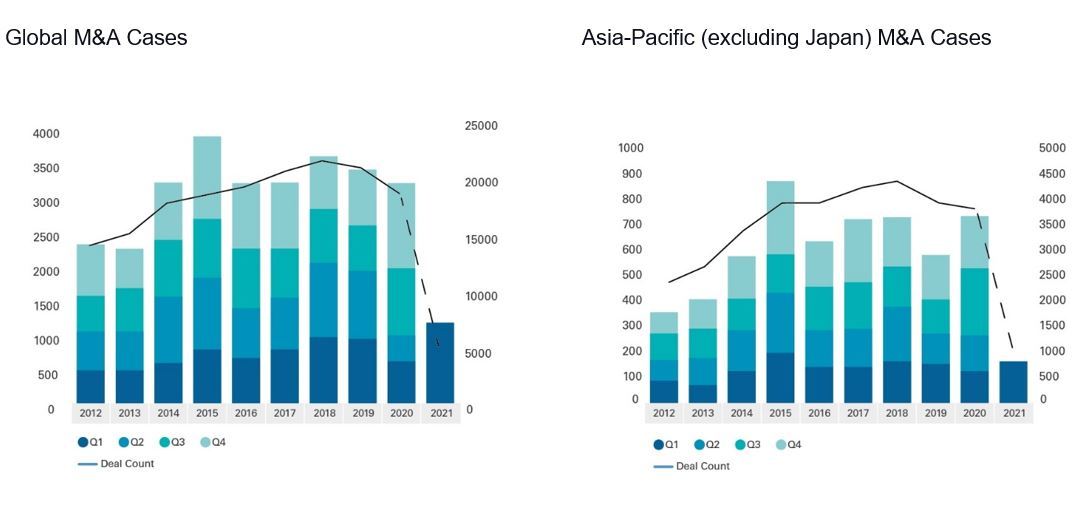

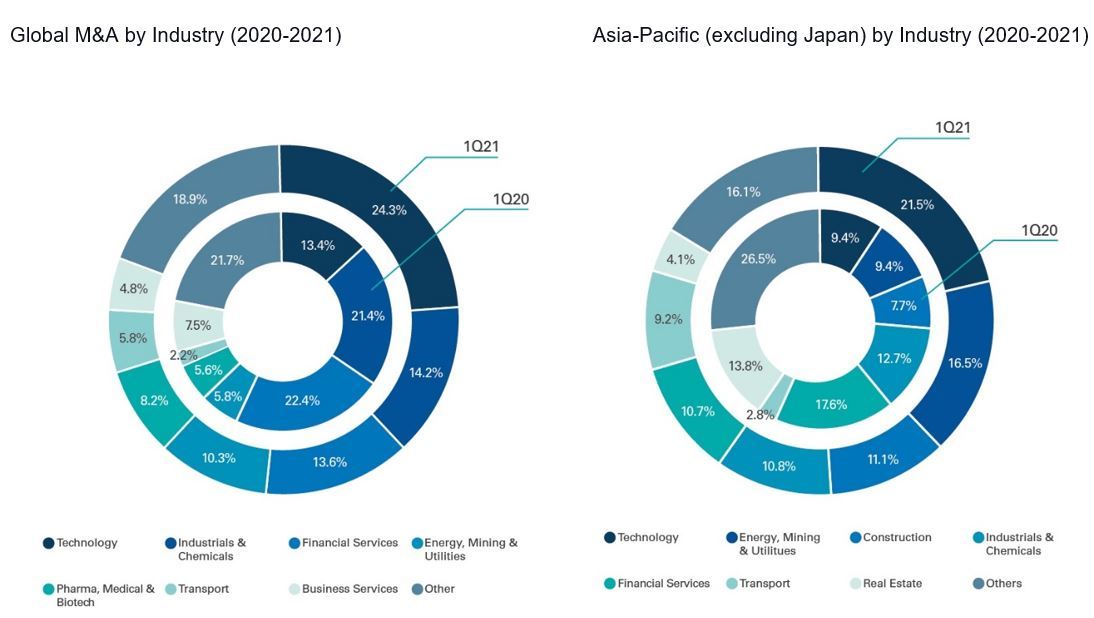

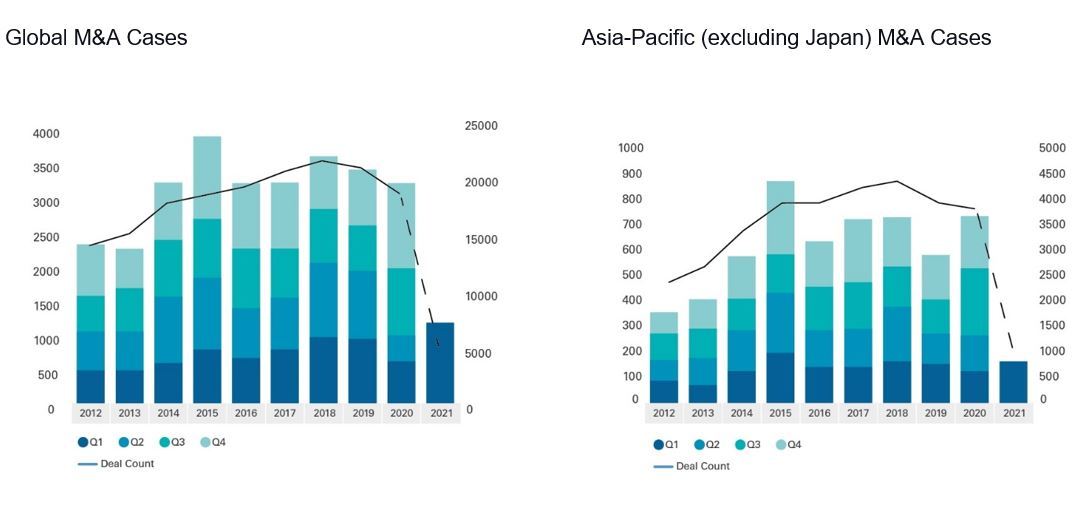

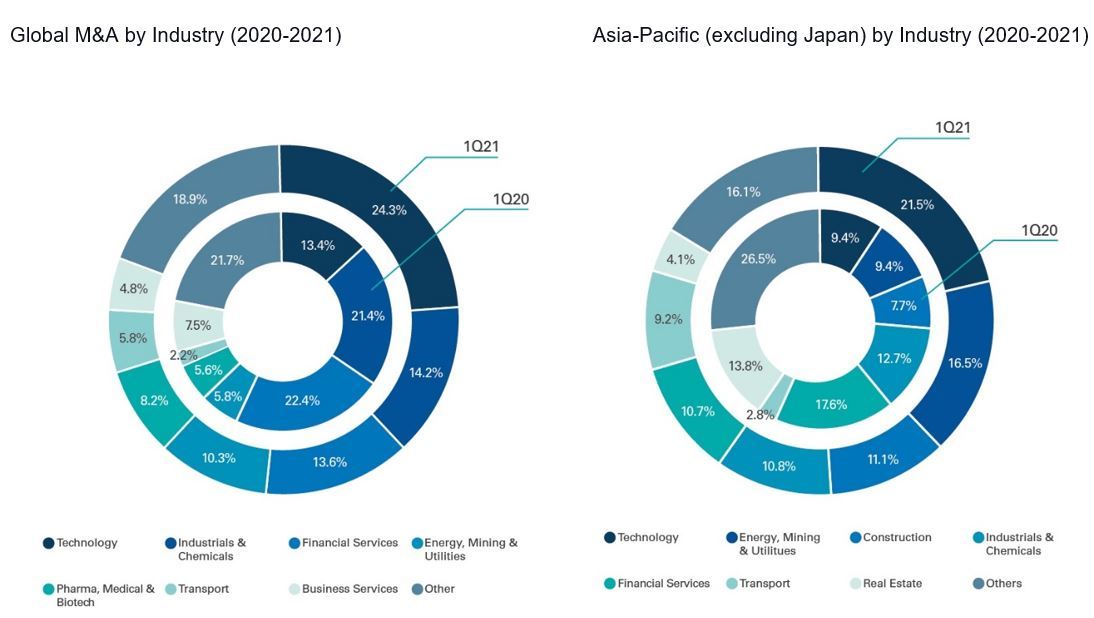

|

(Source: Mergermarket) |

ESG and prospects in South Korea’s M&A market

In early 2021, there was a record-high volume of 160 deals worth $46.9 billion in South Korea’s M&A market. Among these deals, around 40 percent were related to environment and climate change such as renewable energy, carbon reduction, and waste and disposable management.

The National Pension Services has pledged a coal-free investment policy by announcing it would end investments in new coal plants and limit investment in coal-related companies. In addition, Korea Development Bank included ESG factors as new evaluation criteria in their selection policy. Overall, Korea’s public pension funds and public financial institutions are notable players who will lead the ESG drive where direct influence through negative screening may hinder voluntary ESG initiation. However, Korea’s regulatory environment will likely pressure companies to adopt ESG elements immediately to avoid ESG risk.

Conglomerates and large startups are planning to buy out businesses to reboot business portfolios and reactivate growth strategies for the post-pandemic season. These M&A decisions will be significantly determined by the investments’ positive ESG impact.

A wider pool of investors will adopt a standardized approach to managing ESG data and measuring ESG performance within the next one to three years. It means having a verifiable ESG credential in M&A will soon serve as a make-or-break factor in M&A deals.

M&A in the future must have holistic and more long-term approaches to embrace ESG strategically. The M&A process and strategy should have consistent purpose and value, specific targets, action steps, integration schemes, and monitoring mechanisms, all through the lens of ESG to enhance value and impact.

Lee Yeon-wooLee Yeon-woo is an expert adviser at the Korean law firm Bae, Kim & Lee. -- Ed.

By Korea Herald (

koreaherald@heraldcorp.com)

![[Today’s K-pop] Blackpink’s Jennie, Lisa invited to Coachella as solo acts](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/11/21/20241121050099_0.jpg)